Faye travel insurance can reimburse you for nonrefundable expenses if your travel plans go awry or you’re hurt while on vacation. An entirely online provider, Faye boasts 24/7 customer service and streamlined payments through its proprietary app. But is travel insurance worth the cost — and what can you expect your Faye travel insurance policy to cover?

Read on to learn more about how Faye earned the No. 1 rank on our list of top travel insurance providers.

Our Take on Faye Travel Insurance

We gave Faye Travel Insurance an overall score of 4.6 out of 5 stars and ranked it as the best travel insurance provider with an entirely online experience. Faye’s online application is simple, allowing you to get a quote in as little as 60 seconds, and the company’s free app makes filing a claim just as easy. While Faye’s pricing is a bit higher than other insurance providers, its all-in-one app and around-the-clock support might be worth it for some travelers.

In addition to a mobile offering and 24/7 customer support, Faye also includes extra benefits like $2,000 coverage for sporting equipment and $50 towards replacement passports. This coverage, plus Faye’s generous baggage coverage, could be valuable for those who travel with items that would be difficult or expensive to replace. Faye might be a less valuable choice for travelers who are more likely to require medical coverage, as its evacuation and medical bill reimbursement limits are lower than competitors.

Pros and Cons

- Offers a mobile app for policy management and 24/7 support

- Streamlined claims process is available in-app and online

- Standard policy includes comprehensive flight delay coverage

- May be more expensive than other competitors

- Only offers one plan

How Faye Scored In Our Methodology

We rated Faye Travel Insurance 4.6 out of 5 stars. The company is our overall top pick for travel insurance due to its comprehensive travel insurance plan, variety of add-on options and strong reputation for customer service.

Compare Faye to the Other Travel Insurance Providers

Use the table below to compare the costs and coverages of Faye to other top-rated travel insurance companies.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

| Company | Average Plan Cost | CFAR Coverage | COVID-19 Coverage | BBB Rating | |

|---|---|---|---|---|---|

|

$298

|

Yes, up to 75%

|

Yes

|

Not Rated

|

||

|

$242

|

Yes, up to 75%

|

Yes

|

A+

|

||

|

$182

|

Yes, up to 75%

|

Yes, limited

|

A+

|

||

|

$228

|

Yes, up to 60%

|

Yes

|

A+

|

||

|

$273

|

Yes, up to 75%

|

Yes, limited

|

A+

|

||

|

$208

|

Yes, up to 75%

|

Yes

|

B

|

||

|

$266

|

Yes, up to 75%

|

Yes, limited

|

C-

|

||

|

$72

|

Yes, up to 75%

|

Yes, limited

|

A-

|

||

|

$206

|

Yes, up to 75%

|

Yes

|

A+

|

||

|

$241

|

Yes, up to 50%

|

Yes, limited

|

A+

|

| Company | BBB Rating | Average Plan Cost | CFAR Coverage | COVID-19 Coverage | |

|---|---|---|---|---|---|

|

Not Rated

|

$298

|

Yes, up to 75%

|

Yes

|

||

|

A+

|

$242

|

Yes, up to 75%

|

Yes

|

||

|

A+

|

$182

|

Yes, up to 75%

|

Yes, limited

|

||

|

A+

|

$228

|

Yes, up to 60%

|

Yes

|

||

|

A+

|

$273

|

Yes, up to 75%

|

Yes, limited

|

||

|

B

|

$208

|

Yes, up to 75%

|

Yes

|

||

|

C-

|

$266

|

Yes, up to 75%

|

Yes, limited

|

||

|

A-

|

$72

|

Yes, up to 75%

|

Yes, limited

|

||

|

A+

|

$206

|

Yes, up to 75%

|

Yes

|

||

|

A+

|

$241

|

Yes, up to 50%

|

Yes, limited

|

What Does Faye Travel Insurance Cover?

Faye Travel Insurance is a relatively new insurance provider, opening its doors in 2022. However, the company has quickly set itself apart with its app-based offerings. Those who prefer a more streamlined, digital policy experience may prefer the Faye app, which offers benefits like:

- Real-time travel alerts

- Customer support from real humans

- A fully digital claims process

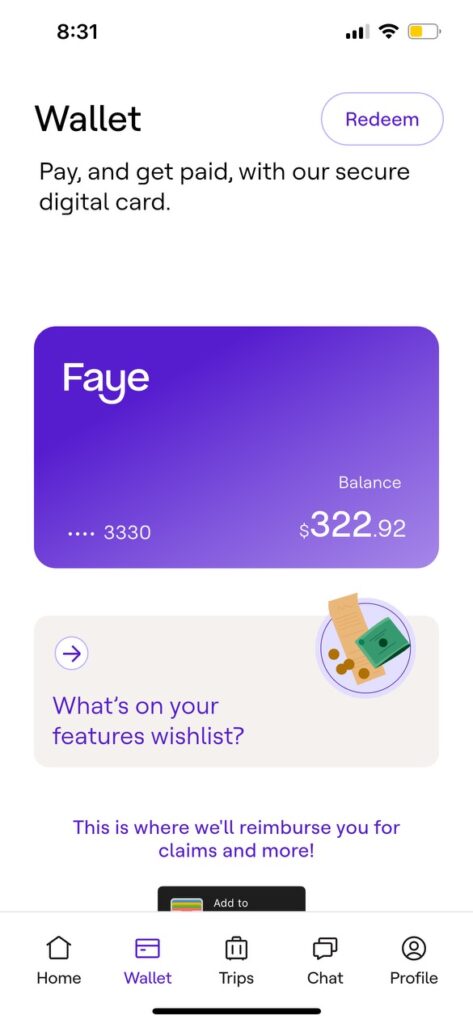

While the Faye app is available as a free download for both Android and iOS devices, it is not required to buy insurance or file a claim. You can utilize Faye’s website to check policy pricing or email the company to file a claim. The app also features the Faye Wallet option, which allows you to get paid directly after filing a claim.

Based on our research, we found that Faye offered a single insurance policy for both domestic and international trips which includes the following coverage:

| Coverage | Amount |

|---|---|

| Trip cancellation | 100% |

| Trip interruptions | 150% |

| Emergency medical expense | Up to $250,000 |

| Emergency medical evacuation | Up to $500,000 |

| Non-medical emergency evacuation coverage | Up to $100,000 |

| Flight delays | $300 per day, up to $4,500 |

| In-trip conveniences | Up to $200 |

| Lost of damaged baggage | $150 per item, Up to $2,000 |

| Baggage delays | Up to $200 |

| Lost or damaged professional or sporting equipment | Up to $2,000 |

| Lost passports and credit cards | $50 |

As long as you purchase your plan within 14 days of your initial trip deposit and are medically able to travel when you purchase your plan, pre-existing conditions can be covered for trip cancellation and trip interruption (not for medical expenses relating to pre-existing conditions). If you do not purchase Faye travel insurance within 14 days of your initial trip deposit, you unfortunately won’t receive the waiver for pre-existing medical conditions.

When compared to other travel insurance providers, Faye’s coverage is average in terms of baggage and delays. Faye also falls a bit short with its medical evacuation coverage. For example, competitors like Nationwide and Travel Insured International offer up to $1 million in evacuation coverage at similar price points. This might make Faye a less appealing choice if you’re planning international travel to a rural area with limited access to medical care.

Optional Riders

Even the best travel insurance coverage will not cover every situation and cancellation. Riders are add-ons that extend your coverage to include more unique circumstances. Faye travel insurance currently allows you to customize your travel insurance policy with the following extra coverages:

- Cancel for any reason (CFAR) coverage: All travel insurance companies specify a list of covered reasons that qualify you for reimbursement if you must cancel your travel plans. Some common covered reasons include the death of a family member, legal obligations or natural disasters. Adding CFAR coverage to your Faye travel insurance policy offers more flexibility in regard to cancellations. With CFAR coverage, you will be reimbursed for up to 75% of non-refundable trip costs when you cancel your trip for any reason — even those not included in your policy. To qualify, you must initiate the cancellation at least 48 hours before your departure.

- Rental car care: This add-on reimburses you for up to $50,000 in rental car damage or theft-related expenses if you’re involved in an accident abroad or if the vehicle is stolen.

- Adventure and extreme sports protection: Like most competing travel insurance provider options, Faye’s coverage for medical expenses excludes bills resulting from extreme sports. If you plan to parasail, scuba dive or engage in any other extreme outdoor activities, you can extend medical evacuation and expense reimbursement coverage with this rider.

- Vacation rental damage protection: This rider reimburses you for up to $3,000 in repair or replacement costs if you damage the rental property you’re staying in.

- Pet care: If your trip is interrupted or canceled while you’re abroad, you could end up with unanticipated pet care expenses. This add-on reimburses you for up to $2,500 in veterinary expenses and $250 for kenneling if you arrive back home later than expected.

Add-on pricing is proportional to the value of your trip and may vary based on the amount of time you’re traveling and your destination.

What Doesn’t Faye Cover?

Faye doesn’t cover the following:

- Expected or foreseeable events

- Costs incurred while under the influence of alcohol or drugs

- Psychological conditions, unless you’re hospitalized for them

- Self-harm or suicide

- War and acts of war

- Illegal activities

- Operating an aircraft or serving as a crew member

- High-risk activities that you are paid to do

How Much Does Faye Travel Insurance Cost?

The average cost of a Faye travel insurance policy is $256, but ranges from $130-$482 depending on your trip details.

Some of the factors that affect the price of travel insurance include:

- Your age

- Your travel destination and home state

- The total value of your trip

- The dates you’re traveling

- When you made your first trip deposit

Based on our Faye travel insurance review, Faye is not the most competitively priced provider. After comparing a few sample trips between providers, we found that Faye’s prices were about 31% higher than competing insurers offering comparable coverage. However, it’s important to remember that travel insurance premiums are highly customizable and personalized — we still recommend getting a quote from Faye before choosing your insurance plan.

To give you an idea of the cost of Faye Travel Insurance policies, we obtained the following quotes for seven different international trips. All trips are one week long, but vary in number of travelers, traveler age and trip destination.

Faye’s Cost by Plan Type

| Traveler | Trip Details | Cost |

|---|---|---|

| 30-year-old couple | $5,000 vacation to Mexico | $298 |

| 65-year-old couple | $7,000 vacation to London | $417 |

| 30-year-old couple | $7,000 trip to London | $351 |

| Family of 4 | $8,000 vacation to Mexico | $378 |

| 19-year-old | $2,000 trip to Paris, France | $135 |

| 27-year-old | $1,800 trip to Athens, Greece | $130 |

| 23-year-old | $4,000 trip to Europe | $189 |

| 51-year-old | $2,000 vacation to Madrid, Spain | $147 |

| Average | $256 |

Use the chart below to compare Faye’s average cost to competitors:

Read More: Travel Insurance For Travelers Visiting The United States

Does Faye Offer 24/7 Travel Assistance?

If you’re traveling internationally for the first time, it can be reassuring to know your travel insurance provider offers around-the-clock assistance in your native language. Faye offers 24/7 customer support through its Apple and Android apps and over the phone. If you don’t need urgent assistance, you can direct any questions about your policy to its customer support team via email at [email protected].

Faye Travel Insurance Reviews

Reading third-party reviews of previous customer experiences can help you anticipate the type of service you’ll receive from a travel insurance provider. Overall, Faye maintains higher-than-average customer reviews, with about 84% of Trustpilot users rating the company 4.5 out of 5 stars. However, Faye is not currently accredited nor rated by the Better Business Bureau (BBB).

Many customer reviews note that Faye was helpful and efficient when issues occurred while traveling. Multiple customers report it was easy to get in touch with a Faye representative when they needed it most and that claims were paid out quickly. However, some customers expressed frustration regarding difficulties finding a medical provider using Faye’s app in some countries. Some customers also reported issues regarding policy “fine print” or a lack of communication with representatives.

We reached out to Faye for comment on its negative customer reviews but did not receive a response.

How To File a Claim with Faye

Filing a claim with Faye starts with the company’s mobile app. Here is an overview of the general process:

- Access the Faye app: Begin by opening the Faye mobile application on your device.

- Navigate to “Get Help”: Within the app, locate the “Get Help” tab, and then click on the “Claim Questions” tab.

- File a new claim: In the “Claim Questions” section, select the option to “File a new claim.”

- Specify your claim reason: You will be prompted to give a reason for filing a claim. Choose the appropriate category, whether it’s related to your health or other claims such as rental car coverage.

- Provide trip details and explanation: Enter essential information about your trip, including dates and destinations. Additionally, explain the circumstances that led to your claim.

- Upload supporting documents: To substantiate your claim, upload relevant supporting documents. These may include flight tickets, hotel reservations or any other travel-related receipts.

- Submit your claim: Once you’ve filled in the required details and attached the necessary documents, you can submit your claim through the app.

- Alternative method: If you don’t have the Faye app, you can still file a claim by sending an email to [email protected]. Make sure to include the same information you would provide through the app so Faye can assist you effectively.

Faye aims to process all claims within 48 hours of submission. You can check for live updates through the Faye app — another benefit of choosing Faye as your travel insurance provider.

Our Experience With Faye

To better understand the experience Faye offers consumers, our team member, Nicole Donzella, purchased a policy for a week-long trip to Aruba. Here’s what she had to say about the signup process:

“I felt the signup process was quick and easy — it took me about two minutes. The information on what’s covered is super straightforward, and you can adjust your coverage and add-ons easily and see how it impacts the cost. There are also helpful tooltips and popups so you can get all the information you need without leaving the page.”

Donzella also noted that Faye’s mobile app is visually appealing, easy to navigate and has a lot of features.

“You can add your flights and get updates on predicted weather, see the current exchange rate for the country you’re visiting and see local trending music via Spotify,” she said about the app. “There is also an easy-to-access chat function and a virtual card you can link to your Apple wallet.”

Our Claims Experience

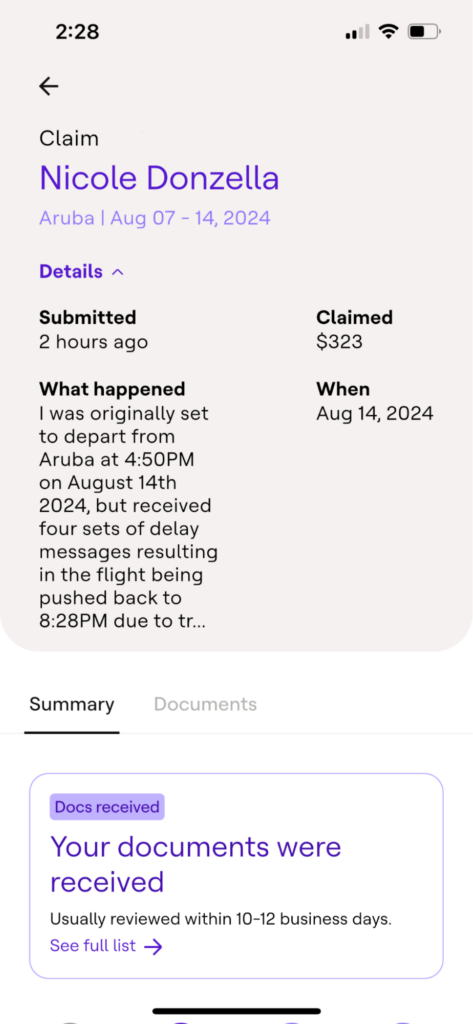

While in Aruba, Donzella experienced a flight delay when heading back home. Once her airline announced several delays in a row, she used Faye’s live chat function, noting:

“As I experienced delays and cancellations, I was able to ask specific questions about coverage and get a response in less than five minutes with no waitlist. Confirming that Faye would cover my situation as it was happening gave me peace of mind and made a stressful situation much more manageable.”

Once Donzella confirmed through a customer service representative that Faye would cover her claim, she submitted her documentation via the app. While she says submitting her claim seemed simple initially, Faye did not request detailed information about what caused the delays and cancellations. The company also did not allow Donzella to include context about the screenshots she submitted with evidence of the travel issues.

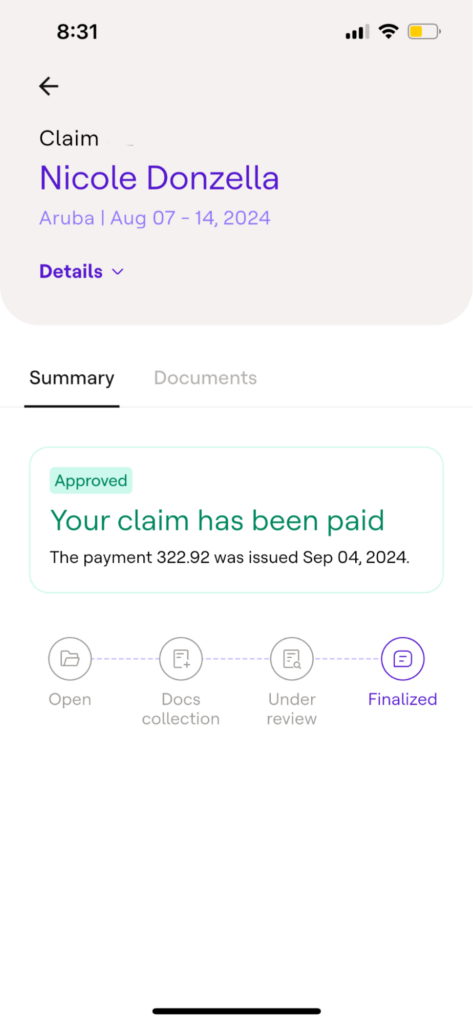

While Faye states its claim processing time takes an average of three to five days, Donzella received a notification that the company’s claims volume was high and it would likely take around 10 days. In the end, it took a total of 18 days from the time Donzella submitted her claim for approval and payment from Faye. Her timeline from filing to payment was as follows:

- Aug. 17, 2024: Submitted the claim

- Aug. 29, 2024: Received a follow-up to confirm the information was correct

- Sept. 4, 2024: Faye sent payment for the claim amount through its app

Donzella appreciated receiving payment through the app, as she didn’t have to wait for a check in the mail, and the amount was easily transferred to her bank account. In addition, she was pleasantly surprised to see that Faye paid her full claim amount of $322 even though her coverage limit for delays was $300. Overall, Donzella felt that her experience with Faye’s claims process was very positive.

Is Faye Travel Insurance a Good Choice?

Overall, Faye can be a strong travel insurance choice for those traveling with valuable items or looking for a digital policy experience. With special coverage for lost sports equipment and up to $4,500 in baggage reimbursements, Faye offers generous coverage limits for your belongings. But this coverage comes at a cost that is higher than some other leading providers. Faye may not be the best choice if you are traveling on a budget and seeking cheap coverage options.

We recommend requesting quotes from at least three travel insurance providers before deciding on a policy.

Frequently Asked Questions About Faye Travel Insurance

Faye travel insurance policies are underwritten by the United States Fire Insurance Company. The United States Fire Insurance Company boasts an A+ rating with the credit agency A.M. Best, indicating the company is financially stable enough to pay out claims.

Travel insurance coverage is a type of protection that reimburses you for non-refundable trip costs if your travel plans are unexpectedly canceled or interrupted. Travel coverage includes coverage for medical expenses you incur abroad and evacuation expenses if you’re forced to leave your destination early. Most policies will also cover lost or damaged baggage.

Faye travel insurance is a legitimate company, backed by the well-rated United States Fire Insurance Company. While not every customer reports a positive experience with Faye, most customers report that the company provided a payout after filing a claim.

As is the case with most travel insurance providers, Faye travel insurance works on a reimbursement-based model. This means you’ll need to cover any medical or travel expenses you incur abroad and apply for a reimbursement later. A Faye underwriter will then look at your coverage, determine if you’re eligible for a payout and calculate your reimbursement.