Project Report On Ratio Analysis

Project Report On Ratio Analysis

Uploaded by

SiddhiCopyright:

Available Formats

Project Report On Ratio Analysis

Project Report On Ratio Analysis

Uploaded by

SiddhiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Project Report On Ratio Analysis

Project Report On Ratio Analysis

Uploaded by

SiddhiCopyright:

Available Formats

A

SUMMER INTERNSHIP PROJECT REPORT

ON

“RATIO ANALYSIS”

FOR

“KANSAI NEROLAC PAINTS LTD.”

At Lote, Parshurum

BY

“Mr. PRATIK VIRAJ KHATU”

Under the guidance of

“Prof. Mrs. ANAGHA GOKHALE”

Submitted to

“University of Mumbai”

In the partial fulfillment of the requirement for the award of the degree of

Master of Management Studies (MMS)

Through

Vishwakarma Sahajeevan Institute of Management, Khed

ACKNOWLEDGMENT

It is my greatest pleasure to acknowledge sincere gratitude towards Mr. S.

R. Deshmukh (HR Manager) who gave me a good opportunity to do my project in the

Kansai Nerolac Paints ltd.

I am also grateful to Mr. Nilesh Jangam (HR Officer), Nitin Jathar

(Commercial Manager) and other officers who are working in accounts department for

their valuable advice, cooperation and support in completion of my project.

I am thankful to Prof. Mrs. Anagha Gokhale madam for helping me to make this

project.

I am also thanks to VSIM College who helped me to making this project.

Regards

Pratik viraj khatu

VISHWAKARMA SAHAJEEVAN INSTITUTE OF MANAGEMENT

Khed, Dist. Ratnagiri. (MS) - 415709

(Affiliated to Mumbai University, Approved by AICTE and DTE)

CERTIFICATE

This is to certify that Mr. PRATIK VIRAJ KHATU has submitted the Summer

Internship Report titled RATIO ANALYSIS completed at KANSAI NEROLAC

PAINTS LTD. as per requirements of the two years full time Master of Management

Studies (MMS) course of Mumbai University for III Semester of the academic year

20010-11.

Date:-

Dr. Prof. Mrs. Anagha Gokhale

(Director VSIM) (Project guide)

TO WHOM SO EVER IT MAY CONCERN

This is to certify that Mr. PRATIK VIRAJ KHATU 3rd semester M.M.S. student from

Vishwakarma Sahajeevan Institute of Management; Khed was engaged as an

“Inplant Trainee”.

In our factory from 17th May 2010 to 30th June 2010, he has completed his training

successfully.

During his entire training period he was found to be sincere, hardworking and punctual.

We wish his success in his future assignments.

For

KANSAI NEROLAC PAINTS LTD.

S.R. Deshmukh

Sr. Manager –Human Resources.

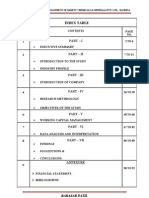

INDEX

Sr. Page

Particulars

Number Number

1 Executive Summary 1

2 Overview of Indian Paint Industry 2–7

3 Company profile 8 – 18

4 Need for the study 19

5 Objective of study 20

6 Research Methodology 21 – 22

7 Introduction to Ratio Analysis 23 – 37

8 Data collection and Interpretation 38 – 63

9 Findings 64 – 65

10 Suggestions and Conclusion 66 – 67

11 Limitations 68

Bibliography

1. EXECUTIVE SUMMARY

As a part of the partial fulfillment of the M.M.S course at VISHWAKARMA

SAHJEEVAN INSTITUTE OF MANAGENT, Khed (Ratnagiri), Summer

Training was undertaken with the KANSAI NEROLAC PAINTS LTD., Lote,

Khed (Ratnagiri)

This project is specially designed to understand the subject matter of Financial

Statement Analysis through various ratios in the company. This project gives us

information and report about company’s Financial Position. Throughout the project

the focus has been on presenting information and comments in easy and intelligible

manner.

The purpose of the training was to have practical experience of working in an

organization and to have exposure to the various management practices in the field of

Finance. This training has also given me an on the job experience of Financial

Management.

This project is very useful for those who want to know about company and financial

position of the company.

2. INDIAN PAINT INDUSTRY

The success story of the 100 years old Indian paint industry began when

Shalimar Paints set up a factory in Calcutta the way back in 1902. In the beginning the

industry was mainly comprised of number of small producers and very few major

players. Immediately after the Second World War, though the Indian Paint Industry had

seen numerous local entrepreneurs, the foreign companies

Like Goodlass Walls (now Kansai Nerolac), ICI, British Paints (now Berger Paints),

Jenson & Nicholson and Blundell & Eomite have been dominating the market for many

years.

Sector trends and specifics

The Indian paint industry is mainly segmented into two categories – industrial

and decorative paints. While industrial paints are used for protection against corrosion

and rust on steel structures, vehicles, white goods and appliances, decorative paints are

used in protecting valuable assets like buildings. In most developed countries, the ratio of

decorative paints vis-à-vis industrial paints is around 50:50. But, in India the industrial

paint segment accounts for only 30% of the paint market while the decorative paint

segment accounts for 70% of paints sold in India. Within the decorative segment, the

share of exterior paints is 21%, interior emulsions 11%, distempers 30%, solvent-based

enamel paint 36% and wood finishes two percent. The exterior category, particularly

exterior emulsions, is the fastest growing segment at 20% for the last three years. The

industrial coatings segment includes high performance coatings with 30% market share,

powder coatings with ten percent, coil coatings with five percent, marine coatings five

percent and automotive coatings 50%.

Demand and Growth

The demand for decorative paints is highly price-sensitive and also cyclical.

Monsoon is a slack season while the peak business period is Diwali festival time, when

most people repaint their houses. The industrial paints segment, on the other hand, is a

high volume-low margin business. Total paint and coatings demand in India in 2008

amounted to 1.64 million tons, of which decorative coatings represented 79% or 1.3

million tons. The industrial coatings market in India still remains relatively small in

comparison at about 340,000 tons, and this is dominated by structural and infrastructural

applications associated with the protective coatings market.

Despite having recorded a healthy growth of 13% annually in the 1990s, the per

capita consumption of paints in India is very low at 0.5 kg per annum as compared to 4

kg in the South East Asian nations and 22 kg in developed countries. And the global

average per capita consumption is 15 kg.

Threats

The industry is raw-material sensitive. Of the 300 odd raw materials, nearly half

of them are imported petroleum products. Thus, any deficit in global oil reserves affects

the bottom-line of the players. The demand for paints is relatively price-elastic but is

linked to the industrial and economical growth. Mainly the construction and automobile

sector throws shades of grey across the industry spectrum during recession in those

sectors. Evidently the slowdown in automotive business had a direct impact on the

growth of Industrial paint sale business this year. Despite having phenomenal real GDP

growth at 9% for the last five years, the consumer durables basket, that forms a part of

Index of Industrial Production (IIP), has shown a negative growth during 2007-08. This

had a direct impact on the paint sale business last year.

Opportunities

Although industry figures expect some modest abatement in growth in the

Indian paint and coatings market, particularly in the short term, the prevailing economic

climate of infrastructure investment and renewal holds the key to most of the growth in

the Indian coatings market.

Other opportunities in India are pegged to the transport sector. Car ownership in

India stands at little more than one percent. However, rising affordability and the launch

of economical cars such as the Tata Nano are expected to propel the market for OEM

coatings and refinishes in the coming years. Higher demand for marine paints can be

expected in the next decade, once investments in ports and port development have started

to reach fruition. As India is hopeful of competing with other established shipbuilding

nations, the multinationals are likely to find plentiful opportunity in India, given the

compliance requirements imposed by effects of international legislation on marine paints.

Powder coatings are also a good growth market in India, growing at about ten

percent per annum, which is typical of the mean coatings segment growth in the country.

This segment has been finding new applications in India and represents one area in which

the consciousness of VOCs and the environment has been raised. Indian companies are

now beginning to appreciate the benefits of cleaner technology once initial investment in

finishing in this area has been made. However, it is in the decorative coatings market that

the greatest volume growth can be expected. Almost another 900,000 tons of decorative

paints may well be in use by 2013, prompted by a whole breadth of different applications,

ranging from the construction of housing and apartment blocks to civil and tourist

amenities. The structure of the decorative paint market in terms of quality is changing

very slowly with growth in the premium and economy sectors squeezing the intermediate

quality segment to about 35‐40% of demand. Other habits are changing too including the

formal entry of Sherwin‐Williams, Jotun and Nippon Paint into the Indian decorative

sector, which has started to bring a much greater international dimension and much

bigger budgets to the Indian decorative paint market. Although the arrival of these

companies in the segment has not had a major impact on the market yet, Indian

consumers are becoming more experimental and adventurous in their use of paint and as

a result many traditional ideas are being given up in favor of trying something different,

especially as the Indian population is a relatively young one.

Market Profile

The organized sector of India’s paint and coatings market holds a whopping

65% share of the approximately Rs. 13600 crore industry, while the balance is made up

of over 2000 unorganized units. There are now twelve major players in the organized

sector namely Asian Paints, Kansai Nerolac, Berger, ICI, Shalimar, and so on. Recent

years, the industry has attracted world leaders like Alzo Nobel, PPG, DuPont and BASF

to set up base in India to offer product ranges such as auto refinishes, powder coatings

and industrial coatings.

Asian Paints (APIL) is the industry leader with an overall market share of 33

per cent in the organized paint market. It has the largest distribution network among the

players and its aggressive marketing has earned it strong brand equity. The Berger Group

and ICI share the second slot in the industry with market shares of 17 per cent each.

GNPL has a market share of 15 percent in the organized sector.

APIL dominates the decorative segment with a 38 per cent market share. The

company has more than 15,000 retail outlets and its brands Tractor, Apcolite, Utsav,

Apex and Ace are entrenched in the market. GNPL, the number-two in the decorative

segment, with a 14 per cent market share too, has now increased its distribution network

to 10,700 outlets to compete with APIL effectively. Berger and ICI have 9 per cent and 8

per cent shares respectively in this segment followed by J&N and Shalimar with 1 and 6

per cent shares. On the other hand, GNPL dominates the industrial paints segment with

41 per cent market share. It has a lion's share of 70 per cent in the OEM passenger car

segment, 40 per cent share of two wheeler OEM market and 20 per cent of commercial

vehicle OEM market. It supplies 70 per cent of the paint requirement of Maruti, India's

largest passenger car manufacturer, besides supplying to other customers like

Telco, Toyota, Hindustan Motors, Hero Honda, TVS-Suzuki, Mahindra & Mahindra,

Ashok Leyland, Ford India, PAL Peugeot and Bajaj Auto. GNPL also controls 20 per

cent of the consumer durables segment with clients like Whirlpool and Godrej GE. The

company is also venturing into new areas like painting of plastic, coil coatings and cans.

APIL, the leader in decorative paints, ranks a poor second after Goodlass Nerolac in the

industrial segment with a 15 per cent market share. But with its joint venture Asian-PPG

Industries, the company is aggressively targeting the automobile sector. It has now

emerged as a 100 per cent OEM supplier to Daewoo, Hyundai, Ford and General Motors

and is all set to ride on the automobile boom. Berger and ICI are the other players in the

sector with 10 per cent and 9 per cent shares respectively. Shalimar too, has an 8 per cent

share.

3. COMPANY PROFILE

3.1 ABOUT KANSAI NEROLAC PAINTS LTD. (KNPL)

Kansai Nerolac Paints ltd is India‘s second largest paint company with group turnover of

about Rs.1170/- crore per annum. It is market leader in industrial coating business in

India and second largest in the Decorative Paints market. KNP Co. Ltd of Japan holds

69.27% equity of KNPL. Kansai Paint is one of the top ten companies in the world. The

company has technical tie ups with reputed foreign collaborations such as Oshima

Kogyo,E.I. Du Pont, NTT, Nihon Parkerizing and Ameron in the field of speciality &

High performance coatings. Kansai Nerolac Paints Ltd. has the reputation in being

innovative, creating value, delivering quality and service.

KNPL has manufacturing locations at Lote in Maharashtra, Perungudi in Tamil Nadu,

Jainpur in Uttar Pradesh, Bawal in Haryana and Hosur in Tamil Nadu. The corporate

office is situated at Lower Parel in Mumbai.

The total strength of the employees is about 2000 spread over in corporate office,

manufacturing plant, zonal, regional, and area offices.

Nerolac is well established brand in Decorative Coatings. It has widespread distribution/

marketing network with over 11000 dealers and 65 depots. Product ranges of Decorative

Coatings include exterior and interior finishes, wood finishes, auto refinishes, and certain

speciality products. The product range in automotive coating includes Pre-treatment

Chemicals, Electro Deposition Primers, PVC sealers, Mono coats & Metallics finishes,

Clear Coatings etc.

KNPL has very good research and development set up. It engages over 175 paint

technologists for continuous developing superior products. KNPL is a professionally

managed company with young and vibrant team with an average age of 37 years.

3.2 History of Kansai Nerolac Paints Ltd. (KNPL):

Kansai Nerolac is one of the largest paints companies in India having a significant

presence in industrial as well as decorative sectors.

Kansai Nerolac embarked their journey in 1920 as Gahagan Paints and Varnish Co. Ltd.

at Lower Parel in Bombay.

In 1930, three British companies merged to formulate Lead Industries Group Ltd.

In 1933, Lead Industries Group Ltd. acquired entire share capital of Gahagan Paints in

1933 and thus, Goodlass Wall (India) Ltd. was born.

Subsequently, by 1946, Goodlass Wall (India) Ltd. was known as Goodlass Wall Pvt.

Ltd.

In 1957, Goodlass Wall Pvt. Ltd. grew popular as Goodlass Nerolac Paints (Pvt.) Ltd.

Also, it went public in the same year and established itself as Goodlass Nerolac Paints

Ltd.

In 1976, Goodlass Nerolac Paints Ltd. became a part of the Tata Forbes Group on

acquisition of a part of the foreign shareholdings by Forbes Gokak.

In 1983, Goodlass Nerolac Paints Ltd. strengthened itself by entering in technical

collaboration agreements with Kansai Paint Co. Ltd., Japan and Nihon Tokushu Toryo

Co.Ltd.Japan.

In 1986, Goodlass Nerolac Paints Ltd. turned into a joint venture of the Tata Forbes and

the Kansai Paint Co. Ltd., with the latter acquiring 36% of its share capital.

In 2000, Kansai Paint Company Ltd., Japan took over the entire stake of Tata Forbes

group and thus GNP became a wholly owned subsidiary of Kansai Paint Company Ltd.

In 2006, on the 11th of July, Goodlass Nerolac Paints Ltd. name has been changed to

Kansai Nerolac Paints Ltd.

3.3 Vision of KNPL:

“KNPL its unique vision to leverage global technology for servicing customer with

superior coating system built on innovative and superior product and world class solution

to strengthen its leadership in industrial coating and propel for leadership in architectural

coating all to the delight of its stake holder”.

3.4 Management:

Being the second largest paint company in India, it spread over the country with

employee strength of around 2000. An efficient management provides the conducive

work atmosphere to develop and grow.

BOARD OF DIRECTORS:

Name Of Person Designation

Dr. Jamshed Jiji Irani Chairman

Mr. Devendra Motilal Kothari Vice –Chairman

Mr. Hiroshi Ishino Director

Mr. Yuzo Kawamori Director

Mr. Pradip Shah Director

Mr. Harishchandra Meghraj Managing Director

Bharuka

Mr. Susim Mukul Datta Director

Mr. Noel Tata Director

Mr. Yaso Tajiri Director

Mr. Pravin Chaudhari Director

Management committee members:

Name Of The Person Designation

Mr. H.M. Bharuka Managing Director

Mr. Pravin Chaudhari Director

Mr. Shrikant Dikhale Vice President – Hr

Mr. Anuj Jain Vice President - Marketing

(Decorative

Mr. Mahesh Mehrotra Vice President – Technical

Mr. Hitoashi Nishibayashi Director Supply Chain & Auto

Marketing

Mr. P.D. Pai Vice President – Finance

Mr. Jason Gonsalves Vice President - Corporate Planning

& It

3.5 Customers of Kansai Nerolac Paints ltd.:

I. Bajaj Auto Ltd.

II. Maruti Udyog Ltd.

III. Godrej & Boyce

IV. Mahindra & Mahindra

V. Samsung

VI. Ashok Leyland

VII. Toyota Kirloskar Motors Ltd.

VIII. Aditya Birla Group

IX. Hero Honda

3.6 About Kansai Nerolac Paint Ltd. (Lote Plant):

Nerolac Lote plant was commissioned on 29th April 1998 which is situated in MIDC

Lote, Parshuram Industrial area. The site is surrounded by other manufacturing units

which is 1km away from National Highway NH-17. Nerolac Lote plant is spread over 10

acres (40400 sq. m.). KLP started this plant mainly to maintain the requirement of the

growing automobile sector in Pune.

In terms of production capacity Lote plant is second largest plant of KNPL and basically

focuses on industrial paint. Recently Industrial Lote Plant achieved 1616.8 KL

production-which is the highest ever production at Lote.

To meet overall requirement of water base paint Kansai Nerolac has started a new plant

of decorative paints which is totally advanced to meet the required quantity water base

paint. The new decorative water base plant started in the end of October 2008.

3.7 Major business lines:

I. Automotive Coating

II. High Performance Coating

III. Architectural Coating

IV. Powder Coating

3.8 Products of KNPL (Lote):

A) Industrial:

I. Primer

II. I/C Coats

III. Top Coats

IV. Thinner

B) Decorative:

I. Water Based: Emulsion, CCD

II. Solvent Based: Primers, Enamels High Performance

3.9 Capacity of Lote Plant:

I. Installed Capacity: 1000 kl/month

II. Actual capacity: 850kl/month

3.10 Quality and EHS certifications received by KNPL (LOTE) plant:

TS 16949 June 2006

ISO 9000-2000 May 2004

ISO 14000 September 2002

OHSAS 18000 January 2005

3.11 Award and Recognition to KNPL (LOTE) Plant:

• Golden Peacock Environment Management Award 2009- Winner

• Symbiosis centre for management –Lean and six sigma excellence

-As a participant

• Greentech Environment Excellence Award 2008 in chemical sector- Awarded by

Greentech foundation, New Delhi.

• ECS Manufacturing Excellence Level 2 Certificate in April 2008

• Goodlass Nerolac Paint Ltd C2E- Commitment to Excellence in May 2006

Lote has achieved recognition to their outstanding performance in commitment

for excellence in Human Resource Care in May 2006

3.12 Employee Team of KNPL (LOTE) Plant:

Category of employees Paint unit Powder coating unit

Managers 10 3

Executive staff 114 25

Operators 144 47

Trainee operators 17 10

Casuals 94 2

Contract Labours 83 45

Thus, total no. of permanent workers/staff in KNPL Lote plant including both Paint unit

and Powder coating unit are 343.

The total number of contract employees/workers in KNPL Lote plant including both

Paint unit and Powder coating unit are 128.

3.13 Other Activities at Lote Plant:

• Monthly Virangula is celebrated at officer’s recreational club at Chiplun.

• World environment day is celebrated by all employees on 5th June.

• Various competition such as kaizen, FIP, Best AET, best CANDO zone are

organised for all three units under ME Convention theme.

• Dassera pooja festival is celebrated at all three units. Various cultural programs

are organized at PC Unit.

3.14 ORGANISATION STRUCTURE OF LOTE PLANT

QC

PROD

QA ENGI.

UNIT

HEAD

NEW MFG

WATE MATE ACCO EXCE

3.15 Functions of Finance HR ENGI FPP HSE

TECH- R & Accounts Department ofRIAL

KNPLUNTS

(lote):LLEN

MFG

NICAL BASE CE

Accounting function is necessary is a necessary input into the finance

function i.e.RESIN

DECO

accounting is a sub-function of finance. Accounting generates information \

INDT.

. /CED

data relating to operations/ activities of the firm. The end product of accounting

constitutes financial statements such as Balance sheet, The Income Statement and The

Statement of changes in Financial position/ sources and uses of funds statement/ Cash

flow statement. The information contained in these statements and reports assists

Financial Managers in assessing the past performance & future direction of the firm and

meeting the legal obligation, such as payment of taxes and so on. Thus Accounting and

Finance are functionally closely related.

STRUCTURE OF ACCOUNTS DEPERTMENT AT LOTE PLANT

COMMERCIAL

MANAGER

ACCOUNTS

HEAD

JUNIOR JUNIOR JUNIOR

OFFICER OFFICER OFFICER

Various Sections in Accounts Department at Lote Plant:

1. Financial:

Funds are arranged from head office for the payment of expenses,

engineering bills, transportation bills etc. Reports are maintained related to operating

expenses that means total expenses during the month like, salary, wages, freight, welfare

etc.

2. Excise:

Accounts of modvat received and payment of the central excise duty on

the finished goods dispatches.

3. Sales Tax:

Accounts of vat received on purchase and payment of vat on finished

goods dispatches.

The various duties and responsibilities of Accounts department in KNPL Lote

plant:

1. Recording day-to-day operating expenses

2. Excise duty analysis

3. Transportation bill passing

4. Engineering bill passing

5. Powder coating bill passing

6. Day-to-day cash transactions

7. MIS Activities

4. NEED FOR THE STUDY

• The study has great significance and provides benefits to various parties whom

directly or indirectly interact with the company.

• It is beneficial to management of the company by providing crystal clear picture

regarding important aspects like liquidity, leverage, activity and profitability.

• The study is also beneficial to employees and offers motivation by showing how

actively they are contributing for company’s growth.

• The investors who are interested in investing in the company’s shares will also get

benefited by going through the study and can easily take a decision whether to

invest or not to invest in the company’s shares.

5. OBJECTIVES OF STUDY

The major objectives of the resent study are to know about financial strengths and

weakness of KANSAI NEROLAC PAINTS LIMITED through FINANCIAL RATIO

ANALYSIS.

The main objectives of resent study aimed as:

• To evaluate the performance of the company by using ratios as a yardstick to

measure the efficiency of the company.

• To understand the liquidity, profitability and efficiency positions of the company

during the study period.

• To evaluate and analyze various facts of the financial performance of the

company. To make comparisons between the ratios during different periods.

Secondary Objectives:

• To study the present financial system at KANSAI NEROLAC PAINTS

LIMITED.

• To determine the Profitability, Liquidity Ratios.

• To simplifies and summarizes a long array of accounting data and makes them

understandable.

6. RESEARCH METHODOLOGY

Research methodology is a way to systematically solve the research

problem. it may be understood as a science of studying how research is done

scientifically. So, the research methodology not only talks about the research methods but

also considers the logic behind the method used in the context of the research study.

6.1 Research Design:

Descriptive research is used in this study because it will ensure the minimization

of bias and maximization of reliability of data collected. The researcher had to use fact

and information already available through financial statements of earlier years and

analyze these to make critical evaluation of the available material. Hence by making the

type of the research conducted to be both Descriptive and Analytical in nature.

From the study, the type of data to be collected and the procedure to be used for

this purpose were decided.

6.2 Data Collection:

The required data for the study are basically secondary in nature and the data are

collected from the audited reports of the company.

6.2.1 Primary Data:

Primary data are those data, which is originally collected afresh.

In this project, Questionnaire Method and Interview Method has been used for

gathering required information.

6.2.2 Sources of Data:

The sources of data are from the annual reports of the company from the year

2007-2008 to 2009-2010.

6.3 Methods of Data Analysis:

The data collected were edited, classified and tabulated for analysis. The

analytical tools used in this study.

6.3.1 Analytical Tools Applied:

The study employs the following analytical tools:

• Comparative statement.

• Common Size Statement.

• Trend Percentage.

• Ratio Analysis.

7. RATIO ANALYSIS

7.1 Financial Analysis:

Financial analysis is the process of identifying the financial strengths and

weaknesses of the firm and establishing relationship between the items of the balance

sheet and profit & loss account.

Financial ratio analysis is the calculation and comparison of ratios, which

are derived from the information in a company’s financial statements. The level and

historical trends of these ratios can be used to make inferences about a company’s

financial condition, its operations and attractiveness as an investment. The information in

the statements is used by

• Trade creditors, to identify the firm’s ability to meet their claims i.e. liquidity

position of the company.

• Investors, to know about the present and future profitability of the company and

its financial structure.

• Management, in every aspect of the financial analysis. It is the responsibility of

the management to maintain sound financial condition in the company.

7.2 Ratio Analysis:

The term “Ratio” refers to the numerical and quantitative relationship

between two items or variables. This relationship can be exposed as

• Percentages

• Fractions

• Proportion of numbers

Ratio analysis is defined as the systematic use of the ratio to interpret the

financial statements. So that the strengths and weaknesses of a firm, as well as its

historical performance and current financial condition can be determined. Ratio reflects a

quantitative relationship helps to form a quantitative judgment.

7.3 Ratios Are Useful For Several Parties Such As:

1) Investors, both present as well as potential investors.

2) Financial analyst.

3) Mutual funds.

4) Stock broker and stock exchange authorities.

5) Government.

6) Tax department.

7) Competitors.

8) Research analysts and students.

9) Company’s management.

10) Creditors and Suppliers

11) Lending Institutions – Banks and Financial Institutions

12) Financial Manager

13) Other Interested parties like credit rating agencies etc.

7.4 Nature of Ratio Analysis:

Ratio analysis is a technique of analysis and Interpretation of financial

statements. It is the process of establishing and interpreting various ratios for helping in

making certain decisions. It is only a means of understanding of financial strengths and

weaknesses of a firm. There are a number of ratios which can be calculated from the

information given in the financial statements, but the analyst has to select the appropriate

data and calculate only a few appropriate ratios. The following are the four steps involved

in the ratio analysis.

• Selection of relevant data from the financial statements depending upon the

objective of the analysis.

• Calculation of appropriate ratios from the above data.

• Comparison of the calculated ratios with the ratios of the same firm in the past, or

the ratios developed from projected financial statements or the ratios of some

other firms or the comparison with ratios of the industry to which the firm

belongs.

7.5 Classification of Ratios:

A) Liquidity Ratios

It is also known as liquidity ratios. it includes the following

1) Measures ability of a company to meet its current obligations.

2) Indicates short term financial stability of a company.

3) Indicates present cash solvency and ability to remain solvent in times of

adversities.

To measure the liquidity of a firm the following ratios can be calculated

• Current ratio

• Quick (or) Acid-test (or) Liquid ratio

(a) Current Ratio:

Current ratio is useful to find out solvency of the company. High current

ratio indicates that company will be able to pay its debt maturity within a year. Low

current ratio indicates that company will not be able to meet its short term debts.

Minimum standard current ratio is 2:1.

Current Assets

Current Ratio=

Current Liabilities

(b) Quick Ratio:

Quick ratio is also known as acid test ratio. It indicates immediate ability

of a company to pay off its current obligations. And also shows the solvency and

financial soundness of the business. Greater the ratio stronger the financial position of

the company.

The standard quick ratio should be 1:1

Quick Assets

Quick Ratio=

Quick Liabilities

B) Profitability Ratios:

The primary objectives of business undertaking are to earn profits.

Because profit is the engine, that drives the business enterprise.

It measures the overall efficiency of the business. It indicates whether

utilization of business assets and funds are done efficiently and best way or not , so as to

generate adequate profits or returns.

Profitability ratios fall in two categories:

a) Related To Sales:

1) Gross Profit Ratio:

It shows the operating efficiency of the business. It measures the

efficiency of production as well as pricing. Decrease in the ratio indicates reduction in

selling price or increase in the cost of production or decline in the business activity.

Increase in the ratio indicates increase in the selling price or reduction in the cost of

production.

Gross Profit

Gross Profit Ratio = X 100

Sales

2) Operating Profit Ratio:

It indicates profitability of entire business after meeting all operating cost

including direct and indirect cost of administrative and distribution expenses.

Operating Profit

Operating Profit Ratio: X 100

Sales

3) Net Profit Ratio:

It shows the overall efficiency of the business. Higher the ratio indicates

higher efficiency of business and better utilization of total resources. In addition it

indicates efficiency of financing operations as well as tax management.

Net profit after tax

Net Profit Ratio: X 100

Sales

b) Related To Investment Of Capital Employed:

1) Return On Investment:

It measures the overall performance of the company that is utilization of total resources

and funds available with the company. Higher the ratio better utilization of funds. It

indicates earning capacity of the business. It measures the management performance.

EBT But AT

Return on Investment: X 100

Total Assets/ Liability

2) Return On Net Worth Or Proprietors Funds:

It measures the productivity of shareholders funds. Higher the ratio indicates better

utilization of shareholders funds or higher productivity of owner’s funds. It helps to

investor to compare the earning capacity of company with that of other companies.

Net Profit after Tax

Return on Net Worth: X 100

Equity Shareholder Fund

C) Turnover Ratio-

It measures how efficiently the assets are employed. These ratios are

expressed in number of times the assets is used during the period.

1) Inventory Turnover Ratio:

It indicates number of times the replacement of inventory during the given

period usually a year. Higher the ratio more efficient is the management of inventory. But

higher inventory turnover ratio is not always good if it is lower level of inventory because

it invites problem of frequency stock outs and loss of sales and customer or goodwill.

Cost of Goods Sold

Inventory Turnover Ratio:

Average Stock in Hand

2) Average Collection Period:

It indicates credit and collection policy and also indicates efficiency in

management of debtors. Smaller no. of dates, higher will be the efficiency of the

collection department.

Avg. collection period should not exceed 1.5 times the credit period allowed.

Receivable (Debtors)

Avg. Collection Period:

Average Sales per Day.

3) Receivable Turnover Ratio:

The ratio indicates average credit period enjoyed by debtors.

Debtors + Bills Receivable

Receivable Turnover Ratio: X 100

Total Credit Sales

4) Fixed Asset Turnover Ratio:

It indicates efficiency in the utilization of fixed assets like plant and machinery by

management.

Net Sales

Fixed Assets Turnover Ratio =

Fixed Assets

5) Total Asset Turnover Ratio =

It indicates how efficiently the assets are employed overall. It indicates

relationships between the amount invested in the assets and the result accrues in terms of

sales.

Net Sales

Total Asset Turnover Ratio =

Total Assets

6) Creditors Turnover Ratio:

It indicates the how the credit period enjoyed by the creditors.

Net Credit Purchases

Creditors Turnover Ratio=

Average Creditors

D) Financial Ratio –

1) Capital Gearing Ratio:

This ratio indicates the relationship between preferential capital,

debenture. Term loan and capital which does not carry fixed rate of interest or dividend.

When the ratio is more than one then the capital is said to be highly geared that means

low equity share capital and greater amount of preference share capital, debenture, long

term loan.

When the ratio is less than one then the capital is said to be very lowly

geared that means low earning per share. Equity shareholder will control the company. It

results in over capitalization.

Preferential Capital + Debenture + Term Loan

Capital Gearing Ratio:

Equity Share Capital + Reserve and Surplus

2) Proprietary Ratio:

It measures the relationship between funds invested in business by the

owners with the total funds invested in business. It indicates long run solvency of the

business. High ratio means company is less dependent on outside funds and company is

quite solvent. Low ratio indicates company is more dependent on outside funds solvency

and solvency may be danger.

Proprietary Fund

Proprietary Ratio:

Total Assets

3) Stock Working Capital Ratio:

It indicates weightage of stock in the current assets or in the working

funds. It indicates strength and weaknesses of working capital; high ratio indicates slow

movement in stock and also reflects better management of inventory as well as working

capital.

Stock

Stock Working Capital Ratio:

Working Capital

E) Financial Leverage Ratio:

It indicates financial structure of the organization that is proportion of

debts as compare to owner’s fund.

1) Debt Equity Ratio:

Higher the ratio less secured is the creditors, lower the ratio creditors

enjoy higher degree of safety.

Debt

Debt Equity Ratio:

Equity

2) Debt Asset Ratio:

It indicates the percentage of the total asset created by the company

through short term and long term debt. Higher the ratio less safe is the creditors and vice

versa.

Debt

Debt Asset Ratio:

Total Assets

3) Long Term Debt to Total Capitalization:

It explains the relationship between long term debts borrowed from

outsiders with owner’s contribution. Lower the ratio better is the solvency of the business

and safer is the creditor so far as his repayment.

Long Term Debt

Long Term Debt to Total Capitalization:

Total Capital Employed

4) Interest Coverage Ratio:

This indicates earning capacity of the business to pay its interest

burden. Higher the ratio business can easily pay the interest.

Earnings before Interest and Tax

Interest Coverage Ratio:

Interest

F) Dividend Ratio:

These ratios for a particular company are relevant for an investor for

making an investment decision as to whether he should invest in the share of the

company.

1) Earnings per Share:

This ratio indicates weather over a given period their have been change

in the wealth per share holder. Other the ratio increases the possibility for the higher

dividends and increase in the market price of the shares.

Earnings after Tax – Preference Dividend

Earnings per Share:

No. Of Shares Paid Up

2) Price Earnings Ratio:

It indicates relationship between market price of the share and the current

earnings per share. It helps to determine the future price of the share.

Market Price per Share

Price Earnings Ratio:

Earning Per Equity Share

3) Payout Ratio:

It indicates how much proportion of the earning per share is retaining for

plaguing back and portion distributed as dividend to the share holder.

Dividend per Equity Shares

Payout Ratio:

Earnings per Share

4) Dividend Yield Ratio:

It indicates the ultimate current return which investor will get as a

percentage of is investment. It indicates the feature like the profitability and dividend

policy of the company. When dividend yield is lower than the expected return, market

price for the share may fall in future or vice versa.

Equity Dividend

Dividend per Share:

No. Of Equity Shares

Dividend per Share

Dividend Yield

Market Price per Share

7.6 Interpretation of the Ratios:

The Interpretation of ratios is an important factor. The inherent limitations of ratio

analysis should be kept in mind while interpreting them. The impact of factors such as

price level changes, change in accounting policies, window dressing etc.

7.7 Guidelines or Precautions for Use of Ratios:

The calculation of ratios may not be a difficult task but their use is not

easy. Following guidelines or factors may be kept in mind while interpreting various

ratios is

• Accuracy of financial statements

• Objective or purpose of analysis

• Selection of ratios

• Use of standards should also be kept in mind when attempting to interpret ratios.

8. DATA ANALYSIS AND INTERPRETATION

8.1 Financial stability Ratios:

To measure the liquidity of a firm the following ratios can be calculate the following

ratios,

a) CURRENT RATIO:

Current Asset

Current Ratio:

Current Liabilities

Table 8.1.a:

(Rupees in lakhs)

Year Current Assets Current Liabilities Ratio

31-3-07 48468.47 21582.46 2.2:1

31-3-08 51764.02 27739.78 1.8:1

31-3-09 49807.77 32808.36 1.5:1

ANALYSIS AND INTERPRETATION:

The current ratio of the firm measures the short term solvency. It indicates

the rupees of current asset available for each rupee of current liabilities.

The above chart shows that decline trend from the F.Y. 2007 to F.Y. 2009.

This is mainly due to increasing creditors from F.Y. 2007 to F.Y. 2009. In the F.Y. 2007-

08 it shows 2.2:1 which was higher than the standard ratio i.e. 2:1. There was continuous

decline in the current ratio which is not good sign for the company.

b) QUICK RATIO:

Quick Asset

Quick Ratio:

Quick Liabilities

Table 8.1.b:

(Rupees in lakhs)

Year Quick Asset Quick Liabilities Ratio

31-3-07 23199.99 21582.46 1.07:1

31-3-08 27062.4 27739.78 0.975:1

31-3-09 28573.68 32808.36 0.870:1

ANALYSIS AND INTERPRETATION:

The above chart indicates the decline trend from the F.Y. 2007 to F.Y. 2009. In

the F.Y. 2008 and F.Y. 2009 the quick ratio of the company was below standard that

means large part of current asset of the firm is tie up in slow moving and unsellable

investment of Finish goods and also slow moving of debts, but, the overall trend shows

declining which is not a positive sign for KNPL.

8.2. PROFITABILITY RATIO

A) RELATED TO SALES

a) Operating Profit Ratio:

Earnings before Interest Taxes

Operating Profit Ratio: X 100

Sales

Table 8.2.A.a:

(Rupees in lakhs)

Earning Before

Year Sales Ratio

Interest Taxes

31-3-07 15542.89 129345.66 12.02 %

31-3-08 16759.11 139992.48 11.97 %

31-3-09 14272.70 139639.94 10.22 %

ANALYSIS AND INTERPRETATION:

The above chart shows that there was a continuous decreased in the ratio.

That means the ratio was decreased from 12.02% in FY 2007-08 to 10.22% in FY 2009-

10. This is due to increases in the expenditure of the company.

b) Net Profit Ratio:

Net Profit

Net Profit Ratio: X 100

Sales

Table 8.2.A.b:

(Rupees in lakhs)

Year Net Profit Sales Ratio

31-3-07 10202.8 129345.66 7.88 %

31-3-08 11702.72 139992.48 8.35 %

31-3-09 10136.19 139639.94 7.25 %

Ratio

8.5

RATIO (%)

8

7.5 Ratio

7

6.5

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

The above chart indicates the Net Profit Ratio in 2007-08 was 7.88 %

which further increases to 8.35% in FY 2008-09. Further it had fallen to 7.25% in FY

2009-10. That means company suffers the losses after the FY 2008-09. In FY 2008-09

the net profit was high to increase in the sales of the company.

(B) RELATED TO CAPITAL EMPLOYED

a) Return on investment:

Earnings before interest but after tax

Return on investment: X 100

Total asset / liability

Table 8.2.B.a:

(Rupees in lakhs)

Earnings Before

Total Asset /

Year Interest But After Ratio

Liability

Tax

31-3-07 10378.39 65912.12 15.74 %

31-3-08 11929.75 73746.32 16.17 %

31-3-09 10257.99 75662.49 13.55 %

Return on investment

17.00%

16.00%

15.00%

Ratio

Ratio

14.00%

13.00%

12.00%

31-3-07 31-3-08 31-3-09

Year

ANALYSIS AND INTERPRETATION

It can be found that the return on investment ratio of KNPL was slightly

increased in first two years. Further it was decreased by 0.13% which implies an

ineffective decisions made by the managers.

(b) Return on Net Worth or Proprietor’s Funds:

Net Profit after Tax

Return on net worth: X 100

Equity shareholder fund

Table 8.2.B.b:

(Rupees in lakhs)

Net Profit after Equity shareholder

Year Ratio

Tax fund

31-3-07 10202.8 51721.18 19.72 %

31-3-08 11702.72 59875.12 19.54 %

31-3-09 10136.19 66299.87 15.28 %

25.00%

20.00%

RATIO (%)

15.00%

Ratio

10.00%

5.00%

0.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

This ratio indicates how well the firm has used the resources of owner.

The earning of a satisfactory result is the most desirable objective of the business. This

ratio is important to present as well as prospective shareholders and also of great concern

to management.

The above chart shows that the ratio was almost constant in first two

years. Further it declined to 15.28% this is due to increased in the reserve and surplus of

the company.

Higher the ratio indicates better utilization of recourses but in KNPL It

shows decreasing trend which is not good.

8.3. TURNOVER RATIOS:

a) Inventory turnover ratio:

Net Sales

Inventory turnover ratio:

Closing Stock

Table 8.3.a:

(Rupees in lakhs)

Year Net Sales Closing Stock Ratio

31-3-07 129345.66 19996.18 6.46 times

31-3-08 139992.48 19926.90 7.02 times

31-3-09 139639.94 17063.39 8.18 times

ANALYSIS AND INTERPRETATION:

The above chart shows that the stock gets converted into cash was 6.46

times, 7.02 times and 8.18 times in the FY 2007 to 2009 respectively.

If we compared the figures of sales and inventory of first two years, the

level of inventory is almost same, but in the FY 2008 and09 the sales was increased with

low cost of inventory which implies the management is successful to reduce the cost

involved for management of inventory.

b) Average Collection Period:

Receivable (Drs)

Average collection period:

Average sales per day

Table 8.3.b:

(Rupees in lakhs)

Average sales per

Year Receivable (Drs) Ratio

day

31-3-07 20994.41 129345.66 59.24days

31-3-08 23637.37 139992.48 61.62 days

31-3-09 20957.29 139639.94 54.77 days

ANALYSIS AND INTERPRETATION:

The above chart shows that the collection period was high in FY 2008-09 i.e. 62 days.

This means, a very long collection period would imply either for credit selection or an

inadequate collection. The average collection period short in FY 2009-10 which means

that better is a credit management and prompt payment on the part of debtors.

c) Receivable turnover ratio:

Credit sales

Receivable turnover ratio:

Average debtors

Table 8.3.c:

(Rupees in lakhs)

Year Credit sales Average debtors Ratio

31-3-07 129345.66 20994.41 6.1times

31-3-08 139992.48 23637.37 5.9 times

31-3-09 139639.94 20957.29 6.6 times

ANALYSIS AND INTERPRETATION:

This ratio indicates the average credit period enjoyed by debtors. The

above chart shows that the customers to whom the credit sales are made pay 6.1times, 5.9

times & 6.6 times in the FY 2007 to respectively. In the FY 2008-09 THE DEBTORS

TURNOVER RATIO was low which indicates the absence of a strict credit policy and

also point out that there were delayed to recover the revenue from sales. This point out

into the huge block up of working capital in book debt.

It was high in FY 2009-10 i.e. 6.6 times which indicate prompt payment

on the part of debtors. Overall debtor’s turnover ratio was good.

d) Fixed Asset Turnover Ratio:

Net sales

Fixed asset turnover ratio:

Fixed assets

Table 8.3.d:

(Rupees in lakhs)

Year Net sales Fixed assets Ratio

31-3-07 129345.66 22538.61 5.73 times

31-3-08 139992.48 24140.44 5.79 times

31-3-09 139639.94 23861.99 5.85 times

ANALYSIS AND INTERPRETATION:

It indicates efficiency in the utilization of fixed assets like plant and

machinery by management.

From the above chart the fixed asset turnover ratio of KNPL slowly

increases over period of time. From this we can say that a company has been successful

to manage and utilized its assets. Also a company has been more effective in using the

investment in fixed assts to generate revenue.

e) Total Asset Turnover Ratio:

Net sales

Total asset turnover ratio:

Total asset

Table 8.3.e:

(Rupees in lakhs)

Year Net sales Total asset Ratio

31-3-07 129345.66 65912.12 1.962 times

31-3-08 139992.48 73746.32 1.898 times

31-3-09 139639.94 75662.49 1.845 times

2

1.95

1.9

ratio

Ratio

1.85

1.8

1.75

31-3-07 31-3-08 31-3-09

year

ANALYSIS AND INTERPRETATION:

The total asset turnover ratio indicates the firm’s ability to generate sales from all

financial resources.

From the above chart the total asset turnover ratio was decreased from 1.9 times in FY

2007-08 to 1.8 in FY 2009-10. The total asset turnover of the company was 1.8 times

implies that KNPL generate a sell of Rs. 1.8 for one rupee investment in fixed and current

asset together.

f) Creditor’s Turnover Ratio:

Net credit purchases

Creditor’s turnover ratio:

Average creditors

Table 8.3.f:

(Rupees in lakhs)

Net credit

Year Average creditors Ratio

purchases

31-3-07 84723.95 15906.86 5.3 times

31-3-08 89136.85 18430.47 4.8 times

31-3-09 92418.41 23007.12 4.0 times

6

5

4

Ratio

3 Ratio

2

1

0

31-3-07 31-3-08 31-3-09

Yea r

ANALYSIS AND INTERPRETATION:

The above chart dips from 5.3 times to 4.0 times from the FY 2007-08 to FY 2009-10.

From this we can interpret that KNPL has successful to manage its creditors because,

over the years trend is declining.

8.4 Financial ratio

a) Proprietary ratio:

Proprietary Fund

Proprietary ratio: X 100

Total assets

Table 8.4.a

(Rupees in lakhs)

Year Proprietary fund Total assets Ratio

31-3-07 51721.18 65912.12 78.46 %

31-3-08 59875.12 73746.32 81.19 %

31-3-09 66299.62 75662.49 87.62 %

Ratio

90.00%

85.00%

Ratio

80.00% Ratio

75.00%

70.00%

31-3-07 31-3-08 31-3-09

Year

ANALYSIS AND INTERPRETATION:

From the above chart the ratio was consistently increased in three years.

The ratio was high in the FY 2009-10 i.e. 0.87%. It indicates the company is quite

solvent.

b) Stock working capital ratio:

Stock

Stock working capital ratio:

Working capital

Table 8.4.b:

(Rupees in lakhs)

Year Stock Working capital Ratio

31-3-07 19996.18 26886.01 74.37%

31-3-08 19926.90 24024.24 82.94%

31-3-09 17063.39 16999.41 100.37%

120.00%

100.00%

RATIO (%)

80.00%

60.00% Ratio

40.00%

20.00%

0.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

The above chart shows the continuous increase in the trend of the ratio.

The weightage of stock in the current assets is high in the FY 2009 – FY 2010 as

compare to other FY. That means there was a slow movement of stock.

8.5 Financial Leverage Ratio:

It indicates financial structure of the organization that is proportion of debts as compare

to owner’s fund.

a) Debt Equity Ratio:

Debt

Debt equity ratio:

Equity

Table 8.5.a:

(Rupees in lakhs)

Year Debt Equity Ratio

31-3-07 12657.80 51721.18 24.47%

31-3-08 12480.40 59875.12 20.84%

31-3-09 9362.62 66299.62 14.12%

30.00%

25.00%

RATIO (%)

20.00%

15.00% Ratio

10.00%

5.00%

0.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

This ratio is useful to judge long term financial solvency of a firm. This

ratio reflects the relative claim of creditor and shareholder against the assets of the firm.

From the above chart the debt equity ratio of the KNPL was consistently

declined from 24.47% in FY 2007-08 to 14.12% in FY 2009-10.The low debt equity ratio

in FY 2009-10 indicates the firm had less claims from outsiders as compared to those of

owner.

b) Debt Asset Ratio:

Debt

Debt asset ratio:

Total assets

Table 8.5.b:

(Rupees in lakhs)

Year Debt Total assets Ratio

31-3-07 12657.80 65912.12 19.20%

31-3-08 12480.40 73746.32 16.92%

31-3-09 9362.62 75662.49 12.37%

25.00%

20.00%

RATIO (%)

15.00%

Ratio

10.00%

5.00%

0.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

From the above chart the debt asset ratio was consistently decreased from

19.20% in FY 2007-08 to 12.37% in FY 2009-10. That means at beginning creditors of

KNPL bear the high risk than the other years.

c) Long Term Debt to Total Capitalization:

Long term debt

Long term debt to total capitalization:

Total capital employed

Table 8.5.c:

(Rupees in lakhs)

Total Capital

Year Long Term Debt Ratio

Employed

31-3-07 4660.29 65912.12 7.07%

31-3-08 4603.14 73746.32 6.24%

31-3-09 1608.29 75662.49 2.12%

8.00%

6.00%

RATIO (%)

4.00% Ratio

2.00%

0.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

The above chart indicates that the ratio was consistently decreased from

7.07% in FY 2007-08 to 2.12% in FY 2009-10, means that KNPL is successful to

manage its long term debt which further implies that the KNPL is in better position in

terms of solvency.

d) Interest Coverage Ratio:

Earning before interest and tax

Interest coverage ratio:

Interest

Table 8.5.d:

(Rupees in lakhs)

Earnings Before

Year Interest Ratio

Interest And Tax

31-3-07 15718.48 175.59 89.51times

31-3-08 16986.14 227.03 74.91 Times

31-3-09 14505.05 212.8 68.16 Times

100

80

60

Ratio

Ratio

40

20

0

31-3-07 31-3-08 31-3-09

Year

ANALYSIS AND INTERPRETATION:

From the above chart the trend of the ratio was decreased from 89.51

times in FY 2007-08 to 68.16 times in FY 2009-10. From this, it indicates that KNPL is

trying to reduce its interest burden which is good sign for both i.e. there creditors and

shareholders.

8.6 Dividend Ratio:

These ratios for a particular company are relevant for an investor for making an

investment decision as to whether he should invest in the share of the company.

a) Earnings per Share:

Earning after tax – preference dividend

Earning per share:

No. of shares paid up

Table 8.6.a:

(Rupees in lakhs)

Earnings After

No. Of Shares Paid

Year Tax – Preference Ratio

Up

Dividend

31-3-07 10202.08 255.07666 39.99

31-3-08 11702.72 269.45986 43.43

31-3-09 10136.19 269.45986 37.61

44

42

RATIO (Rs.)

40

Ratio

38

36

34

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

From the above chart the EARNING PER SHARE of the company was

high in FY 2008-09 i.e. Rs.43.43. This means that as compare to the other FY there has

been increase in wealth per shareholder.

b) Payout Ratio:

Dividend per equity share

Payout ratio: X 100

Earnings per share

Table 8.6.b:

(Rupees in lakhs)

Dividend per Earning per equity

Year Ratio

equity share share

31-3-07 12.14 39.99 30.35%

31-3-08 12.00 43.43 27.63%

31-3-09 12.00 37.61 31.90%

33.00%

32.00%

31.00%

RATIO (%)

30.00%

29.00% Ratio

28.00%

27.00%

26.00%

25.00%

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

It indicates how much proportion of the earning per share is retaining for

plugging back and portion distributed as dividend to the share holder.

The above chart indicates that the pay out ratio was high in FY 2009-10

i.e. 31.90%. If the divided pay out ratio is subtracted from 100, retention ratio is obtained.

Means that in KNPL the retention ratio from FY 2007 to FY 2009 was 69.65%, 72.37%,

68.1% respectively and KNPL is ploughed back its maximum percentage of its profit.

c) Dividend per shares ratio:

Equity dividend

Dividend per share:

No. of equity shares

Table 8.6.c:

(Rupees in lakhs)

No. Of Equity

Year Equity Dividend Ratio

Shares

31-3-07 309879000 25507666 Rs. 12.14

31-3-08 323352000 26945986 Rs. 12.00

31-3-09 323352000 26945986 Rs. 12.00

12.2

12.15

RATIO (Rs.)

12.1

12.05 Ratio

12

11.95

11.9

31-3-07 31-3-08 31-3-09

YEAR

ANALYSIS AND INTERPRETATION:

The dividend per share ratio of the KNPL was almost same i.e. Rs. 12 in

the FY 2007 to FY 2009.But if we compared earning per share with Dividend per share it

shows that Earning per share is more than Dividend per share. In this case of Earning per

share, adjustment of bonus or right issue should be made while calculating Dividend per

share over the year.

9 FINDINGS

1. The ideal current ratio is 2:1 which the firm obtains only in the FY 2007-08 it shows

the positive impact.

2. The ideal liquid ratio is 1:1 which is also obtained by the firm in FY 2007-08 and FY

2008-09 it indicates that KNPL, without selling its inventory, has enough short-term

assets to cover its immediate liabilities.

3. The net profit ratio shows fluctuating trend, it shows that more or less the company is

successful to maintained efficiency in sales value and operating expenses.

4. The operating profit ratio of the KNPL is in fluctuating manner as 12.02%, 11.97%,

and 12.22% from FY 2007to FY 2009.

5. The return on investment ratio is increased from 0.15% to .016% in FY 2007 to FY

2008 because both the EBIT and total asset increased.

6. The company is maintaining the proper record of inventory. Management is successful

to manage the cost involved in inventory, because of increasing ratio of inventory.

7. The fixed asset turnover ratio of the firm is in increasing trend from the F.Y. 2007 to

2009, means that the company is efficiently utilizing the fixed assets.

8. The proprietary ratio of the firm shows increasing trend, means that the long term

solvency of the firm is increased.

9. KNPL borrowed loans in such a way that the cost of this debt financing do not

outweigh the return that the company generates on the debt through investment and

business activities And become too much for the company to handle.

10. The KNPL is successful to manage its long term debt. In the FY 2007-08 the long

term debt was Rs. 4660.29 which was reduced to Rs. 1608.29 in FY 2009-10.

11. KNPL is far better in covering its fixed cost with the interest coverage ratio.

12. The sales, profit before tax, profit after tax shows the increasing trend during the

period under review. It depicts that the company is working with more efficiency.

13. The company has not made any preferential allotment of shares and also company has

not issue any debentures.

10 SUGGESTIONS AND CONCLUSION

10.1 Suggestions:

1. The CURRENT RATIO of KNPL was less than the standard in FY 2008-09 and

2009-10 i.e.1.8, 1.5 respectively. A low current ratio indicates that co will not be able to

meet its short term debts.

2. KNPL should look into its credit policies in order to ensure the timely collection of

imparted credit that is not earning interest for the firm.

3. There is decreasing trend in interest coverage ratio which is due to heavy investment

which further effect on the return on investment ratio. So KNPL should keep up its

investment unto sufficient level.

4. The KNPL should formulate the strategy to use the fixed assets more effectively to

generate more revenues.

5. Operating expenses should be especially considered to be reduced.

6. Inventory is the biggest item of balance sheet that must have demanded a large

amount of maintaining cost. So there is need for efficient Inventory Management.

7. There should be efficient utilization of share holder fund to increase return on

investment and return on equity to maintain its goodwill in investors mind.

10.2 CONCLUSION:

Finance is the life blood of every business. Without effective financial

management a company cannot in this competitive world. A Prudent financial Manager

has to measure the working capital policy followed by the company.

The company’s overall position is at a good position. Through the losses

were there in the FY 2003-2004, they were able to come out of it successfully and regain

into profitable scenario. Particularly the last three year’s position is well due to raise in

the profit level from the FY 2007 to FY 2009. It is better for the firm to diversify the

funds to different sectors in the present market scenario.

On a whole Kansai Nerolac Paints Limited has once again demonstrated

its potential to ride through the difficult times. Despite the slowdown in its growth, it has

determined to grab numerous opportunities that are facing Indian Paint Industry.

As mentioned earlier, other opportunities in India are pegged to the

transport sector. Car ownership in India stands at little more than one percent. However,

rising affordability and the launch of economical cars such as the Tata Nano are expected

to propel the market for OEM coatings and refinishes in the coming years.

Higher demand for marine paints can be expected in the next decade, once

investments in ports and port development have started to reach fruition. As India is

hopeful of competing with other established shipbuilding nations, the multinationals are

likely to find plentiful opportunity in India, given the compliance requirements imposed

by effects of international legislation on marine paints.

Also other segments are showing promising opportunities to grow. With

these many opportunities at hand along with the potential player who would be able to

make use of the situation well, I would rather start looking at a career in KNPL.

So from this we can conclude that there is a better opportunities for

investors to invest in this company.

11 LIMITATIONS

The main limitations of the project undertaken are as under:-

• Time: The time of around two months was too short to study as wide subject like

Financial Analysis.

• Confidential information: The executives were hesitant to reveal complete

information since it was confidential.

• Busy Schedule of Concerned Executives: The concerned executives were not

having very busy schedule because of which they were reluctant to give

appointment.

12 BIBLIOGRAPHY

• Financial Management: M Y KHAN AND P K JAIN Fifth Edition

• FINANCIAL MANAGEMENT - I. M. PANDEY

• Financial Management (BMS): MR. Kale.

• Kansai Nerolac Paint’s magazines, brochures etc.

• Annual Reports of the Kansai Nerolac Paints Ltd.

o 88th annual report 2007-08

o 89th annual report 2008-09

• www.nerolac.com

• Search Engine : www.google.com

You might also like

- Ratio Analysis ProjectDocument83 pagesRatio Analysis Projecttejas.waghulde75% (8)

- MBA Project Report On Financial AnalysisDocument73 pagesMBA Project Report On Financial AnalysisShainaDhiman80% (25)

- Review of Literature of Ratio AnalysisDocument4 pagesReview of Literature of Ratio Analysisrleo_1987198279% (33)

- A Study On Consumer Buying Behavior Towards PaintDocument74 pagesA Study On Consumer Buying Behavior Towards PaintHiteshwari Jadeja100% (2)

- Main Project Capital Budgeting MbaDocument110 pagesMain Project Capital Budgeting MbaRaviKiran Avula66% (35)

- Financial Statement Analysis in Bhel PDFDocument62 pagesFinancial Statement Analysis in Bhel PDFRohit Vishwakarma75% (4)

- Summer Internship Project On Cash Flow AnalysisDocument42 pagesSummer Internship Project On Cash Flow AnalysisSworanjali Jena86% (7)

- Ratio Analysis of WalmartDocument31 pagesRatio Analysis of Walmartagga1111100% (2)

- b2b CMR Group7 v8Document16 pagesb2b CMR Group7 v8HarshShahNo ratings yet

- Working Capital ManagementDocument45 pagesWorking Capital ManagementRaghav100% (1)

- Working Capital Management PROJECT REPORT MBADocument90 pagesWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)93% (15)

- LG Ratio Analysis FinanceDocument70 pagesLG Ratio Analysis FinanceAkshay Panwar0% (1)

- Ratio Analysis ProjectDocument40 pagesRatio Analysis ProjectPallavi Satardekar100% (2)

- Ratio Analysis Dabur India Ltd.Document100 pagesRatio Analysis Dabur India Ltd.Manish Gupta75% (4)

- Profitability Analysis - Ultratech CementsDocument61 pagesProfitability Analysis - Ultratech CementsSilverster100% (4)

- Report On Ratio Analysis (Reliance Infrastructure Limited)Document21 pagesReport On Ratio Analysis (Reliance Infrastructure Limited)SiddhiNo ratings yet

- Analysis of Financial Statement at Kirloskar Project Report Mba FinanceDocument87 pagesAnalysis of Financial Statement at Kirloskar Project Report Mba FinanceBabasab Patil (Karrisatte)100% (3)

- Ratio Analysis at Gadag Textile Mill Project Report Mba FinanceDocument86 pagesRatio Analysis at Gadag Textile Mill Project Report Mba FinanceBabasab Patil (Karrisatte)67% (3)

- Financial Ratio Annalysis Dharwad Milk Project Report MbaDocument97 pagesFinancial Ratio Annalysis Dharwad Milk Project Report MbaBabasab Patil (Karrisatte)100% (4)

- Project ReportDocument41 pagesProject ReportJassar Gursharan50% (4)

- Ratio Analysis - Ashokleyland SUDHEERDocument83 pagesRatio Analysis - Ashokleyland SUDHEERArun Kumar100% (3)

- Final Project 1Document51 pagesFinal Project 1Imran KhanNo ratings yet

- Project Report Berger Paints Gaurav Tripathi (MBA)Document114 pagesProject Report Berger Paints Gaurav Tripathi (MBA)Ambika Pandey100% (4)

- Business PlanDocument22 pagesBusiness PlanShandy PansaNo ratings yet

- FABM-1 Module 3 Accounting EquationDocument6 pagesFABM-1 Module 3 Accounting EquationKJ Jones100% (3)

- Discussion Forum 4.4B SolutionsDocument5 pagesDiscussion Forum 4.4B SolutionsSidra UmairNo ratings yet

- Ratio Analysis at Nirani Sugar Limited Project Report Mba FinanceDocument74 pagesRatio Analysis at Nirani Sugar Limited Project Report Mba FinanceBabasab Patil (Karrisatte)100% (1)

- Project On Ratio AnalysisDocument69 pagesProject On Ratio AnalysisJitender FansalNo ratings yet

- Project Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Document121 pagesProject Report On Financial Statement Analysis of Kajaria Ceramics Ltd.Syed Mohd Ziya86% (83)

- Financial Analysis of RelianceDocument51 pagesFinancial Analysis of Reliancekkccommerceproject100% (3)

- Ratio AnalysisDocument79 pagesRatio Analysisanjali dhadde100% (1)

- A Project Report On Ratio AnalysisDocument22 pagesA Project Report On Ratio Analysisanon_80156868480% (5)

- FINANCIAL STATEMENT ANALYSIS - Hero Moto CompDocument83 pagesFINANCIAL STATEMENT ANALYSIS - Hero Moto CompArunKumar80% (5)

- Financial Analysis of Reliance Industries Limited: Arindam BarmanDocument109 pagesFinancial Analysis of Reliance Industries Limited: Arindam Barmananon_645298319100% (1)

- Financial Analysis of Reliance Industries Limited MAKSUDDocument93 pagesFinancial Analysis of Reliance Industries Limited MAKSUDAsif KhanNo ratings yet

- A Study On Comparative and Common Size Statement, Trend AnalysisDocument62 pagesA Study On Comparative and Common Size Statement, Trend AnalysisPraveen Kumar67% (3)

- A Study On Ratio Analysis PDFDocument97 pagesA Study On Ratio Analysis PDFDr Linda Mary SimonNo ratings yet

- A Study of Financial PerformanceDocument58 pagesA Study of Financial PerformanceVidyashree PNo ratings yet

- Ratio Analysis - FinanceDocument46 pagesRatio Analysis - FinancePragya ChauhanNo ratings yet

- Financial Analysis at Tata MotorsDocument70 pagesFinancial Analysis at Tata MotorsNivesh GurungNo ratings yet

- Project Ratio AnalysisDocument106 pagesProject Ratio AnalysisNital Patel33% (3)

- Summer Training Report File On Topic of Ratio AnalysisDocument94 pagesSummer Training Report File On Topic of Ratio Analysisanshul5410100% (3)

- Sip Project On Comparative Analysis of Financial Satatement of Sail With Other Steel Companies in IndiaDocument90 pagesSip Project On Comparative Analysis of Financial Satatement of Sail With Other Steel Companies in IndiaKumar Mayank100% (4)

- A STUDY ON Financial Statement Analysis of Axis BankDocument94 pagesA STUDY ON Financial Statement Analysis of Axis BankKeleti Santhosh75% (8)

- Ratio Analysis Project ReportDocument68 pagesRatio Analysis Project ReportRaghavendra yadav KM57% (7)

- Literature ReviewDocument3 pagesLiterature ReviewRohit Aggarwal100% (2)

- Project Report On Working Capital ManagementDocument76 pagesProject Report On Working Capital ManagementVikas Dalvi100% (1)

- Athul - Summer Internship ProjectDocument6 pagesAthul - Summer Internship Projectthulli06100% (2)

- Financial Statement and Ratio Analysis of Tata MotorsDocument120 pagesFinancial Statement and Ratio Analysis of Tata MotorsAMIT K SINGH100% (1)

- Sip Report On Working CapitalDocument114 pagesSip Report On Working CapitalKumari Manisha100% (2)

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocument69 pagesFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- PROJECT ARJUN D.N.RDocument85 pagesPROJECT ARJUN D.N.Rcrazynag2venkat100% (1)

- MBA Finance ProjectDocument72 pagesMBA Finance Projectamoramadi70% (20)

- 2Document6 pages2pradeepNo ratings yet

- ""Consumer Buying Behavior Towards Paint Segment": Master of Business AdministrationDocument90 pages""Consumer Buying Behavior Towards Paint Segment": Master of Business Administrationramprasad_navada7897No ratings yet

- A Report On To Estimate The Market Size of Project Sales in Segment-Housing Societies by Cold CallingDocument35 pagesA Report On To Estimate The Market Size of Project Sales in Segment-Housing Societies by Cold Callingabhiruchisingh14187No ratings yet

- Mangalam Cement Ltd. Published by Riyaz Ahmad MBA (Brand Equity of Birla Uttam Cement)Document74 pagesMangalam Cement Ltd. Published by Riyaz Ahmad MBA (Brand Equity of Birla Uttam Cement)Riyaz Ahmad80% (5)

- Berger Paints SIP ReportDocument69 pagesBerger Paints SIP ReportSayam RoyNo ratings yet

- Summer Internship Report 2020: Biju Patnaik Institute of It & Management StudiesDocument33 pagesSummer Internship Report 2020: Biju Patnaik Institute of It & Management StudiesArpita MohapatraNo ratings yet

- RATNESH MINI-2Document35 pagesRATNESH MINI-2ratneshanand478No ratings yet

- SIP Report Berger PaintsDocument62 pagesSIP Report Berger PaintsTiktok Viral UnofficialNo ratings yet

- "Marketing Analysis of FVB Trade House PVT LTD": Summer Training Report ONDocument63 pages"Marketing Analysis of FVB Trade House PVT LTD": Summer Training Report ONArvindSinghNo ratings yet

- StartDocument14 pagesStartshaikhhuzailhussainNo ratings yet

- Project Report ON: Berger Paints Its Distribution Channel and Comparison Between Its Peers Group" ATDocument117 pagesProject Report ON: Berger Paints Its Distribution Channel and Comparison Between Its Peers Group" ATAshutosh ParmarNo ratings yet

- JK - Lakshmi (1) .Doc - New - Doc 007Document74 pagesJK - Lakshmi (1) .Doc - New - Doc 007Kailash Solanki100% (2)

- SG X Annual ReportDocument181 pagesSG X Annual ReportstephNo ratings yet

- Profile of OrganizationDocument5 pagesProfile of OrganizationSilver Stones PharmaNo ratings yet

- ch01 PDFDocument2 pagesch01 PDFDanish BaigNo ratings yet

- Go Digit General Insurance Limited Financials Income StatementDocument3 pagesGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNo ratings yet

- Business Plan OF Ko-Fi Business: The Day PowerDocument27 pagesBusiness Plan OF Ko-Fi Business: The Day PowerAbhishek GargNo ratings yet

- Financial Accounting: Prof Padmini SrinivasanDocument26 pagesFinancial Accounting: Prof Padmini SrinivasanSudhanyuNo ratings yet

- City of Iloilo vs. Smart CommunicationsDocument2 pagesCity of Iloilo vs. Smart CommunicationsKim SimagalaNo ratings yet

- Karnataka (Sandur Area) Inams Abolition Act, 1976Document18 pagesKarnataka (Sandur Area) Inams Abolition Act, 1976Latest Laws TeamNo ratings yet

- Problems & SolutionsDocument436 pagesProblems & Solutionsmelissa100% (1)

- Creative Accounting: & Earnings ManagementDocument29 pagesCreative Accounting: & Earnings ManagementrasheshpatelNo ratings yet

- Director Revenue in DC MD VA NY FL Resume Rennie ChanDocument2 pagesDirector Revenue in DC MD VA NY FL Resume Rennie ChanRennieChan1No ratings yet

- Chapter 13Document6 pagesChapter 13Hareem Zoya WarsiNo ratings yet

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyNo ratings yet

- 04 - Logics ScriptsDocument69 pages04 - Logics ScriptsGiorgio Jacchini100% (1)

- No. Account Account Name Header Balance Account Type Aset Current AsetDocument2 pagesNo. Account Account Name Header Balance Account Type Aset Current Asetwndy rdvlvtNo ratings yet

- Financial Requirements Solutions Financial AccountingDocument7 pagesFinancial Requirements Solutions Financial AccountingRochelle DizonNo ratings yet

- Quiz 2 Ncahs/ Discontinued Operation: FeedbackDocument67 pagesQuiz 2 Ncahs/ Discontinued Operation: FeedbackAngela Miles DizonNo ratings yet

- Iem Newipo IpoDocument319 pagesIem Newipo Iporaja rajanNo ratings yet

- AFAR 04 Construction AccountingDocument13 pagesAFAR 04 Construction Accountingmysweet surrenderNo ratings yet

- Ayesha - FDMDocument24 pagesAyesha - FDMMahreen MalikNo ratings yet

- PFRS-15Document25 pagesPFRS-15Marin, Nicole DondoyanoNo ratings yet

- Chapter Three Accounting For General and Special Revenue FundsDocument22 pagesChapter Three Accounting For General and Special Revenue Fundshabtamu tadesse100% (3)

- Exercise 18-2Document4 pagesExercise 18-2Christopher Imanuel100% (1)

- Financial Ratios Cherat Cement 2018-2019Document39 pagesFinancial Ratios Cherat Cement 2018-2019Muhammad Umair Rajput100% (2)

- Registry of Revenue and Other Receipts (Internally Generated Funds/Retained Income Funds Business Related/Revolving Fund)Document1 pageRegistry of Revenue and Other Receipts (Internally Generated Funds/Retained Income Funds Business Related/Revolving Fund)abbey89No ratings yet