BS Accountancy

Uploaded by

Glacier Franz Mayang TabatBS Accountancy

Uploaded by

Glacier Franz Mayang TabatBACHELOR OF SCIENCE

IN ACCOUNTANCY

Program Description

The Bachelor of Science in Accountancy (BSA) Program provides general accounting

education to students wanting to pursue a professional career in Accountancy in

general, and in Public Accounting in particular. It develops the knowledge, skills, and

attitude required to pass the Certified Public Accountant (CPA) licensure examination.

Program Educational Objectives:

Within three to five years after obtaining a bachelor’s degree in Accountancy

graduates are expected to:

1. Exhibit professional competence as accountants and business advisers in both

Philippine and international settings.

2. Discharge professional functions with integrity and professionalism, consistent with

professional standards and Christian principles.

3. Use CPA credentials in providing exemplary professional service to customers and

in contributing to the greater good of the profession and society at large.

4. Assume leadership or influential roles in the organizations where they work.

5. Demonstrate agility and adaptability as lifelong learners in handling and responding

to changes at work and in the work environment to maintain professional

competitiveness in the ever-evolving labor market.

Program Outcomes

By the time of graduation, the students of the program shall have develop the ability to:

1. Demonstrate and act in recognition of corporate citizenship, professional, ethical and

social responsibility.

2. Function effectively as a member and/or leader in teams, preferably multi-

disciplinary in composition.

3. Use proper decision tools including information and communication technology, to

critically, analytically and creatively solve problems and drive results.

4. Implement the basic functions of management (such as planning, leading, organizing,

staffing, directing and controlling) in various functional areas of business

(marketing, accounting, finance, human resource, production and operations, IT and

strategic management)

5. Engage in independent learning for continual development as a business professional,

while generating new knowledge and keeping abreast with the latest

developments in the field of business.

6. Communicate effectively with stakeholders, both orally and in writing.

7. Resolve business issues and problems, with a global perspective and particular

emphasis on matters confronting financial statement preparers and users, using their

knowledge and technical proficiency in the areas of financial accounting and

reporting, cost accounting and management, management accounting, auditing,

taxation, and accounting information systems, and finance.

8. Demonstrate self-confidence in performing functions as a professional accountant.

9. Employ technology as a business tool efficiently and effectively in capturing

financial and non-financial information, generating reports, and making decisions.

10. Apply knowledge and skills that will enable them to successfully respond to

various types of assessments (including professional licensure and certifications).

11. Preserve and promote Filipino historical and cultural heritage.

Admission Policies

1. UBAT score of at least 40

2. A grade point average (GPA) in high school of at least 85

3. A total admission score of at least 70

4. Non-ABM SHS Graduates must take the following subjetcs:

* Business Math

* Business Finance

* Marketing Management

Admission Requirements for Incoming 2nd Year

1. A GPA of at least 83 in first year college, excluding NSTP and PE.

2. A final grade of at least 83 in Acct101, Acct102, Acct 201A, Acct 202, and

MATHMW.

3. A score meeting the cut-off in the Accountancy Qualifying Examination (AQE) Note:

Students who fail the AQE for the first time are allowed to take it a second time in the

next academic year.

Admission Requirements for Transferees

1. A score of at least 60 in CTBS

2. A score meeting the cut-off in the AQE

Retention Policies (for 2nd – 4th Year students)

1. A grade of at least 83 in Acct203 and Acct204

2. A grade of at least 80 in FinMa1, FinMa2 and Acct 401

3. A maximum of two major* subjects with grades below 80

4. No failing grade in any major* subject

Academic Honors

Students who have repeated any major* subject are automatically disqualified from

academic honors.

*The following are considered major subjects:

• All accounting subjects, identified by the code “ACCT” or its equivalent

• All commercial law subjects, identified by the code “COMLAW” or its equivalent

• All taxation subjects, identified by the code “TXTN” or its equivalent

• All finance subjects, identified by the code “FINMA” or its equivalent

• All economics subjects, identified by the code “ECON” and “MACRO” or their

equivalents

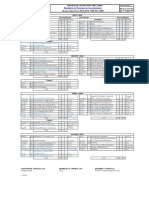

BACHELOR OF SCIENCE IN ACCOUNTANCY

FIRST YEAR

First Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

CWRLD The Contemporary World 3 3 0 0 3 3

RHIST Readings in Philippine History 3 3 0 0 3 3

IGG Group Guidance 1.5 1.5 0 0 1.5 1.5

MATHMW Mathematics in the Modern 3 3 0 0 3 3

ACCT101WorldAccounting, inc. Basic

Basic

Corp.

Acctg - SE & FS Presentation) 6 6 0 0 6 6

COMLAW Law on Obligations & Contracts 3 3 0 0 3 3

1

NSTP1 National Service Training 3 3 0 0 3 3

PED1 Program Education

Physical 1 1

(Wellness and Fitness) 2 2 0 0 2 2

IRS1 Lasallian Spirituality 3 3 0 0 3 3

Total 27.5 27.5 0 0 27.5 27.5

Second Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

COMLAW2 Negotiable Instruments 3 3 0 0 3 3

PCOM Purposive Communication 3 3 0 0 3 3

INFOT1 IT Application Tools in Business

(Concepts & Productivity Tools) 0 0 3 3 3 3

ACCT201A Intermediate Accounting 1

(Conceptual Framework) 3 3 0 0 3 3

ACCT202 Intermediate Accounting 2 6 6 0 0 6 6

ACCT102 Partnership Accounting 3 3 0 0 3 3

NSTP2 National Service Training Program 2 3 3 0 0 3 3

PED2 Physical Education 2

(Team Sports and Rhythmic Activities) 2 2 0 0 2 2

Total 23 23 3 3 26 26

Summer Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

USELF Understanding the Self 3 0 0 0 3 3

ARTAP Art Appreciation 3 0 0 0 3 3

IRS2 Christian Morality 3 0 0 0 3 3

Total 9 0 0 0 9 9

SECOND YEAR

First Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ACCT203 Intermediate Accounting 3

(Acctg Standards & Reporting) 6 6 0 0 6 6

FINMA1 Financial Management 3 3 0 0 3 3

PSPEAK1 Public Speaking 0 0 3 3 3 3

COMLAW3 Business Organizations 3 3 0 0 3 3

TXTN1 Income Taxation 3 3 0 0 3 3

IBT100 International Business and 3 3 0 0 3 3

PED3 Trade Education 3

Physical

(Swimming and Recreation) 2 2 0 0 2 2

ECON104 Managerial Economics 3 3 0 0 3 3

A

GBOOKS Great Books 3 3 0 0 3 3

Total 26 26 3 3 29 29

Second Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ACCT204 Intermediate Accounting 4

(Acctg Standards & Reporting) 6 6 0 0 6 6

INFOT2 Accounting Information System 0 0 3 3 3 3

TXTN2 Business Taxation and Other

Taxation Topics 3 3 0 0 3 3

FINMA2 Financial Markets 3 3 0 0 3 3

COMLAW4 Sales, Agency and Credit Transactions 3 3 0 0 3 3

ACCT401 Auditing and Assurance 1

(Governance, Business Ethics, Risk

Management, and Internal Control) 6 6 0 0 6 6

PED4 Physical Education 4

(Individual and Dual Sports) 2 2 0 0 2 2

MACRO Macroeconomics 3 3 0 0 3 3

Total 26 26 3 3 29 29

Summer Lec # of Lab # of Total Total

Units hrs/wk hrs/wk Credit Assesse

Units d

Units Units

IRS3E Religions, Religious Experiences

and Spirituality 3 3 0 0 3 3

OMTQM Operations Management and 3 3 0 0 3 3

RIZAL TQM

Rizal 3 3 0 0 3 3

Total 9 9 0 0 9 9

THIRD YEAR

First Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

COMLAW Regulatory Framework and

5 Business

Legal Issues 3 3 0 0 3 3

LITEA Living in the IT Era

(for Accounting) 0 0 3 3 3 3

ACCT501 Cost Accounting and Control 3 3 0 0 3 3

MGTSCI Management Science 3 3 0 0 3 3

ACCT402 Auditing and Assurance 2 6 6 0 0 6 6

ACCT601 Advanced Acctg 1 - Acctg. for

Special Transactions 3 3 0 0 3 3

ACCT121 Crafting Notes to Financial

Statements 3 3 0 0 3 3

ECON501 Economic Development 3 3 0 0 3 3

Total 24 24 3 3 27 27

Second Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ACCT502 Strategic Cost Management 3 3 0 0 3 3

BA102 Prof Electives 1 - Business 3 3 3 3

ACCT701 Analytics 2 Research Methods

Accounting 3 3 0 0 3 3

ACCT602 Advanced Acctg 2 (Acctg. for

GovtProfit

Non & Orgs. &

Business Combination inc. 6 6 0 0 6 6

Foreign

Currency)

ACCT403 Auditing and Assurance 3

(Specialized Industries) 3 3 0 0 3 3

INFOT3 Auditing in a CIS Environment 0 0 3 3 3 3

SAPP Statistical Analysis w/ Software

Application 0 0 3 3 3 3

ACCT801 Strategic Business Analysis

(Managerial Acctg) 3 3 0 0 3 3

Total 18 18 9 9 27 27

Summer Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ETHICS Ethics 3 3 0 0 3 3

STS Science, Technology, and Society 3 3 0 0 3 3

BA103 Prof Electives 2 - Business 0 0 3 3 3 3

Analytics 3

Total 6 6 3 3 9 9

FOURTH YEAR

First Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ACCT901 Accounting Internship 6* 6 0 0 6 6

ACCT702 Accountancy Research 3* 3 0 0 3 3

BA104 Prof Elective 3 - Business 0 0 3 3 3 3

Analytics 4

*Field

Total 9 9 3 3 12 12

Second Semester Lec # of Lab # of Total Total

Units hrs/wk Units hrs/wk Credit

Assessed

Units Units

ACCT303 Prof Electives 4 - Updates on

Financial Reporting Standards 3 3 0 0 3 3

BA105 Business Analytics 5 0 0 3 3 3 3

STRAT100 Strategic Management 3 3 0 0 3 3

ACCT111 Management Consultancy with

Feasibility Study 3 3 0 0 3 3

ACCT131 Integration and Updates -

Practical Accounting 1 3 3 0 0 3 3

ACCT132 Integration and Updates -

Practical Accounting 2 3 3 0 0 3 3

ACCT133 Integration and Updates - 3 3 0 0 3 3

ACCT134 Auditing

Integration and Updates -

Management Services 3 3 0 0 3 3

ACCT135 Integration and Updates -

Business Law & Taxation 3 3 0 0 3 3

Total 24 24 3 3 27 27

SUMMARY OF REQUIRED COURSES

Bachelor of Science in Accountancy

No. of Units

Total Courses Equivalent

Units Required

General

Education

Languages

English 2 6 6

Mathematics

Mathematics in the Modern World 1 3 3

Social Sciences

Understanding the Self 1 3

Readings in Philippine History 1 3

The Contemporary World 1 3

Art Appreciation 1 3

Rizal 1 3

Science, Technology, and Society 1 3 18

Other Courses

Religious Studies 3 9

Group Guidance 1 1.5

PE 4 8

NSTP 2 6

GBooks 1 3 27.5

Basic Business Core

Basic Accounting 1 6

Partnership Accounting 1 3

Financial Accounting 1 6

Law on Obligations and Contracts 1 3

Income Taxation 1 3

Managerial Economics 1 3

Ethics 1 3 27

Major Subjects

Business Education Core

Operations Management and TQM 1 3

Management Science 1 3

Strategic Management 1 3

Business Analytics 1 3

International Business and Trade 1 3

Macroeconomics 1 3

Economic Development 1 3

Statistical Analysis with Software Application 1 3 24

Business Law and Taxation

Law on Negotiable Instruments 1 3

Law on Business Organizations 1 3

Law on Sales, Agency and Credit Transactions 1 3

Regulatory Framework and Legal Business Issues 1 3

Business Taxation and Other Taxation Topics 1 3 15

Financial Management 2 6 6

Financial Accounting and Reporting 3 15 15

Auditing and Assurance 3 15 15

Cost Accounting 2 6 6

Advanced Accounting 2 9 9

Management Accounting and Management Consultancy 2 6 6

Accounting Research 2 6 6

Accounting Internship 1 6 6

Integration and Updates 5 15 15

Information Technology Education

IT Application Tools in Business 1 3

Accounting Information System 1 3

Auditing in a CIS Environment 1 3 9

Professional Electives

Updates on Financial Reporting Standards 1 3

Business Analytics 4 12

Crafting Notes to FS 1 3 18

Total 231.5

MAJOR COURSE DESCRIPTIONS

BACHELOR OF SCIENCE IN ACCOUNTANCY

ACCT 101 6 statement presentation, is discussed. The

course also delves into accounting

units

standards on financial statements and their

BASIC

preparation and presentation.

ACCOUNTING

Introduces basic accounting principles for a Students are expected to explain the

business. Topics include the complete Conceptual Framework for Financial

accounting cycle with end of period Reporting, relate it to the standards

statements, incorporation and dividends. governing financial reporting and be able

Upon completion, students should be able to prepare general-purpose financial

to demonstrate an understanding of statements, including appropriate disclosure

accounting principles & apply those skills to requirements and schedules.

a business organization. Prerequisite: Acct

101

Students are expected to accomplish a

practice set where they analyze, record,

classify, and report financial transactions

from source documents. The practice set is

a venue for the students to apply their

learning in this course.

ACCT 102 3

units

PARTNERSHIP

ACCOUNTING

Aims to develop the ability to analyse

business transactions peculiar to a

partnership business

– formation, operation, dissolutions and

changes in ownership interests, and

liquidation, and relate their effects to the

interest of the stakeholders. Students are

expected to understand the influence of

partnership reporting in decision- making

and its effect in the growth of a business.

The students complete and submit the

accounting practice set for partnership as

the final output of the course. This

emphasizes the importance of credibility,

integrity, and accountability in the practice

of accounting.

Prerequisite: Acct

101

ACCT201A 6 units

INTERMEDIATE ACCOUNTING 1

(CONCEPTUAL FRAMEWORK)

This course tackles the overview of the

Philippine Financial Reporting Standards

(PFRS), the Philippine Accounting

Standards (PAS) and related

interpretations, and their relationship to

International Financial Reporting Standards

(IFRS), International Accounting

Standards (IAS), and related

interpretations. It explains the standard

setting process, the authority attached to

the standards and the body authorized to

promulgate them. It is in the foregoing

context that the Conceptual Framework for

Financial Reporting, which sets forth

general guidelines governing financial

ACCT202 6 units come up with the answers or conclusion.

INTERMEDIATE ACCOUNTING 2 The students are expected to interpret and

(WITH ACCOUNTING apply accounting standards related to the

STANDARDS AND recognition, measurement, valuation and

REPORTING) financial statements presentation and

This course presents a detailed discussion, disclosures of Investment Accounts,

appreciation and application of accounting Property, Plant and Equipment, Wasting

standards set forth by the Financial Reporting Assets and Intangibles. The students

Standards Council of the Philippines and, should be able to pass comprehensive

where applicable, by other authoritative exam.

bodies of the accountancy profession that Prerequisite :

are currently applicable to the recognition, Acct202

measurement and financial statement

presentation of Cash and Cash Equivalents,

Receivables and Inventories. The related

internal control measures are also presented

and enabling the students to prepare Bank

Reconciliation and Aging of Receivables. It

also exposes the students to accounting for

SMEs as a contrast to full IFRS application.

At the end of the semester, the students are

expected to develop critical thinking skills

and become effective communicators. This

course also aims that students will

understand the importance of transparency

in financial reporting making them socially –

responsible. The students should be able to

interpret and apply the accounting

standards in relation to the recognition,

measurement, and financial statement

presentation of Cash and Cash

Equivalents, Receivables and Inventories.

The students should be able to prepare

Bank Reconciliation and Aging of

Receivables and pass comprehensive exam.

Prerequisite : Acct

101

ACCT203 6 units

INTERMEDIATE ACCOUNTING 3

(WITH ACCOUNTING

STANDARDS AND

REPORTING)

This course is a continuation of Intermediate

Accounting I. It is designed to cover the

discussion, appreciation and application of the

Philippine Accounting Standards (PAS) and

Philippine Financial Reporting Standards

(PFRS) on the recognition, measurement,

valuation and financial statements

presentation and disclosures of Investments

accounts, Property, Plant and Equipment,

Wasting Assets and Intangibles. It also

includes the revaluation and impairment of

these accounts. Incorporated in this course

is the PFRS application to SMEs.

At the end of this course, the students are

expected to analyze and solve problems

regarding Investments, PPE, Wasting Assets

and Intangibles, and explain the

procedures on how they were able to

and understand its importance. Through this,

ACCT204 6 units

they will become more sensitive and

INTERMEDIATE ACCOUNTING 4

responsive to the needs of the society.

(WITH ACCOUNTING

STANDARDS AND

At the end of the course, the students are

REPORTING)

expected to be able to discuss the different

This course covers an extensive discussion

problems addressed by the PAS or PFRS

and practical application of the currently

applicable to each topic and apply

applicable Philippine Accounting Standards

appropriate accounting treatments. The

(PAS) and Philippine Financial Reporting

students are expected to apply the specific

Standards (PFRS) relative to the

presentation and disclosure requirements by

recognition, measurement, valuation and

the standards relative to each topic.

financial statement presentations of

Prerequisite :

current liabilities (including provisions and Acct204

contingent liabilities), bonds payable, notes

payable, shareholders’ equity, retained

earnings, and contemporary issues like

leases, accounting for income taxes, post-

employment benefits and other employee

benefits. The students will also be

exposed to cash and accrual basis

accounting, integrating all topics in

financial accounting. The course is

structured in such a way that it challenges

the students to their full potential,

encourages synergy, collaboration and

dialogue in an environment that is fraternal,

caring, and respectful. The course

prepares the students to be responsible in

the world of work, family, nation and the

Church.

At the end of the course, the students

should be able to interpret and apply

accounting standards related to the

recognition, measurement, valuation and

financial statements presentation and

disclosures of Current and Non-current

Liabilities, components of the Shareholders’

Equity, Leases, accounting for Income

Taxes, Employee Benefits and Post-

employment Benefits. The students are

expected to prepare financial statements

for Tax purposes and reconcile the

difference with financial accounting Income.

The students are likewise expected to

prepare Income Statement under accrual

basis accounting as a migration from

cash basis account.

Prerequisite: Acct

203

ACCT303 3 units

PROFESSIONAL ELECTIVES 4 -

UPDATES ON FINANCIAL REPORTING

STANDARDS

This course covers special topics in financial

accounting that deals with the recognition,

measurement, valuation and financial

statement presentations of biological assets

and the agricultural industry as a whole,

investment properties, non- current assets

held for sale and discontinued operations,

and government grants. It also discusses

environmental accounting and reporting in

hyperinflationary economies. Discussions are

aimed to develop students’ awareness on the

different areas where accounting is applied

procedures pertaining to specialized

ACCT401 6 units

industries such as banking, insurance,

AUDITING AND ASSURANCE 1

real estate, not for profit entities,

(Governance, Business Ethics, Risk

cooperatives, mining and agricultural

Management, and Internal Control)

companies (sugar farming).

This course deals with the nature of the

accounting profession, auditing and

Students are expected to pass a

assurance fundamentals, professional

comprehensive examination at the end of

standards, and public sector regulation of

the course.

accounting practice. Then the students are

Prerequisite: Acct402

introduced to the basic concepts and

methodology of auditing in general as

applied to the various types of audit. After

which, the discussion is more focused on

financial statements audit using risk-based

audit approach, which will cover risk

assessment (preliminary engagement

activities, planning the audit and risk

assessment procedures) and risk response

(designing test of controls and substantive

test procedures), and culminates in audit

report preparation including

communications with the board of

directors and management concerning

internal control weaknesses. Also

discussed in detail are the professional

values and the Code of Ethics for

Professional Accountants, which aims to

focus on the responsibility of every Lasallian

CPA to uphold the ethical and legal

standards in the exercise of his/her

profession.

At the end of the course, the students are

expected to submit case study reports

relating to application of Code of Ethics, a

simple audit plan and internal control

evaluation, as well as to prepare audit

reports based on different audit findings.

Prerequisite: Acct203

ACCT402 6 units

AUDITING AND ASSURANCE 2

(APPLIED) This course is a continuation

of Auditing and Assurance 1, and covers

the detailed approaches and substantive

test procedures on problems and

situations ordinarily encountered in the

independent examination of cash and

cash equivalents, receivables, inventories,

investments, property and equipment,

intangibles, liabilities, shareholders equity,

and revenue and expense accounts.

Students are expected to pass a

comprehensive examination at the end of

the course.

Prerequisite: Acct401

ACCT403 6 units

AUDITING AND ASSURANCE 3

(SPECIALIZED INDUSTRIES)

This course covers the detailed approaches

on problems and situations ordinarily

encountered in the independent

examination of financial statements. It

deals specifically with the application of

auditing standards, techniques and

for joint arrangement and corporate

ACCT501 3 liquidation. Students’ mastery of the course

units will be tested by a comprehensive

COST ACCOUNTING & examination given at the end of the

CONTROL semester.

Orients the students in the nature,

peculiarities and importance of the various At the end of the course, the students will

concepts & objectives of cost discipline. be able to analyze and account for

The first part is on cost accumulation and transactions involving installment sales, long

the traditional concepts of job order costing term construction contracts, franchises and

and process costing with accounting for consignment sales, applying the provisions

production losses. The second part deals of PFRS15, IAS18 and IAS11, apply the

with backflush costing system, service cost provisions of PFRS 4 in accounting for

allocation, and joint cost allocation and Insurance Contracts and account for build,

treatment of by products. The course aims operate & transfer schemes in accordance

to help the students understand the with IFRIC 12. In addition, students will

factors and aspects necessary to come up also be able to record the

with with an effective cost system. Because

of the dynamic nature of the companies,

exposure to actual manufacturing scenario

is required to have a better understanding

of this course.

Students are then required to submit a

manufacturing process flowchart of the

company plants visited integrated with

theories & application of the cost

accounting process.

Prerequisite:

Acct204

ACCT502 3

units

STRATEGIC COST

MANAGEMENT

Focuses on the analysis of costs & profits

and other relevant information for

management decision making.

Discussions on the behaviour of costs

specifically on CVP analysis, standards

& variances, variable, and absorption

costing are covered under management

planning. It also covers problems in TQM,

JIT, business process reengineering,

KAIZEN costing, and target costing.

At the end of the course, the

students are required to submit a

comprehensive case analysis of the cost

accumulation of selected SMEs of the

province. The evaluation papers are

then presented to the owners for

application. Prerequisite: Acct501

ACCT601 3 units

ADVANCED ACCOUNTING 1

(ACCOUNTING FOR SPECIAL

TRANSACTIONS)

Advanced Accounting 1 deals with

specialized accounting concepts usually

encountered by accountants in practice.

The gist of this course revolves around the

application of fundamental accounting

valuation and accounting theory to special

income and expense recognition methods in

accordance with the relevant accounting

standards. This will also include accounting

students in their preparation for a long term

transactions involving Joint Operations and

professional accounting career, responsive

Joint Venture, applying the provisions of

to the challenges and dynamics set by the

IFRS11 and IAS 28, respectively. Lastly,

profession while maintaining the highest

students will be able to prepare statement

degree of integrity and ethical standards.

of liquidation for financially distressed

Prerequisite:

corporations. In the conduct of these Acct601

activities, students are expected to

maintain integrity, embodying a true

Lasallian value of Christianity.

Prerequisite:

Acct204

ACCT602 6 units

ADVANCED ACCOUNTING 2

(ACCOUNTING FOR GOV’T & NON-

PROFIT ORGANIZATIONS

& BUSINESS COMBINATION

INCLUDING FOREIGN CURRENCY

TRANSACTIONS) Advanced Accounting

2 is a continuation of Advanced

Accounting 1. This primarily deals with

topics in accounting that covers business

combinations and accounting for inter-

company transactions entered into by these

firms. Included in this course are

accounting for non-profit organizations

and the government’s national

accounting system. The course will also

expose students to transactions

involving foreign operations. This six-

unit course is intended to train

students for their preparation in their

Licensure examination and for them to

acquire the necessary skills in accounting

that will prepare them to analyze complex

business transactions.

At the end of the course, the students will

be able to manifest skills in analyzing and

accounting for transactions involving

business combinations accounted for using

acquisition method and special problems

involving mergers and parent- subsidiary

transactions. The students are likewise

expected to prepare consolidated financial

statements in accordance with the relevant

International Financial Reporting

Standards. In this course, the students will

also be able to record transactions

involving home office and branch

transactions. To simulate all the learning,

the students will be required to answer a

comprehensive problem in business

combination. They will prepare a

consolidated working paper covering

transactions from acquisition up to the

eventual preparation of consolidated

financial statements for years subsequent

to acquisition date. The students are

expected to journalize transactions of non-

profit organizations, identify the differences

between the accounting system of

government (including its instrumentalities)

and private corporations, record the effects

of changes in foreign exchange and

translate foreign financial statements to

presentation currency. All these will equip

research paper and defend the same before

ACCT701 3 a panel. Prerequisites: Acct701, SAPP

units

ACCOUNTING RESEARCH ACCT801 3 units

METHODS STRATEGIC BUSINESS

The focus of this course is on applied ANALYSIS

accounting research. It is intended to (MANAGERIAL ACCOUNTING)

provide the learners with a strong This course equips accountants with key

foundation in the conceptualization and concepts and tools useful in providing

operationalization of research, how to managerial information for planning,

design a research project, and skills in the control, and decision- making purposes. It

utilization of a wide range of research emphasizes how data can be analyzed and

methods. The foregoing are fundamental interpreted to support the achievement of

to designing and implementing a business objectives. It includes (but not

successful research project. The objective necessarily limited to) such techniques as

of the course is to prepare the learners to financial planning & budgeting,

conduct quality research using various responsibility accounting & transfer pricing,

approaches, including qualitative, balanced scorecard, and differential

quantitative, mixed methods, action analysis.

research, and outcome-based research. It

instructs the learners on the research process

as applied to the pursuit of an accountancy

research project directed at solving an

accounting or finance problem. The final

segment of the course consists of

constructing a research proposal that serves

as the basis for the study that learner

conducts in the next research course, which

allows him to apply research concepts and

techniques in an actual research undertaking.

Students are required to produce and

defend a research proposal on a particular

topic, as basis for the actual applied

accounting research project in the

subsequent research course.

Prerequisite:

PCom

ACCT702 3

units

ACCOUNTANCY

RESEARCH

This is the continuation of the course on

Accounting Research Methods. It is the

second of two courses on the conduct of

empirical research relevant to the field of

Accountancy. The previously-approved

research proposal - the final output of the

Accounting Research Methods course -

becomes the springboard for the actual

conduct of applied research in this course.

The primary thrust of the course is on

developing skills for producing applied

research output that has real-world

significance. Students are afforded the

opportunity to implement the previously-

conceptualized and approved research

project through data collection & analysis,

interpretation of results, developing &

evaluating alternatives, developing

recommendations, and research reporting.

This may involve the use of statistical

procedures through SPSS, Business STATA

or Excel.

Students are expected to produce a

CONSULTANCY

At the end of the course, students are

expected to pass a comprehensive exam Deals with the basic considerations,

covering all topics taken up. In addition, concepts and methodology on the practice

students are required to develop a simple of management consultancy, with particular

budgeting system and prepare a sample emphasis on work done by CPAs. It

master budget for a small business or provides an overview and survey of the

cooperative. practice; a profile of the ideal management

Prerequisite: consultant; practice standards and ethical

Acct501 considerations; and the relevant concepts,

methodology, and practices on the

administration and conduct of management

ACCT901 6 consultancy. The course also delves into

units the social responsibilities of management

ACCOUNTING consultants. It discusses in more detail

INTERNSHIP certain types of management consulting

This is an applied academic and mentored engagements.

practical experience conducted under joint

faculty and employer supervision, requiring

a minimum of

400 contact hours. This is in the area of

auditing, which prepares them for their

likely eventual work as CPAs. A grade is

given at the end of the internship by both

the employer and the faculty- mentor. Each

internship assignment shall meet the

following requirements:

1. Be substantial and practical, including the

analysis, evaluation, and application of

auditing concepts;

2. Be subject to periodic documentation of

progress and review by both the employer

and the Accountancy Program Chair;

The internship culminates in a final

evaluation prepared by the employer and

faculty-mentor, and a final course grade

awarded by the faculty-mentor.

Upon completion of the internship program,

students are expected to have had hands-

on, practical experience and learning gained

from being exposed to and involved in real,

actual operations of an auditing firm. They

are expected to acquire a deeper

understanding of classroom lessons

stemming from their first-hand experience

of how business, accounting, and auditing

concepts are concretely applied in

practice. They are required to submit a

written report documenting the tasks,

responsibilities, learning experiences,

training, and hours worked. Reports should

include comments on areas such as

human relations aspects of their work,

including leadership and management

skills; importance of and emphasis on

teamwork as opposed to individual work;

technical, intellectual, physical, social, and

ethical challenges; work schedule; and

how the Accountancy Program’s course

work prepared them for internship.

Prerequisite: Completion of at least 80% of

courses in the entire curriculum

ACCT111 3

units

MANAGEMENT

At the end of the course, students are

Students are required to pass a

expected to pass a comprehensive

comprehensive exam at the end of the

examination on topics covered.

course. They also expected to perform an

Prerequisite: InfoT3,

actual operations audit of a small business Acct403

or cooperative and submit a report on

audit results.

Prerequisites: Acct801, FinMa2, MgtSci,

Acct402

ACCT121 3 units

CRAFTING NOTES TO

FINANCIAL STATEMENTS

This course deals with the types of Notes

that accompany Financial Statements, which

are important in the understanding of the

lines items shown therein. It deals with

the preparation of the notes relevant to

statements of compliance with IFRSs,

significant accounting policies applied,

supporting information for items

presented on the face of the financial

statements, and other necessary

disclosures such as contingent liabilities and

non – financial disclosures.

Students are expected to prepare

complete set of financial statements with

corresponding Notes thereto, and to pass a

comprehensive examination at the end of

the course.

Prerequisite:

Acct204

ACCT131 3 units

INTEGRATION AND UPDATES -

PRACTICAL ACCOUNTING 1

This course provides integration and

updates on all topics in Practical Accounting

1 (lAcct201A, Acct202, Acct203, Acct204),

both theory and application.

At the end of the course, students are

expected to pass a comprehensive

examination on topics covered.

Prerequisite:

Acct204

ACCT132 3 units

INTEGRATION AND UPDATES -

PRACTICAL ACCOUNTING 2

This course provides integration and updates

on all topics in Practical Accounting 2

(Acct501, Acct502, Acct601, Acct602), both

theory and application.

At the end of the course, students are

expected to pass a comprehensive

examination on topics covered.

Prerequisite:

Acct602

ACCT133 3 units

INTEGRATION AND UPDATES -

AUDITING This course provides

integration and updates on all topics in

Auditing (Acct401, Acct402, Acct403,

InfoT3), both theory and application.

ACCT134 3 units

INTEGRATION AND UPDATES - MACRO 3

MANAGEMENT SERVICES units

This course provides integration and MACROECONOMI

updates on all topics in Management CS

Services (Acct801, Acct501, Acct502, Introduces the students to the different

Finance and Economics), both theory and topics concerning national economic issues

application. and measures of economic performance

such as GDP, unemployment and inflation,

At the end of the course, students are fiscal and monetary policies, international

expected to pass a comprehensive trade, and foreign exchange rates. These

examination on topics covered. are the topics given priority as these are

Prerequisite: Acct801, covered in the CPA board exams.

Acct502 Additional topics concerning the macro

economy such as national income

ACCT135 3 units determination, employment,

INTEGRATION AND UPDATES -

BUSINESS LAW AND TAXATION

This course provides Integration and

updates on all topics in Business Law

(ComLaw1, ComLaw2, ComLaw3, ComLaw4,

ComLaw5) and Taxation (Txtn1 and Txtn 2),

both theory and application.

At the end of the course, students are

expected to pass a comprehensive

examination on topics covered.

Prerequisites: ComLaw1, ComLaw2,

ComLaw3, ComLaw4, ComLaw5,Txtn1, Txtn

2

ECON 104A 3

units

MANAGERIAL

ECONOMICS

This course covers both basic

microeconomics and managerial economics

concepts. It introduces basic

microeconomics to students including the

concepts of and factors affecting supply,

demand, market equilibrium, price elasticity

of demand, market structure, production,

and cost functions - topics that are given

priority as these are covered in the CPA

board exams. In the managerial

economics part, students learn the

concepts of profit and wealth

maximization, corporate social

responsibility, price determination, and

characteristics of the different markets.

Economic tools are also introduced to

students to aid them in their analysis and

decision making on the cases and problem

exercises presented in class. This

basically trains students to become good

decision makers in the area of business

management.

At the end of the semester, the students

are expected to create their own case that is

anchored on any of the topics included in

the course and applying the different

economic and mathematical tools, and the

economic principles that should be

observed by business, societies and

individuals. They are expected to be able to

present the case in class.

comprehensive examination given at the

price levels, taxation, and agrarian reform

end of this course. The exam should test

are also taken up. The course creates

the students’ skills in financial analysis

awareness among students on how

(interpreting and analyzing financial

individual decisions affect the aggregate so

statements for indications of business

that they will make more socially

performance), cash flows analysis,

responsible decisions.

operating and financial leverage. Students

should also be able to do financial

Students will be asked to create an

forecasting, planning and control, and apply

economic agenda that they think will boost

concepts that would enable them to answer

the economic standing of the country

cases involving working capital

considering its present state. The agenda

management, capital structure issues,

should be able to touch the pressing

sources of short-term and long-term

economic issues of today and make

financing. This course also focuses on

recommendations that incorporate sound

enabling the students to use basic firm

economic policies.

Prerequisite: valuation techniques and analyze the

Econ104A following: investment decision processes,

financing, and dividend policy structures

asset management and financial

ECON501 3

units

ECONOMIC

DEVELOPMENT

Deals with problems and constraints for

growth of developing countries in line with

their national goals by discussing the past

and present development strategies

including the effects of globalization. The

students are expected to discuss the ethical

dimensions of development strategies that

helps alleviate poverty conditions.

The students are expected to develop

international perspectives, foster concerns

for global issues while raising awareness

of own responsibilities at a local, national

and international level. The course aims

to develop in students values and attitudes

that will enable them to achieve a degree of

personal commitment in trying to resolve

the issues, appreciating their responsibility

as citizens of an increasingly independent

world.

Prerequisite:

Econ104A

FINMA1 3

units

FINANCIAL

MANAGEMENT

This course provides the synthesis of

financial policy into a grand strategy which

integrates organizational purpose and

goals. This course is a three-unit subject,

which aims to introduce the student to

financial management as a function and

role of finance, a vital aspect of a business

organization. The course is an introduction

to advanced finance subjects, to the

preparation and presentation of feasibility

studies, and as a core subject for all

business programs. Students’ effective

communication skills will be honed in this

course as they will be presenting cases in

class.

Students should be able to pass the

the profession. It discusses the

strategies and portfolio theory.

fundamentals of the computer systems,

Likewise, the course intends for the

data processing concepts, development of

students to properly share firm wealth by

computing device leading to network

answering problems on dividend

principles, and internet technologies. The

distributions, share repurchase and other

course aims to enrich students’ prior

payouts. Finally, the course gives an

knowledge and skills in the use of the

avenue for the students to examine the

computer and computer applications

main types of derivative contracts: forward

through hands-on manipulation of office

contracts, futures, swaps and options, and

productivity programs such as MS Word,

how these instruments are used in

MS PowerPoint and MS Excel.

managing and modifying financial risks.

Completion of this course prepares them to

Prerequisite: Acct202

use technology responsibly and skillfully to

address academic and future professional

FINMA2 3 demands.

units

FINANCIAL

MARKETS

This course gives fundamental

knowledge on the structure, function and

role of the financial system in light of the

complex web of links and interconnections

between capital providers and users of

capital. The course will cover financial

intermediaries, financial instruments and

the different markets where credit

institutions are active players. The students

should be able to describe characteristics of

equity investments, security markets, and

indices, fixed income securities and their

markets, yield measures, risk factors, and

valuation measures and drivers The

candidate should also be able to analyze

industries, companies, and equity securities.

In the conduct of the course, students

should be able to explain the important

characteristics of the markets in which

equities, fixed-income instruments,

derivatives, and alternative investments

trade. Acquired knowledge on market

organization and structure will allow them to

describe market classifications, types of

assets and market participants, and how

assets are traded.

Throughout the course, the students will

be able to explain how security market

indices are constructed, managed, and used

in investments. In addition, the students will

be able to classify different markets in

accordance with their efficiency to which

market prices reflect information. As to

fixed income market, the course intends

for the students to be introduced to the

elements that define and characterize fixed-

income securities. They are also expected to

describe the primary issuers, sectors, and

types of bonds.

Prerequisite:

FinMa1

INFOT1 3 units

IT APPLICATION TOOLS IN

BUSINESS (CONCEPTS &

PRODUCTIVITY TOOLS)

This course tackles the basic concepts of

information technology geared towards

business systems and its significance to

COMLAW1 3 units

At the end of the course, students are

LAW ON OBLIGATIONS AND

expected to render an oral presentation and

CONTRACTS This course is the first in

submit a soft copy therewith on concepts

the series of four courses that cover

learned in the subject by utilizing computer

business laws including their legal

applications tackled in the course.

implications. This course deals with the

laws governing obligations and

INFOT2 3 contracts and application of these

units concepts to practical problems. It deals

ACCOUNTING INFORMATION with the study of the basic rights and

SYSTEM duties of a debtor and a creditor in the

This course establishes students to the performance of their respective

systems that produce financial information obligation/s. Topics discussed include the

for organizations. Although discussions will nature and effects of obligations, the

cover information systems as a whole, extinguishment of obligations, the creation

particular emphasis will be placed on of contracts, the basic nature and kinds of

financial transaction cycles and business contracts, and defective contracts.

processes in the accounting information

systems (AIS). It will also cover risks and

controls involved in the processing of

financial transactions in an information

technology environment. Once the overall

understanding of the theory and manual

processing is accomplished, students will

harness their understanding in an

automated environment using SAP, a

widely-used financial application by many

local and international businesses to process

their financial information.

Students are expected to implement

processes and controls, present and defend

a working accounting information system

prototyped for a company to gain

knowledge and skills with more relevance in

today’s business world.

Prerequisite:

INFOT1

INFOT3 3

units

AUDITING IN A CIS

ENVIRONMENT

This course dIT-related risks, computer

information system (CIS) security and

control mechanisms and audit techniques

that may be employed to address the risks,

and the impact of computer use. It also

tackles emerging IT-related topics affecting

the public accounting profession. In

addition, itdiscusses computer-assisted

audit tools and techniques (CAATTs) and

how auditors use CAATTs in performing

audits.

In this course, students gain hands-on

experience in auditing with the use of

computers particularly using the Audit

Command Language (ACL) as generalized

audit software (GAS) to equip them to

handle auditing in the global scenario. At

the end of the course, students are

expected to pass a comprehensive exam

and to submit a soft file of audit working

papers using the ACL software.

Prerequisites: Acct402, InfoT2

incorporation, complete with all the

Students will prepare their own

necessary requirements they desire to

contracts complete with all its necessary

establish in their own business

elements: (1) offer; (2) acceptance; (3)

organizations. Prerequisite: ComLaw1

consideration; (4) mutuality of obligation;

(5) competency and capacity; and, in

COMLAW4 3 units

certain circumstances, (6) a written

LAW ON SALES, AGENCY AND

instrument.

CREDIT TRANSACTIONS

This course is the fourth in the series of

four courses that cover business laws

COMLAW2 3 including their legal implications. This

units course deals with the law on sales, its

LAW ON NEGOTIABLE nature, form and requisites. It discusses

INSTRUMENTS the rights and obligations of the vendor and

This course is the second in the series of vendee including remedies in case of

four courses that cover business laws defaults. It also covers applicable laws

including their legal implications. This on installment

course covers the law on negotiable

instruments in general, their form and

interpretation, their consideration and

negotiation, the rights of the holders

thereof and the liabilities of the parties

thereto. It includes presentment, notice of

dishonor, and discharge of negotiable

instrument. Topics discussed include the

meaning of acceptance, presentment for

acceptance, acceptance for honor, and

payment for honor. This course also

contains discussions on bouncing checks.

Students will prepare their own negotiable

instruments complete with all the

requirements for the instrument to be

negotiable: (1) in writing and with

signature or maker or drawer; (2)

unconditional promise or order; (3) date of

payment; (4) payable to order or bear (5)

name of drawee.

Prerequisite:

ComLaw1

COMLAW3 3

units

LAW ON BUSINESS

ORGANIZATIONS

This course is the third in the series of four

courses that cover business laws including

their legal implications. This course is

intended to give the students a broad

knowledge of legal provisions governing

business associations - partnership,

corporations (including foreign

corporations), and cooperatives. The course

discusses their organization/formation,

registration, administration, rights, powers,

duties and obligations, dissolution,

liquidation, and other relevant topics. The

power and obligations of the board of

directors and stockholders, statutory

books, records and returns required for a

corporation, and securities regulation are

also discussed. This course also provides

basic knowledge on the Law on

Cooperatives.

Students will prepare their own

partnership agreement and articles of

Acct102

sales. The course also provides the

students an understanding of the law on

TXTN2 3 units

credit transactions such as pledges, real

BUSINESS TAXATION AND

mortgages and chattel mortgages. It also

OTHER TAXATION TOPICS

discusses the insolvency law as well as

This taxation course deals with business

corporate rehabilitation.

taxes. Students will be able to identify

the business taxes required for each type

Students will prepare their own

of taxpayer engaged in business such as

mortgage contract complete with clauses

percentage taxes and value-added tax

and requirements necessary to make the

(VAT). They will also be able to

contract effective. Prerequisite: ComLaw1

COMLAW5 3 units

REGULATORY FRAMEWORK AND

LEGAL BUSINESS ISSUES

This course provides basic knowledge

on the laws on other business transactions,

to wit: PDIC Law, Secrecy of Bank Deposits

and Unclaimed Balances Law, General

Banking Law with emphasis on loans,

AMLA Law with emphasis on covered

transactions, suspicious transactions and

reportorial requirements, the New Central

Bank Act with emphasis on legal tender

power over coins and notes,

conservatorship and receivership and

closures, and the Intellectual Property Law

(except provisions under part I) with

emphasis on the Law on Patents, the Law

on Trademark, Service Marks and Trade

Names, and the Law on Copyright.

Students will use the principles of the

aforementioned legal provisions to address

certain legal cases to be presented in a moot

court setting in the classroom.

Prerequisite:

ComLaw1

TXTN1 3

units

INCOME

TAXATION

This introductory taxation course is

primarily concerned with income taxation.

Students will have their initial exposure to

the Philippine income tax system. The

course is divided into six main topics:

general principles of taxation, classification

of income tax payers, different sources of

income, final tax, income taxation of

individuals, and income taxation of

corporations. The objective is to develop a

working knowledge on basic principles and

rules of the income tax system in the

Philippines as they apply to individuals,

partnerships and corporations. This course

also covers different tax remedies.

Students will prepare BIR Forms on

income taxes specifically BIR Form 1604CF

or the Annual Information Return of Income

Tax Withheld on Compensation and Final

Withholding Taxes and BIR Form 2306 or

the Certificate of Final Income Tax

Withheld.

Prerequisite:

theory, decision analysis, and decision

determine inclusions in gross estate and

trees. The introduction of concepts via

gross gift, allowable deductions, and the

cases in decision-making related to

computation of transfer taxes such as estate

operations and strategies in preferred

and donor taxes. This course also covers

whenever appropriate.

other taxation topics such as taxation under

the local government code, preferential

Students are expected to enhance their

taxation, Senior Citizens Law, Magna Carta

ability to perform the quantitative analysis

for Disabled Persons, Special Economic Zone

necessary, understand the usefulness and

Act, Omnibus Investments Code, Barangay

limitations of the methods, recognize

Micro- Business Enterprises (BMBEs) Act,

situations where the methods can be

Double Taxation Agreements, and tariff and

applied beneficially, and be aware of the

customs code.

issues involved when utilizing the results of

the analyses.

Students will prepare a testamentary will

with all its necessary elements. They will

also prepare BIR Forms on transfer and

business taxes specifically BIR Form 1801

or Estate Tax Return, BIR Form

1800 or Donors Tax Return and BIR Form

2551M

or Monthly Percentage Tax

Return. Prerequisite: Txtn1

OMTQM 3

units

OPERATIONS MANAGEMENT AND

TQM

This course introduces the students to the

nature, scope, functions and importance of

production and operations management in

business. It includes discussions on

productivity, competitiveness and strategy,

forecasting, production, system design,

process selection and capacity planning.

The students are also exposed to facilities

layout, design of work systems, quality,

scheduling and just-in-time manufacturing

systems. Cases will also be used to illustrate

and apply the basic production and

operations concepts and tools commonly

used in the business firms. The course also

introduces the fundamental concepts of

total quality management and its

importance, its philosophy as an approach

to doing business, and how it can increase

productivity by utilizing the resources of an

organization that will benefit the society.

The course requires the students to

understand operations management’s

relevance as one of the major functions of

business and its role in improving the quality

of life.

The students are expected to develop

decision making, analytical, synthesis, and

problem solving skills from an operations

management viewpoint through case and

quantitative operations problems. MGTSCI

3 units

MANAGEMENT SCIENCE

Covers review/discussion of basic statistics

principles, regression analysis, time-series

analysis, non-parametric statistics, and

quantitative analysis techniques such as

matrices, graphic linear inequalities,

graphical sensitivity analysis, linear

programming, simulation, optimization

Descriptive analytics makes use of

STRAT100 3 tools to graphically present business

units performance indicators and enable

STRATEGIC managers to visualize how the company is

MANAGEMENT performing.

This course provides the framework for the

development of long-term strategies for an The course will enable the students to

entire organization to carry out its goals prepare reports using descriptive analytics

and objectives effectively. The course tools ranging from spreadsheet to

covers the process of long-range planning dashboards.

from the context of decision- making of the

organization.

The students are expected to apply

knowledge in management, marketing,

accounting and finance in determining a

business unit’s strengths/ weaknesses and

core competencies. During the duration

of the course, they will undertake a

business environment scan and analysis,

and prepare a strategic plan for a business.

Prerequisite: Should be in the 4th year

level.

LITEA 3

units

LIVING IN THE IT ERA (For

Accounting)

The course provides students with an

overview of the current trends in

information technology that drive today’s

business.

The course will provide understanding on

data management techniques that can help

an organization to achieve its business

goals and address operational challenges.

This will also introduce different tools

and methods used in business analytics

to provide the students with opportunities

to apply these techniques in simulations in a

computer laboratory.

BA102 3 units

BUSINESS ANALYTICS 2 –

FUNDAMENTALS OF DATA

WAREHOUSING

The course is designed to introduce students

to the fundamentals of data warehousing

for managers. Data warehousing is used in

business intelligence, enabling managers to

make critical decisions based on different

business transactions.

Managers of business should be able to see

opportunities for exploiting data coming

from transactions using data warehousing.

This provides a discussion on how to adapt

data warehousing as an approach for

managing data, highlighting the needed

resources to roll out a data warehouse.

BA103 3 units

BUSINESS ANALYTICS 3 –

DESCRIPTIVE ANALYTICS

The course aims to introduce students to

the fundamentals of descriptive analytics.

This course introduces the student to basic

BA104 3 units

statistical concepts and methods of

BUSINESS ANALYTICS 4 –

statistical inference. It deals with both

PREDICTIVE ANALYTICS

descriptive and inferential statistics. It

The course is designed to introduce to

emphasizes the role of statistics in

students the fundamentals of predictive

interpreting research results. It covers

analytics.

sampling, the collection and

presentation of data, frequency

Through this course, students are trained

distributions, graphs, measures of central

to process voluminous data to be used for

tendency, measures of variability,

prediction, classification and association,

making it essential for projections,

forecasts and correlations. The use of

historical data examine various trends

and behaviour patterns are explored,

applying statistical models and techniques

to be able to predict what might happen in

the future.

BA105 3 units

BUSINESS ANALYTICS 5 –

PRESCRIPTIVE ANALYTICS

The course aims to provide the students

with applications that help organizations

develop insights to make decisions from

current data to achieve organizational goals.

Through this course, leaners are allowed to

recommend a number of different possible

actions and guide them to finding the

optimal solution. Using optimization and

simulation techniques, learners will attempt

to quantify the effect of future decisions in

order to advise on possible outcomes

before the decisions are actually made.

IBT100 3

units

INTERNATIONAL BUSINESS &

TRADE

This introductory course focuses on the

core concepts and techniques for entering

the international marketplace. Emphasis is

on the effect of sociocultural, demographic,

economic, technological, and political-legal

factors in the foreign trade environment.

It covers a variety of topics to illustrate

the unique nature of international business

including the patterns of world trade,

currency exchange and international

finance, globalization of the firm,

international marketing, and operating

procedures of the multinational enterprise.

International business and trade in the

Asian and ASEAN contexts is highlighted.

Each student is expected to develop a

Foreign Market Opportunity Assessment.

He/she chooses a company, product or

service and a country. The company could

be imaginary or real. The purpose of the

project is to reinforce information covered

in the course, which represents a macro

perspective, but the project is on a micro or

firm level perspective.

SAPP 3 units

STATISTICAL ANALYSIS WITH

SOFTWARE APPLICATION

measures of relationship, the normal

distribution, and tests of hypothesis. Students

are taught the use of the statistical software

SPSS in analyzing data.

After course completion, students are

expected to be able to use statistical tools in

studying and resolving business problems

especially those relating to accounting and

finance issues.

You might also like

- Bachelor of Science in Management Accounting BSMANo ratings yetBachelor of Science in Management Accounting BSMA5 pages

- SBA-2018-2019 Curricula ACCOUNTANCY 09122019 PDFNo ratings yetSBA-2018-2019 Curricula ACCOUNTANCY 09122019 PDF3 pages

- Holy Angel University Bachelor of Science in Accountancy (Bsa)100% (1)Holy Angel University Bachelor of Science in Accountancy (Bsa)2 pages

- Batangas State University BSA CurriculumNo ratings yetBatangas State University BSA Curriculum3 pages

- Overview of Accounting Seminar WorkshopNo ratings yetOverview of Accounting Seminar Workshop11 pages

- Bachelor of Science in Accountancy CurriculumNo ratings yetBachelor of Science in Accountancy Curriculum6 pages

- Coc Revised Curriculum BS Accountancy Sy 2018 2019 Duly NotedNo ratings yetCoc Revised Curriculum BS Accountancy Sy 2018 2019 Duly Noted6 pages

- BSA 1101 - Fundamentals of Accounting 1 & 2No ratings yetBSA 1101 - Fundamentals of Accounting 1 & 213 pages

- Kfupm Business School: The Bachelor of Science in Accounting (Acct) Revised Progrm AUG 25, 2020No ratings yetKfupm Business School: The Bachelor of Science in Accounting (Acct) Revised Progrm AUG 25, 202011 pages

- Bachelor of Science in Accountancy: Tabulated CurriculumNo ratings yetBachelor of Science in Accountancy: Tabulated Curriculum3 pages

- FBE Courses Descriptions 2017-18 Revise 25 Jul 2017No ratings yetFBE Courses Descriptions 2017-18 Revise 25 Jul 201737 pages

- St. Joseph'S Degree & PG College: Autonomous - Affiliated To Osmania UniversityNo ratings yetSt. Joseph'S Degree & PG College: Autonomous - Affiliated To Osmania University21 pages

- Bachelor of Science in Internal Auditing (Bsia) Abm Track: School of Management and AccountancyNo ratings yetBachelor of Science in Internal Auditing (Bsia) Abm Track: School of Management and Accountancy4 pages

- Bachelor of Science in Accountancy (2018) : P U P College of Accountancy and Finance83% (6)Bachelor of Science in Accountancy (2018) : P U P College of Accountancy and Finance3 pages

- A. Defining Honesty and Integrity SAMPLENo ratings yetA. Defining Honesty and Integrity SAMPLE3 pages

- Organized Partnership and Corporation Win BalladaNo ratings yetOrganized Partnership and Corporation Win Ballada142 pages

- Business Administration: Economics MajorNo ratings yetBusiness Administration: Economics Major6 pages

- (Effective October 2006 Examination) : The Cpa Licensure Examination Syllabus - Auditing TheoryNo ratings yet(Effective October 2006 Examination) : The Cpa Licensure Examination Syllabus - Auditing Theory7 pages

- Directorate of Distance Education ManageNo ratings yetDirectorate of Distance Education Manage289 pages

- The Doctrine of Vicarious Liability of Auditors - Delhi HC Judgment in Deloitte v. Union of India - India Corporate LawNo ratings yetThe Doctrine of Vicarious Liability of Auditors - Delhi HC Judgment in Deloitte v. Union of India - India Corporate Law5 pages

- Management Accounting Fundamentals SyllabusNo ratings yetManagement Accounting Fundamentals Syllabus3 pages

- Accounting for Plant and Intangible AssetsNo ratings yetAccounting for Plant and Intangible Assets15 pages

- (Your Last Name, First Name Initial) Excel#2No ratings yet(Your Last Name, First Name Initial) Excel#24 pages

- Accounting For Managers: Dr.R.Vasanthagopal University of KeralaNo ratings yetAccounting For Managers: Dr.R.Vasanthagopal University of Kerala22 pages

- ITIL V3 Concepts & Processes: Module: Financial ManagementNo ratings yetITIL V3 Concepts & Processes: Module: Financial Management23 pages

- Accounting and Auditing Responsibilities of Sme'sNo ratings yetAccounting and Auditing Responsibilities of Sme's129 pages

- Goodwill Impairment Allocation in ConsolidationNo ratings yetGoodwill Impairment Allocation in Consolidation52 pages