BACHELORS DEGREE IN BUSINESS EDUCATION

SPECIALIZATION: BUSINESS EDUCATION

COURSE NAME: PRINCIPLES OF FINANCAL ACCOUNTING I

COURSE CODE: BE101SEB

NUMBER OF CREDITS: 3

NUMBER OF HOURS: 45 hours

PREREQUISITES: CSEC ACCOUNTS

COURSE DESCRIPTION

This course is an introductory one which covers the frame work of accounting, the

double entry system, books of original entry, preparation of financial statements with

adjustments and payroll accounting. Upon completion of this course, students should

have knowledge of basic accounting practices and concepts. They will be equipped

with the knowledge and competence necessary to engage in further accounting

studies. The course will be delivered using demonstration/explanation techniques,

problem-solving simulations and research methods.

GENERAL LEARNING OUTCOMES:

This course will develop student teachers’ understanding of and response to:

1. the basic structure of accounting and the double entry system of accounting.

2. the various books of original entry.

3. the adjustments to the final accounts and the preparation of the adjusted final

accounts.

4. the procedures used in payroll systems.

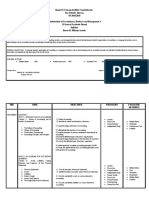

UNIT 1 BASIC STRUCTURE OF ACCOUNTING (2 Hours)

Reviewed October 2013

Learning Outcomes

Students will be able to:

a. State the major fields of accounting

b. Explain the purpose of keeping accounting records

c. Describe the users of, and characteristics of accounting information

d. Explain the concepts on which accounting is based

e. Outline the features of various types of business organizations

Content

1. Definition of accounting terminologies

2. Purposes of accounting and relationship between accounting and book keeping

3. User of accounting information

4. Characteristics of accounting information

5. Accounting concepts: going concern, accruals, prudence, realization, historical

cost concept etc

6. Features of Business Organizations- sole traders, partnerships, companies

UNIT 2 DOUBLE ENTRY SYSTEM OF ACCOUNTING (4 Hours)

Learning Outcomes

Students will be able to:

a. Explain each of the elements of the accounting equation

b. Give examples of the elements of the accounting equation

c. Manipulate the accounting equation

d. Examine the effects of transactions on the different types of accounts

e. Record transactions in the ledger using the double entry system of accounting

f. Balance the ledger accounts

g. Extract a trial balance

Content

1. Accounting equation

2. Double entry accounting

3. Types of Accounts: real accounts, nominal accounts, personal accounts

4. Balancing off accounts and extraction of the unadjusted trial balance

Reviewed October 2013

UNIT 3 CLASSIFIED STATEMENT OF FINANCIAL POSITION

(3 Hours)

Learning Outcomes

Students will be able to:

a. Define the term balance sheet

b. Explain the relationship between the accounting equation and the statement of

financial position

c. Classify the different types of assets, liabilities and capital

d. Prepare the classified statement of financial position

Content

1. Definition of Balance Sheet

2. The Accounting equation and the statement of financial position

3. Preparation of statement of financial position in order of liquidity and

permanence.

UNIT 4 THE PREPARATION OF FINANCIAL STATEMENTS FOR

THE SOLE TRADER (4 HOURS)

Learning Outcomes

Students will be able to:

a. Explain the concepts of trading account and profit and loss accounts.

b. Use the horizontal and vertical formats to construct a simple trading, profit

and loss account and a statement of financial position.

c. Define the term working capital

d. Calculate working capital from given information

Content

1. Definition of balance sheet and trading, profit and loss

2. Prepare simple trading, profit and loss and balance sheet from trial balance

using vertical and horizontal formats.

Reviewed October 2013

UNIT 5 BOOKS OF ORGINAL ENTRY (10 Hours)

Learning Outcomes

Students will be able to:

a. State the uses of subsidiary books

b. Identify the source documents used to write up the books of original entry

c. Record transactions in the appropriate subsidiary books

d. Post entries from subsidiary books to respective ledgers

e. Describe the accounting cycle

f. Distinguish between trade and cash discounts

g. Interpret the balance of the cash book

h. Balance the petty cash book

i. Indicate treatment of totals from the books of original entry

Content

1. Subsidiary Books: Purchases, Sales, Returns Inwards and Outwards, Cash

Book, General Journal and Petty Cash.

2. Related Source Documents: Invoices, Receipts, payment vouchers, debit and

credit note

3. Calculation of trade and cash discount; discount received and allowed

4. Record entries in all books of original entry from related source documents

5. Post from subsidiary journals to the ledgers

6. Posting totals to books of original entry to the General Ledger.

UNIT 6 ADJUSTMENTS TO FINAL ACCOUNTS No. of hours 14

Learning Outcomes

Student teachers will be able to:

a. Analyze the various adjustments to the final accounts

b. Calculate depreciation charges using straight line and reducing balance

methods

c. Prepare the ledger accounts with the relevant adjustments

d. Journalize the various adjustments to the final accounts

e. Prepare final accounts with adjustments

Reviewed October 2013

Content

1. Purpose of Adjustments to Final Accounts

2. Straight Line and Reducing Balance Depreciation Methods

3. General Ledger and adjustments:

- Accruals and prepayments, provision for discounts

- Depreciation expense and Provision for depreciation

- Provision of bad debts, bad debts and bad debt recovered

- Disposal of fixed assets

4. General Journal and adjustments

5. Final accounts with adjustments

UNIT 7 PAYROLL ACCOUNTING No of Hours: 4

Learning Outcomes

Students will be able to:

a. Identify the basic source documents used in a payroll system

b. Transfer information from time cards or sheets to payroll systems

c. Calculate employees’ gross earnings

d. Calculate employees’ net pay

e. Calculate statutory deductions

f. Distinguish between voluntary and statutory deductions

g. Prepare payslips and cheques from given payroll information.

Content

1. Payroll Source Documents.

2. Gross Emoluments and Net Pay

3. Statutory deductions and voluntary deductions

4. Payroll documents- pay advice and cheques

ASSESSMENT STRATEGIES

College Coursework (3 hours) 50%

Coursework should include:

Mid-Semester Test on Units 2, 3, 4 & 6 to assess students’

competence in preparing financial statements.

20%

A group project on Units 1 or 5 to facilitate cooperative

learning.

10%

Individual class presentation to enable students to develop

confidence in lesson execution, time management skills and

Reviewed October 2013

build confidence.

15%

Participation and attendance

5%

Written Final Examination 50%

Multiple choice Questions

Structured Questions

METHODS OF DELIVERY

Demonstration/Explanation

Student Presentation

Research (Observing APA 6th Ed format for referencing)

Group assignment

Video (Youtube video/teacher made)

RECOMMENDED TEXTS AND REQUIRED READING

Prescribed Text:

Wood, Frank (latest edition) Business Accounting One Prentice Hall

Recommended Texts:

Hosein-Thompson, Fay (latest edition) Principles of Accounts

Heinemann Educational Publishers

Wood F. and Robinson S. (latest edition) Principles of Accounts,

International Version Longman Publishers

Internet resources

[Link]

Reviewed October 2013