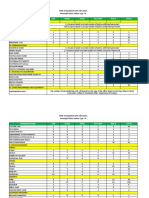

Unit 1 L4 Lesson Practice

9.5 Calculating i and j

1. Canary Calendars Inc. invested this year's profits of $64,000 in a bond that matured to

$84,500 in 2 years. Calculate the fund's quarterly compounding nominal interest rate and

periodic interest rate.

N

I/Y

P/Y

C/Y

PV

PMT

FV

2. An initial $1800 investment was worth $2299.16 after two years and nine months. What

semi-annually compounded nominal rate of return did the investment earn?

N

I/Y

P/Y

C/Y

PV

PMT

FV

3. A computer assembling company took a loan of $30,000 to purchase a conveyer belt. If the

debt accumulated to $45,850 in 2 years, calculate the quarterly compounding interest rate.

N

I/Y

P/Y

C/Y

PV

PMT

FV

4. Mark heard that he could triple his money in 15 years if he invested it in his friend's

telecommunications business. What monthly compounding interest rate should the business

offer?

N

I/Y

P/Y

C/Y

PV

PMT

FV

5. If an investment grew to $12,000 in 2 years and the interest amount earned was $800,

calculate the monthly compounding interest rate.

N

I/Y

P/Y

C/Y

PV

PMT

FV

Unit 1 L5 Lesson Practice

9.6 Calculating n and t

1. How long would it take a loan of $15,625 to accumulate to $18,500 at the rate of 8%

compounded quarterly?

N

I/Y

P/Y

C/Y

PV

PMT

FV

2. Rudolph invested $5000 in his RRSP that was earning 9.55% compounded semi-annually.

How long would it take for his investment to grow to $100,000?

N

I/Y

P/Y

C/Y

PV

PMT

FV

3. Texas Equipment wanted to invest in a bond that promises to triple its investment at 12.5%

compounded quarterly. How long would it take for the bond to mature?

N

I/Y

P/Y

C/Y

PV

PMT

FV

4. The maturity value of a bond is $10,850 and it has grown at an interest rate of 6%

compounded quarterly. Calculate the time period of the bond if the interest earned is

$2300.

N

I/Y

P/Y

C/Y

PV

PMT

FV

5. Calculate the time period of an investment in a mutual fund that matured to $43,676.25

yielding an interest of $13,676.25 at 8% compounded monthly.

N

I/Y

P/Y

C/Y

PV

PMT

FV