0% found this document useful (0 votes)

132 views7 pagesApplied Econometrics - Compulsory Assignment Hand-IN

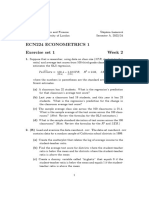

This document summarizes an applied econometrics assignment analyzing cross-sectional data. It includes:

1) Multiple choice questions and answers

2) Code to standardize a variable

3) A regression of log wages on education and experience variables, finding education increases wages by 7.6% while experience has diminishing returns

4) An explanation that including the correlated variable "age" would cause multicollinearity issues.

5) A conclusion that while OLS assumptions are met, heteroskedasticity is present, so a weighted least squares approach could provide a more efficient analysis.

Uploaded by

Lars TonnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

132 views7 pagesApplied Econometrics - Compulsory Assignment Hand-IN

This document summarizes an applied econometrics assignment analyzing cross-sectional data. It includes:

1) Multiple choice questions and answers

2) Code to standardize a variable

3) A regression of log wages on education and experience variables, finding education increases wages by 7.6% while experience has diminishing returns

4) An explanation that including the correlated variable "age" would cause multicollinearity issues.

5) A conclusion that while OLS assumptions are met, heteroskedasticity is present, so a weighted least squares approach could provide a more efficient analysis.

Uploaded by

Lars TonnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd