COMMON STOCKS: ANALYSIS &

STRATEGY

Structuring a Stock Portfolio : The Objective

The four main portfolio objectives are stability

of principal, income, growth of income, and

capital appreciation.

In a world with taxes, one dollar in capital

gains is worth more than one dollar in

income.

The overriding investment objective is utility

maximization.

Structuring a Stock Portfolio : Asset Allocation

An asset class refers to a broad category of

investments.

Domestic equities, foreign equities, bonds,

and cash are four widely used asset classes.

Allocating total portfolio wealth to various

asset classes such as stocks, bonds and

cash equivalents is asset allocation.

Structuring a Stock Portfolio : Asset Allocation

Asset allocation: the most Important

decision

Investors failure or success depends

upon asset allocation.

Structuring a Stock Portfolio : Asset Allocation

Portfolio

attitude

toward risk

need for

return

individual choice

stocks

bonds

real

estate

ASSET

CLASSES

cash foreign

equities

asset class mix

realized

return

and risk

with the

passage

of time

investment results

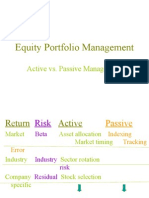

Structuring a Stock Portfolio :

Active vs. Passive Management

A strategy of passive management is one in

which, once established, the portfolio is

largely left alone.

An active management policy, in contrast, is

one in which the composition of the portfolio

is dynamic.

Buy and Hold Strategy

With a passive buy and hold strategy

(a naive strategy), investors simply

select their investments and hang on

to them.

Constant Mix Strategy:

Always maintain a fix percentage of risky

assets in your portfolio.

Buy and Hold , Constant Mix Strategy

A buy and hold strategy does well If the

market is in upward trend.

in Constant Mix Strategy the

appreciating assets are sold off ( i.e.

profits are taken to buy other assets)

so as to maintain the same percentage

of risky assets in portfolio.

8

Buy and Hold , Constant Mix Strategy

In a downward market trend buy and

hold strategy dont do well.

Constant Mix Strategy is forced to

maintain the same percentage of risky

assets during downtrend hence

constant mix strategy is worst off in a

bear market.

9

The performance of Buy and Hold

Strategy during a oscillating market is

flat.

Constant mix strategy does quite well

in a oscillating market. In a oscillating

market

10

The Costs of Revision

There are costs to revising a portfolio.

Trading fees : Historically, stock commissions

are a function of the number of shares and the

dollar amount involved.

Even relatively simple portfolio revisions take up

management time.

Selling securities can involve tax implications.

Window dressing refers to largely cosmetic

portfolio changes made near the end of a

reporting period.

11

Portfolio Rebalancing

Rebalancing a portfolio is the process of

periodically adjusting the portfolio so that

certain original conditions of the portfolio are

maintained.

In a constant proportion portfolio,

adjustments are made so as to maintain the

relative weighting of the portfolio components

as their price change.

A constant beta rebalancing scheme seeks to

maintain beta at a prespecified level. This

method is not commonly used now.

12

Portfolio Rebalancing

Indexing : Some funds seek to mirror the

performance of a market index

Dollar cost averaging : The idea is to invest a

fixed amount on a regular interval into the

same security, regardless of current market

conditions.

13

Index Funds

Using index funds, the pools of mutual &

pension funds assets are designed to duplicate

as precisely as possible the performance of

come market index.

It may consist of all the stocks in a wellknown market average (e.g. S&P 500)

14

Index Funds

Expenses are kept to a minimum

Research costs

Portfolio managers fees

Brokerage commissions

No sales or exit charges

Total operating expenses are extremely low

(about 0.20%)

Tax efficiency

15

Index Funds

Kinds of portfolios

The Index Trust Portfolio

Extended Market Portfolio

The Total Stock Market Portfolio

The Value Portfolio

The Growth Portfolio

The Total International Portfolio

16

Index Funds

According to a recent survey ending 2000,

indexing funds outperformed comparable

actively managed equity funds

17

Active approach

Investors use valuation models to value and

select stocks. They assume or expect the

benefits to be greater than the costs

Advantages

Superior analytical and judgment skills

Superior information

Willingness to take risk

18

Active approach

Despite the EMH, investor focus on the high

potential rewards and they are confident to

achieve these rewards even if others cant do

19

Active Management Strategy

Most common technique of investing involving:

Security Selection

The Importance of Stock Selection

Role of Sell-side and Buy-side Analysts

Sector Rotation

Indirect investing un sectors

Industry momentum and sector investing

Market Timing

Rational Markets and Active Strategies

20

Security Selection

The most traditional and popular strategy,

which offers superior return-risk

characteristics

Stocks are typically selected using

fundamental as well as technical security

analysis

21

Security Selection

A key feature of the investment environment is

the uncertainty influencing investment

decisions, which persuades the investors to

adopt stock diversification

Significance

Focus of advisory services

Increase in cross-sectional variation of returns

22

Sector Rotation

An active strategy, similar to stock selection is

group or sector rotation

This strategy involves shifting sector weights

in the portfolio in order to take advantage of

those sectors that are expected to do relatively

better and reduce for relatively worse sectors

23

Sector Rotation

Broader classifications

Interest-sensitive stocks

Consumer-durable stocks

Capital goods stocks

Defensive stocks

Each of the above are expected to perform

differently during the various phases of the

business and credit cycles

24

Market Timing

Entering the market in good timings and being

out of the stock market at the bad times

When equities are expected to do well, timers shift

from money market to common stock and vice

versa

market timing strategy pay more brokerage

commissions and taxes as compared to buy and

hold strategy

25

Market Timing

switching between stocks and cash-equivalents

over a long period, a successful timer could

enhance returns, but the timer needed to be

right seven times out of ten (Sharpe, 1975)

26

Approaches for Analyzing and

Selecting Stocks

Technical Analysis

A form of security analysis that attempts to

forecast price changes based on historical price

and volume trends.

Two Groups of Strategies Used:

1. Momentum and Contrarians Strategies

2. Moving Average and Trading Range Breakout

Strategies

27

Technical Analysis

Momentum and Contrarians Strategies

examine the returns over a time period just

ended to identify

momentum investors who seek out stocks

recently rising in price for purchase; falling

for sale

contrarians who follow the opposite strategy

of most investors (base their strategy on

the overreaction theory)

28

Technical Analysis

Moving Average and Trading Range

Breakout Strategies

MOVING AVERAGE STRATEGY:

calculate a moving average over the last 200 days of

closing prices

dividend todays closing price into the moving average

(SHORT-TO-LONG RATIO)

if short-to-long ratio is greater than 1, buy

if ratio is less than 1, sell.

29

Technical Analysis

Moving Average and Trading Range

Breakout Strategies

TRADING RANGE BREAKOUT STRATEGY:

high and low prices for past 200 trading days are

identified

if todays close is greater than the high = buy!

if todays close is less than the low = sell!

30

Fundamental Analysis

Fundamental Analysis: the study of stocks

value using basic financial data of corporations

such as earnings, sales, risks of firms and so

forth.

Approaches to Fundamental Analysis:

Bottom-up Approach

Top-down Approach

31

Bottom-up Approach

Approach to fundamental analysis that focuses

directly on a companys fundamentals.

Attempts to estimate prospects in the

following order:

The firm

The Industry

The economy

32

Bottom-up Approach

The emphasis of bottom-up approach is to find

out the companies with good long term growth

perspectives, and making accurate earnings

estimates. Bottom-up approach is categorizes

into:

Value Investing

Growth Investing

33

The Value Approach to Investing

A value investor believes that securities

should be purchased only when the

underlying fundamentals (macroeconomic

information, industry news, and a firms

financial statements) justify the purchase.

34

The Growth Approach to Investing

Growth investors seek steadily growing

companies. There are two factions:

Information traders are in a hurry; they

believe information differentials in the

marketplace can be profitably exploited.

True growth investors are more willing to

wait, but they share the belief that good

investment managers can earn above-average

returns for their clients.

35

The Growth Approach to Investing

Growth investors seek steadily growing

companies. There are two factions:

Information traders are in a hurry; they

believe information differentials in the

marketplace can be profitably exploited.

True growth investors are more willing to

wait, but they share the belief that good

investment managers can earn above-average

returns for their clients.

36

The Growth Approach to Investing

Growth investors seek steadily growing

companies. There are two factions:

Information traders are in a hurry; they

believe information differentials in the

marketplace can be profitably exploited.

True growth investors are more willing to

wait, but they share the belief that good

investment managers can earn above-average

returns for their clients.

37

The Value vs. Growth Investing

Value Stocks and Growth Stocks: How to

Tell by Looking

No precise definition exists.

Classification by Morningstar Mutual

Funds:

relative

relative

price to book + price-earnings

ratio

ratio

1.75

2.25

otherwise

- value

- growth

- blend

38

Top-down Approach to Fundamental

Analysis

TOP-DOWN APPROACH attempts to forecast in the

following order

1. economic activity

2. industry performance

3. firms performance

The analyst first considers conditions in

the overall economy (market risk),

then determines which industries are the

most attractive in light of the economic conditions (using

Porters competitive strategy analysis framework, for

example),

and finally identifies the most attractive

companies within the attractive industries

39