2023å¹´12月末ã®è³‡ç”£é…分(アセットアãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³)ã¨ä¸»ãªæŠ•è³‡å•†å“ã€ä»Šå¾Œã®æŠ•è³‡æ–¹é‡

※当ブãƒã‚°ã¯è¨˜äº‹ä¸ã«PRã‚’å«ã‚€å ´åˆãŒã‚ã‚Šã¾ã™

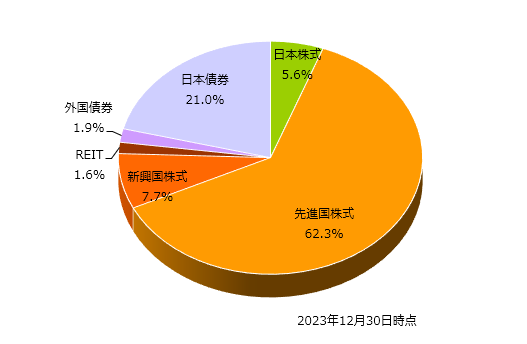

毎年2回ã€6月末ã¨12月末ã«è³‡ç”£é…分(アセットアãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³ï¼‰ã®æŠŠæ¡ã‚’ã—ã¦ã„ã¾ã™ã€‚2023å¹´12月末ã®è³‡ç”£é…分を確èªã—ã¾ã—ãŸã€‚国内外ã®æ ªå¼å¸‚å ´ãŒå¥½èª¿ã ã£ãŸå°è±¡ã§ã™ãŒã€è³‡ç”£é…分ã¯æžœãŸã—ã¦ã©ã†ãªã£ã¦ã„ã‚‹ã®ã§ã—ょã†ã‹ã€‚

◆資産é…分(アセットアãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³)

å…ˆé€²å›½æ ªå¼ã€€62.3% (▲3.0%)

æ–°èˆˆå›½æ ªå¼ã€€7.7% (+2.6%)

REIT(国内外) 1.6% (±0%)

外国債券 1.9%(+0.2%)

日本債券 21.0% (▲0.9%)

※カッコ内ã¯å‰å›žæ¯”

åŠå¹´å‰ã¨æ¯”ã¹ã¦ã€æ—¥æœ¬æ ªå¼ã¨æ–°èˆˆå›½æ ªå¼ã®æ¯”率ãŒã™ã“ã—盛り返ã—ã€å…ˆé€²å›½æ ªå¼ã®æ¯”率ãŒ3ï¼…ã»ã©å°ã•ããªã£ã¦ã„ã¾ã™ã€‚特ã«æ—¥æœ¬æ ªå¼ã¯è¿‘年比率ãŒä¸‹ãŒã‚Šç¶šã‘ã¦ããŸã®ã§ã€ç››ã‚Šè¿”ã™ã®ã¯ã¡ã‚‡ã£ã¨æ„外。ãã‚Œã ã‘æ—¥æœ¬æ ªå¼ã‚‚好調ã ã£ãŸã®ã§ã™ã今年ã¯ã€‚

æ ªå¼ã‚¯ãƒ©ã‚¹ï¼ˆãŠã‚ˆã³REITクラス)ã®æ¯”率ã¯77.1ï¼…ã¨ãªã‚Šã€å‚µåˆ¸ã‚¯ãƒ©ã‚¹ã®æ¯”率ã¯22.9ï¼…ã¨ãªã‚Šã¾ã—ãŸã€‚債券クラスãŒç›®æ¨™æ¯”率ã§ã‚ã‚‹30ï¼…ã‹ã‚‰ã ã„ã¶å°ã•ããªã£ã¦ã„ã‚‹ï¼ˆæ ªå¼æ¯”率ãŒå¤§ãããªã‚Šã™ãŽã¦ã„る)ã“ã¨ã«åŠ ãˆã¦ã€æ¥å¹´ã¯æ–°NISAã®å¹´é–“éžèª²ç¨Žæž ã‚’ã™ã¹ã¦å…¨ä¸–ç•Œæ ªå¼ã®ã‚ªãƒ«ã‚«ãƒ³ã§åŸ‹ã‚る予定ãªã®ã§ã€ã©ã“ã‹ã§ãƒªãƒãƒ©ãƒ³ã‚¹ã—よã†ã‹ãªã¨æ€ã£ã¦ã„ã¾ã™ã€‚

有効フãƒãƒ³ãƒ†ã‚£ã‚¢ã¯åŽ³å¯†ã«è¿½ã„求ã‚ã¦ãŠã‚‰ãšã€æœŸå¾…リターンã¨ãƒªã‚¹ã‚¯ã‚’æ•°å—ã§æŠŠæ¡ã—ã¦ã„ã¾ã™ã€‚ãŸã„ã—ãŸã‚¢ã‚»ãƒƒãƒˆã‚¢ãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³ã§ã¯ãªã„ã®ã§ã€ãƒžãƒã—ãªã„æ–¹ãŒã‚ˆã‚ã—ã„ã‹ã¨æ€ã„ã¾ã™ã€‚

â—†2023å¹´12月末時点ã®ä¸»ãªæŠ•è³‡å•†å“

â– å…¨ä¸–ç•Œæ ªå¼

・eMAXIS Slim å…¨ä¸–ç•Œæ ªå¼ï¼ˆã‚ªãƒ¼ãƒ«ãƒ»ã‚«ãƒ³ãƒˆãƒªãƒ¼ï¼‰ â†ç©ã¿ç«‹ã¦ä¸

・Vanguard Total World Stock ETF (VT)

â– æ—¥æœ¬æ ªå¼

ãƒ»æ—¥æœ¬æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹e

・<購入・æ›é‡‘手数料ãªã—>ニッセイTOPIXインデックスファンド

・eMAXIS Slim å›½å†…æ ªå¼(TOPIX)

â– å…ˆé€²å›½æ ªå¼

・iShares Core S&P 500 ETF (IVV)

ãƒ»å¤–å›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹e

・<購入・æ›é‡‘手数料ãªã—ï¼žãƒ‹ãƒƒã‚»ã‚¤å¤–å›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹ãƒ•ã‚¡ãƒ³ãƒ‰

・eMAXIS å…ˆé€²å›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹

・eMAXIS Slim å…ˆé€²å›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹

â– æ–°èˆˆå›½æ ªå¼

・eMAXIS æ–°èˆˆå›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹

・eMAXIS Slim æ–°èˆˆå›½æ ªå¼ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹

■日本債券

・個人å‘ã‘国債 変動10å¹´ â†ç©ã¿ç«‹ã¦ä¸

■外国債券

・GS米ドルMMF(海外ETFã®åˆ†é…金ã®ä¸€æ™‚ç•™ä¿ï¼‰

上記以外ã«ã‚‚ç´°ã‹ã„投資商å“ãŒã‚ã£ãŸã‚Šãªã‹ã£ãŸã‚Šã—ã¾ã™ãŒã€ä¸»ãªã‚‚ã®ã¯ä»¥ä¸Šã§ã™ã€‚eMAXIS(Slimã˜ã‚ƒãªã„方)シリーズã¨ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹eシリーズã¯ã€æ˜”ã‹ã‚‰ä¿æœ‰ã—ã¦ã„ã‚‹å¤ã„商å“ã®ãŸã‚今ã¾ã§è¡¨ç¤ºã‚’çœç•¥ã—ã¦ã„ã¾ã—ãŸãŒã€ä»Šå›žã‹ã‚‰ä¿æœ‰ã—ã¦ã„ã‚‹é™ã‚Šè¡¨ç¤ºã™ã‚‹ã“ã¨ã«ã—ã¾ã—ãŸã€‚é‹ç”¨ä¼šç¤¾ãŒã„ã¤ã¾ã§ãŸã£ã¦ã‚‚投信併åˆã—ã¦ãã‚Œãšã€é«˜ã„ä¿¡è¨—å ±é…¬ã‚’ãšã£ã¨æ‰•ã‚ã•ã‚Œã¦ã„ã‚‹ã“ã¨ã¸ã®ã•ã•ã‚„ã‹ãªæŠ—è°ã®æ„味ã§ã™ã€‚投信併åˆã§ä¸€ç‰©äºŒä¾¡ã‚’解消ã—ã¦ãã ã•ã„。ãªã«ã¨ãžã€‚

ç¾åœ¨ã®ç©ã¿ç«‹ã¦ç”¨ã®ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹ãƒ•ã‚¡ãƒ³ãƒ‰ã¯ã€ŒeMAXIS Slim å…¨ä¸–ç•Œæ ªå¼ï¼ˆã‚ªãƒ¼ãƒ«ãƒ»ã‚«ãƒ³ãƒˆãƒªãƒ¼ï¼‰ã€1本ã§ã€ã¨ã¦ã‚‚シンプルã§ã™ã€‚ã“ã‚Œã‹ã‚‰ã‚¤ãƒ³ãƒ‡ãƒƒã‚¯ã‚¹æŠ•è³‡ã‚’æ–°ãŸã«ã¯ã˜ã‚ã‚‹ã¨ã„ã†æ–¹ã¯ã€æœ€åˆã‹ã‚‰æŠ•è³‡ãƒ•ã‚¡ãƒ³ãƒ‰ã¯ã‚ªãƒ«ã‚«ãƒ³1本ã ã‘ã«ã™ã‚‹ã¨ç®¡ç†ãŒæ¥½ã¡ã‚“ã§ãšã£ã¨ã„ã‘ã‚‹ã¯ãšã€‚ã†ã‚‰ã‚„ã¾ã—ã„ã§ã™ã€‚

◆今後ã®æŠ•è³‡æ–¹é‡

今ã¾ã§åŒæ§˜ã€ã‚¢ã‚»ãƒƒãƒˆã‚¢ãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³ã®æŠŠæ¡ã¯å¹´2回(ãã®éš›å¤§ãã変化ã—ã¦ãŸã‚‰ãƒªãƒãƒ©ãƒ³ã‚¹ï¼‰ã€ãƒ¢ãƒ‹ã‚¿ãƒªãƒ³ã‚°ã¨ç©ã¿ç«‹ã¦æŠ•è³‡ã¯æœˆ1回行ãªã„ã¾ã™ã€‚2024å¹´ã‹ã‚‰ã¯ç‰¹å®šå£åº§ã§ã¯ãªãæ–°NISAã®ã¤ã¿ãŸã¦æŠ•è³‡æž ã«ç©ã¿ç«‹ã¦ã—ã¤ã¤ã€æˆé•·æŠ•è³‡æž ã«ã¯æ—©ã„タイミングã§ã‚ªãƒ«ã‚«ãƒ³ã«ä¸€æ‹¬æŠ•è³‡ã™ã‚‹äºˆå®šã§ã™ã€‚低コストã€ã‹ã¤ã€ã‚ˆã分散ã•ã‚ŒãŸãƒãƒ¼ãƒˆãƒ•ã‚©ãƒªã‚ªã‚’ã€ãƒã‚¤ï¼†ãƒ›ãƒ¼ãƒ«ãƒ‰ã—ã¾ã™ã€‚

今回確èªã—ãŸè³‡ç”£é…分ã¯ã€ç›®æ¨™ã‹ã‚‰ã‚„や乖離ã—ã¦ã„ãŸã®ã§ä»Šå¾Œãƒªãƒãƒ©ãƒ³ã‚¹ã‚’è¡Œã„ã€æ‰€å®šã®è³‡ç”£é…分ã«æˆ»ã™äºˆå®šã§ã™ã€‚

今後ã€ç›¸å ´ãŒã©ã†ãªã‚‹ã®ã‹ã¾ã£ãŸãã‚ã‹ã‚Šã¾ã›ã‚“ã®ã§ã€ãƒãƒ¼ãƒˆãƒ•ã‚©ãƒªã‚ªå…¨ä½“ã®ãƒªã‚¹ã‚¯ã‚’自分ã®ãƒªã‚¹ã‚¯è¨±å®¹åº¦ã®ç¯„囲内ã«ãŠã•ã‚ã‚‹ã“ã¨ã‚’é‡è¦–ã—ã€æŠ•è³‡è‡ªä½“ã«ã¯ã‚ã¾ã‚Šæ‰‹é–“ã¨æ™‚é–“ã‚’ã‹ã‘ã¾ã›ã‚“。ã®ã‚“ã³ã‚Šã„ãã¾ã™ã€‚ãã‚Œã§ã¯ã¾ãŸåŠå¹´å¾Œã«ã€‚

※言ã‚ãšã‚‚ãŒãªã§ã™ãŒã€æŠ•è³‡åˆ¤æ–ã¯è‡ªå·±è²¬ä»»ã§ã™ã€‚ã”自身ã®ãƒªã‚¹ã‚¯è¨±å®¹åº¦ã®ç¯„囲内ã§ã€‚

ã€PR】 上記商å“ã¯ã€ä»¥ä¸‹ã®ãƒãƒƒãƒˆè¨¼åˆ¸ã§è³¼å…¥ã—ã¦ã„ã¾ã™ã€‚会社åをクリックã™ã‚‹ã¨å£åº§é–‹è¨ï¼ˆç„¡æ–™ï¼‰ã§ãã¾ã™ã€‚

・楽天証券

・SBI証券

- 関連記事

-

-

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€26å¹´1月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰247ヶ月目

2026/01/21

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€26å¹´1月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰247ヶ月目

2026/01/21

-

2025å¹´12月末ã®è³‡ç”£é…分(アセットアãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³)ã¨ä¸»ãªæŠ•è³‡å•†å“ã€ä»Šå¾Œã®æŠ•è³‡æ–¹é‡

2026/01/02

2025å¹´12月末ã®è³‡ç”£é…分(アセットアãƒã‚±ãƒ¼ã‚·ãƒ§ãƒ³)ã¨ä¸»ãªæŠ•è³‡å•†å“ã€ä»Šå¾Œã®æŠ•è³‡æ–¹é‡

2026/01/02

-

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´12月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰246ヶ月目

2025/12/15

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´12月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰246ヶ月目

2025/12/15

-

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´11月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰245ヶ月目

2025/11/05

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´11月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰245ヶ月目

2025/11/05

-

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´10月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰244ヶ月目

2025/10/16

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´10月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰244ヶ月目

2025/10/16

-

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´9月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰243ヶ月目

2025/09/25

「ã¡ã‚‡ã£ã¨æŠ•è³‡å¿ƒã‚’ãã™ãるドルコスト平å‡æ³•ã€25å¹´9月分を実行。記録をã¯ã˜ã‚ã¦ã‹ã‚‰243ヶ月目

2025/09/25

-