Learning Objectives:

At the end of the lesson, the students will be able to:

1 distinguish difference between stocks and bonds;

2

describe the different markets for stocks and

bonds;

3 analyzes the different market indices for stocks

and bonds.

STOCKS and BONDS

DEFINITION

STOCKS BONDS

A form of equity instrument A form of debt instrument of

or raising money by allowing raising of money by borrowing

investors to be part owners of from investors

the company

ISSUERS

STOCKS BONDS

Government Institutions

Corporates

Financial Institutions

Companies, etc.

STATUS OF HOLDERS

STOCKS BONDS

Shareholders are the owners Bondholders are the lenders to

of the company the company

FORM OF RETURNS

STOCKS BONDS

Profits earned by the company Interest payments are made in

are paid in the form of the form of Coupon Payments

Dividends

RISK LEVEL

STOCKS BONDS

HIGH since it depends upon the Relatively LOW since

performance of the issuer, so bondholders are prioritized for

no guaranteed returns repayments

MAJOR RISK ASSOCIATED

STOCKS BONDS

Market Risk Interest Rate Risk

Business Risk Inflation Risk

ADDITIONAL BENEFIT

STOCKS BONDS

Shareholders get the right to Bondholders get the

vote preference in terms of

repayment and also on

liquidation

MARKET VALUE

STOCKS BONDS

When interest rates have When Market Interest Rates

fallen significantly, the decrease, the market value of

market stock value rises an existing bond increases

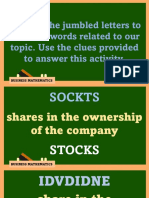

DRILL

TOCSK

Share in the ownership of the company

denivdid

Share in the company’s profit.

Denivdid rep resha

Ratio of the dividends to the numbers of

shares

SCTOS RETMAR

A PLACE WHERE STOCKS CAN BE

BOUGHT OR SOLD (pse)

RETMAR EUVAL

The current price of a stock at which it

can be sold

ckots ylide ioart

Ratio of the annual dividend per share

and the market value per share.

RAP EUVAL

It is determined by the company and

remains stable over time.

Different Markets

for Stocks and Bonds

Example #1: A certain financial institution declared a ₱30,000,000 dividend

for the common stocks. If there are a total of 700,000 shares of common

stocks, how much is the dividend per share?

Given:

Total Dividend = ₱30,000,000

Total Shares = 700,000 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 =

𝑻𝒐𝒕𝒂𝒍 𝒄𝒐𝒎𝒎𝒐𝒏 𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅

𝑻𝒐𝒕𝒂𝒍 𝑺𝒉𝒂𝒓𝒆𝒔

Find: Dividend per share

𝟑𝟎, 𝟎𝟎𝟎, 𝟎𝟎𝟎

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 =

𝟕𝟎𝟎, 𝟎𝟎𝟎

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 = 𝟒𝟐. 𝟖𝟔

Example #2: Kash Corporation has 2,500,000

shares of common stock outstanding. If the

dividend pf 4,000,000 pesos declared by the

company directors last year, what are the

dividends per share of common stock? How

much would be your earning if you own 2,500

shares?

Example #3: The Corporation ni Jian

declared a dividend of 300,000 pesos. The

company has 30,000 pesos total preferred

dividend and 100,000 total common shares.

Calculate the dividend per share and your

earnings if you own 2,000 shares.

Example #4: A certain corporation declared a 3% dividend on a stock with a

par value of ₱500. Mrs. Lingan owns 200 shares of stocks with a par value

of ₱500. How much is the dividend she received?

Given:

Dividend Percentage = 3%

Par Value = ₱500

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 = 𝟓𝟎𝟎 𝒙 𝟎. 𝟑 = ₱𝟏𝟓

Number of Shares = 200

Since there are 200 shares, the total dividend is:

Find: Dividend

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 = 𝟏𝟓 𝒙 𝟐𝟎𝟎

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 = ₱𝟑, 𝟎𝟎𝟎

Stock yield Ratio

Shows what percentage of the market price

of a share a company annually pays to its

stockholders in the form of dividends.

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆

Stock yield ratio=

𝒎𝒂𝒓𝒌𝒆𝒕 𝒗𝒂𝒍𝒖𝒆

Example #5: Corporation A, with a current market

value of ₱52 , give a dividend of ₱8 per share of

its common stock. Corporation B, with a current

market value of ₱95 , give a dividend of ₱12 per

share. Use the stock yield ratio to measure how

much dividends shareholders are getting in

relation to the amount invested.

Example #5: Corporation A, with a current market value of ₱52 , give a dividend of ₱8 per

share of its common stock. Corporation B, with a current market value of ₱95 , give a

dividend of ₱12 per share. Use the stock yield ratio to measure how much dividends

shareholders are getting in relation to the amount invested.

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆

Given: (Corporation A) 𝑺𝒕𝒐𝒄𝒌 𝒀𝒊𝒆𝒍𝒅 𝑹𝒂𝒕𝒊𝒐 =

𝑴𝒂𝒓𝒌𝒆𝒕 𝑽𝒂𝒍𝒖𝒆

Dividend per share = ₱8

Market Value = ₱52 Corporation A Corporation B

𝟖 𝟏𝟐

Given: (Corporation B) 𝑺𝒀𝑹 =

𝟓𝟐

𝑺𝒀𝑹 =

𝟗𝟓

Dividend per share = ₱12 𝑺𝒀𝑹 = 𝟎. 𝟏𝟓𝟑𝟖 𝑺𝒀𝑹 = 𝟎. 𝟏𝟐𝟔𝟑

Market Value = ₱95 𝑺𝒀𝑹 = 𝟏𝟓. 𝟑𝟖% 𝑺𝒀𝑹 = 𝟏𝟐. 𝟔𝟑%

S

O T

C K

S

B O

D N

I

D D

E I

N V

D

C

N U

P O

O

V I S

O T

RNE

Example #1: Determine the amount of the semi-annual coupon for a bond

with a face value of ₱300,000 that pays 10% payable semi-annual for its

coupon.

Given: 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑭𝒂𝒄𝒆 𝑽𝒂𝒍𝒖𝒆 𝒙 𝑪𝒐𝒖𝒑𝒐𝒏 𝑹𝒂𝒕𝒆

Face Value (F) = ₱300,000 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝟑𝟎𝟎, 𝟎𝟎𝟎 𝒙 𝟎. 𝟏𝟎

Coupon Rate = 10% 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝟑𝟎, 𝟎𝟎𝟎

Find: Amount of the Semi- 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕(𝒔𝒆𝒎𝒊 − 𝒂𝒏𝒏𝒖𝒂𝒍) = 𝟑𝟎, 𝟎𝟎𝟎

annual Coupon 𝟐

𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 𝒔𝒆𝒎𝒊 − 𝒂𝒏𝒏𝒖𝒂𝒍 = 𝟏𝟓, 𝟎𝟎𝟎

Example #2: Find the amount of the semi-annual coupon for a ₱200,000

bond which pays 5% convertible semi-annually coupons.

Given: 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝑭𝒂𝒄𝒆 𝑽𝒂𝒍𝒖𝒆 𝒙 𝑪𝒐𝒖𝒑𝒐𝒏 𝑹𝒂𝒕𝒆

Face Value (F) = ₱200,000 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝟐𝟎𝟎, 𝟎𝟎𝟎 𝒙 𝟎. 𝟎𝟓

Coupon Rate = 5% 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 = 𝟏𝟎, 𝟎𝟎𝟎

Find: Amount of the Semi- 𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕(𝒔𝒆𝒎𝒊 − 𝒂𝒏𝒏𝒖𝒂𝒍) = 𝟏𝟎, 𝟎𝟎𝟎

annual Coupon 𝟐

𝑪𝒐𝒖𝒑𝒐𝒏 𝑨𝒎𝒐𝒖𝒏𝒕 𝒔𝒆𝒎𝒊 − 𝒂𝒏𝒏𝒖𝒂𝒍 = 𝟓, 𝟎𝟎𝟎

Market Indices for

Stocks and Bonds

Stock Market Index

The measure of a portion of

the stock market

Example:

One example is the PSE Composite Index (PSEi). It is

composed of 30 companies carefully selected to represent the

general movement of market prices.

Sector Indices

Indices that representing a

particular sector.

Example:

Financial Institutions

Industrial Corporations

Holding Firms

Service Corporations , etc.

Stock Index Tables

Here is the example of the stock index table that shows how a

list of index values is typically presented:

Value – it refers to the value of

index

Chg – change of the index value

from the previous trading day

(difference between the value

today and value yesterday)

%Chg – ratio of chg to value

Stock Tables

The heading 52-WK-HIGH is the highest selling price of the

stock in the past 52 weeks.

The heading 52-WK-LOW is the lowest selling price of the

stock in the past 52 weeks.

Stock Tables

The heading STOCK is a three-letter symbol that company

using for trading. Example: AAA

The heading HIGH is the highest selling price of the stock

on the last trading day.

Stock Tables

The heading LOW is the lowest selling price of the stock on

the last trading day.

The heading DIV is the dividend per share last year.

Stock Tables

The heading VOL is the number of shares (in hundreds)

traded in the last trading day.

The heading CLOSE is the closing price on the last trading

days.

Stock Tables

The heading NETCHG is the net change between the last two

trading days. In the case AAA, the net change is 0.10. The

closing price the day before the last trading day is

₱70.25 - ₱0.10 = ₱70.15

Buying or Selling Stocks

To sell the stock is another way of a shareholder to earn an

income. A broker may be used to buy or sell stocks. Those

with accounts in online trading platforms may often

encounter a table such this:

Buying or Selling Stocks

Bid Size – the number of individual buy orders and the total

number of shares they wish to buy.

Bid Prize – the price that buyers are willing to pay for the stock

Buying or Selling Stocks

Ask Size – how many individual sell orders have been placed in the online

platform and the total number of shares these sellers wish to sell

Ask Prize – the price that sellers of the stock are willing to sell

Example

1. Give the highest and lowest prices for the past 52 weeks.

FFF GGG

52-WK-HIGH = ₱75 52-WK-HIGH = ₱118

52-WK-LOW = ₱69 52-WK-LOW = ₱100

Example

2. Give the highest and lowest prices for the last trading days.

FFF GGG

HIGH = ₱71.00 HIGH = ₱115.20

LOW = ₱67.90 LOW = ₱114.30

Example

3. What was the dividend per share last year?

FFF GGG

Dividend per share = ₱3.50 Dividend per share = ₱1.40

Example

4. What was the annual percentage yield last year?

FFF GGG

YLD% = 2.5% YLD% = 3.1%

Example

5. What was the closing price in the last trading day?

FFF GGG

Closing Price = ₱72.30 Closing Price = ₱115.00

Example

6. What was the closing price the day before the last trading day?

FFF GGG

Closing Price (the day before Closing Price (the day before

the last trading day) the last trading day)

₱72.30 - ₱0.30 = ₱72.00 ₱115.00 – (-₱0.10)

₱115.00 + ₱0.10 = ₱115.10

Example

7. How many shares were traded?

FFF GGG

190 shares x 100 = 19,000 10,500 shares x 100 = 1,050,000

Example

8. During the past 52 weeks, which stocks in the table sold at the highest

price? At the lowest price?

Answer: During the past 52 weeks, the GGG stock sold at the highest

price ₱118 and FFF stock sold at the lowest price ₱69

Example

9. Which stocks have the lowest shares were traded for the day?

Answer: The FFF stock has the lowest shares were traded with 190 shares

of 100 which is equal to 19,000 shares

REMINDERS !!!