Car insurance protects you and other drivers from the financial repercussions of an accident. Having a car insurance policy is not just a smart financial decision — in 49 states, it’s the law.

In this guide, we’ll tell you everything you need to know about car insurance, including the differences between liability coverage and full-coverage car insurance, what most policies don’t cover, additional protections you can purchase and some of the best car insurance companies and cheapest car insurance companies to consider.

Key Takeaways

- Auto insurance provides financial protection for you, your passengers and other drivers who are involved in an accident.

- Liability car insurance covers damage done to another driver’s vehicle, while full coverage also covers damage done to yours.

- 49 states require drivers to have at least liability coverage. New Hampshire is the sole exception.

Learn more about our methodology and editorial guidelines.

What Is Car Insurance?

Car insurance can financially and legally protect you, your passengers, your car and other people in the event of a car accident or other specific car-related incidents. The average cost of car insurance varies significantly by state, driving history, and coverage type, making it important to compare quotes from multiple providers.

What Does Car Insurance Cover?

There are different types of car insurance that pay for different things, such as:

- Medical bills, lost wages or funeral costs after an accident

- Legal fees in an auto-related lawsuit

- Vehicle replacement after a theft

- Car repairs for damages caused by accidents or vandalism

- Car repairs for damages caused by fire, floods or other acts of nature

Which of these things you get covered by car insurance depends on whether you opt for a minimum- or full-coverage policy. Below, we go into more detail on how the two coverage levels differ from each other.

Minimum Coverage

Minimum coverage is the lowest amount of liability coverage your state law requires to drive legally. Understanding what constitutes full coverage can help you decide whether minimum liability or comprehensive protection is right for your situation. In a nutshell, liability insurance covers medical expenses for other drivers and their passengers plus property damages done to their vehicle — all from an accident that you cause.

Liability coverage doesn’t cover repair or replacement costs for your vehicle or your medical bills. It’s best for insuring older vehicles that won’t cost too much to replace if a crash happens. Understanding what constitutes full coverage can help you decide whether minimum liability or comprehensive protection is right for your situation. Below, we go into more detail on liability insurance and its importance.

Full Coverage

Full-coverage car insurance protects you, your passengers, other drivers, all vehicles involved and any property damaged during a collision. It even covers damages done to your vehicle when it’s stationary, such as from falling tree branches, hail, fire or theft. Full coverage is often required when you lease or finance a car. It’s also a good option if you have a newer vehicle and can’t afford the out-of-pocket expenses to repair it after an accident. If you’re looking for ways to save money while maintaining comprehensive protection, exploring options for the most affordable full coverage can help you balance cost with coverage needs.

When you have full coverage for a vehicle that gets damaged, you’ll take your car to a repair shop approved by your insurance company. You’ll pay the car insurance deductible and once your insurance company approves the claim, they’ll pay the remaining repair costs.

Read more: Liability vs. Full Coverage

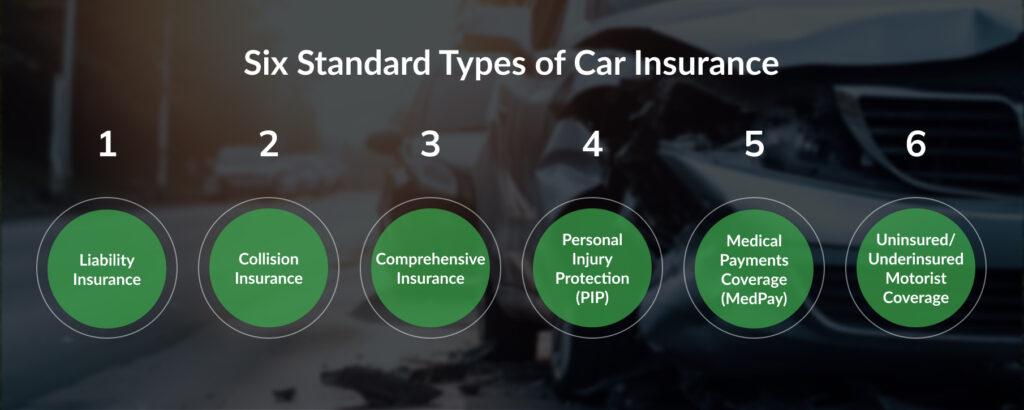

Types of Car Insurance

Here are the six basic types of car insurance coverage:

Liability Insurance

Liability insurance is the minimum amount of insurance coverage you need to legally drive in your state. This insurance comes with the following two types of coverage:

- Bodily injury liability coverage: This covers other parties’ medical bills, lost wages and any pain and suffering damages from a car accident you’re found at fault for. Many policies cap this coverage at a specific amount per accident or per person involved in the accident.

- Property damage liability coverage: This covers damages done to another vehicle due to an accident you caused. It may also cover repair expenses for dwellings, fences and other personal property involved in the accident.

Essentially, liability insurance protects other drivers, passengers or injured parties outside of your own when you’re found at fault for an auto accident. Liability coverage won’t cover your medical bills or car repairs, which makes getting full-coverage insurance a good idea.

Comprehensive Insurance

Comprehensive insurance will pay to replace your vehicle if it’s stolen, and typically covers damages to your vehicle that are non-accident-related or that come from the environment, such as:

- Fire

- Floods

- Tornadoes

- Earthquakes

- Vandalism

- Falling objects like hail and trees

- Animals hitting or infesting the car

As mentioned, comprehensive coverage is typically required by most auto lenders and is one of the standard types of coverage you need to create a full-coverage policy. It’s not legally required in any states, however.

Collision Insurance

Collision insurance covers repair or replacement costs for your vehicle after it’s involved in an accident with another vehicle — regardless of who’s at fault. It also covers collisions with inanimate objects like trees or fences and damage caused by flipping and potholes.

Most car financing and leasing companies require you to have collision insurance to protect their investment, but it’s not required by law to have. Having both collision and comprehensive insurance added to your policy makes it a full-coverage policy.

Personal Injury Protection (PIP)

PIP covers medical expenses for you and your passengers. Also known as “no-fault car insurance,” it covers items like trips to your doctors or hospitals, X-rays, surgeries and lost income during your recovery. It can also pay for items like cleaning and childcare services or funeral benefits for survivors. PIP is required in 12 states. Find out if your state requires it in our PIP guide.

Medical Payments Coverage (MedPay)

MedPay covers medical bills you or your passengers incur due to a car accident, regardless of who causes the accident. It covers expenses like trips to the doctor, X-rays, prostheses, nursing services, rehabilitation costs, deductibles and copays, ambulance fees and funeral expenses. MedPay is required in Maine, New Hampshire and Pennsylvania.

Underinsured/Uninsured Motorist Coverage

Underinsured or uninsured motorist coverage (UIM/UM) pays for medical and car repair or replacement expenses when you’re involved in an accident with someone who has either very little to no car insurance at all.

Like with liability insurance, there are two components to this coverage: uninsured motorist bodily injury coverage and uninsured motorist property damage coverage. Both have policy limits. If your claim exceeds those limits, your insurance company could go after the uninsured driver to recover the damages in court. UIM/UM is required in 22 states. Find out if your state requires it in our guide to uninsured motorist coverage.

Additional Car Insurance Coverage

Insurance carriers also offer add-on policies to cover extra expenses. Some options include:

Emergency Roadside Assistance

These policies cover towing up to a certain distance, putting air in flat tires, replacing spare tires, locksmith services, fuel deliveries and more. You can only use most emergency roadside assistance programs a certain number of times per year, so check with your auto insurance company to find out whether yours has any limitations. Comparing different roadside assistance options can help you find the most comprehensive coverage for your driving needs.

Gap Insurance

Gap insurance covers the remaining balance on a loan or lease after your insurance company pays the actual cash value for your totaled vehicle. For example, if your car loan balance is $18,000 but your insurance carrier only gave you $15,000 for the vehicle, gap insurance cuts a check for the remaining amount.

Rental Car Reimbursement

You’ll still need transportation to run errands or get to work while the repair shop works on your damaged car. With rental car reimbursement, your insurance company will reimburse you for the cost of renting a car or taking public transportation.

This optional insurance policy comes with a daily and maximum limit. For example, a policy might cover up to $25 per day for transportation expenses with a total limit of $700. Keep in mind that rental car reimbursement doesn’t pay for items like tolls, fuel and deposits.

What Car Insurance Doesn’t Cover

Car insurance doesn’t cover the following items:

| Wear and tear | Your vehicle will experience normal wear and tear over time. You’ll need to cover the cost of replacing tires, repairing frayed seating and other similar expenses on your own. |

| Maintenance | Your policy won’t cover routine oil changes, tire rotations, wiper blade replacements, wheel alignments and other maintenance-related expenses. |

| Intentional damage | If the repair shop or insurance adjuster rules that the damage resulted from an intentional act, your insurance company won’t approve the claim. |

| Losses exceeding your liability limits | If your bodily injury liability limit is lower than the other party’s total medical expenses, you’ll have to pay the difference out of pocket. Understanding how insurance rates change after accidents can help you prepare for potential premium increases following a claim. |

| Pet injuries | Some insurance carriers offer pet insurance as part of their car insurance policies. If you don’t have this coverage, you’re liable for any veterinary bills that result from an accident you caused. |

| Ridesharing | Companies like State Farm offer policies specifically for those working with ridesharing services. However, you must add this protection to your policy or notify your insurer before starting work. Your standard auto policy doesn’t cover commercial purposes. |

| Your car loan/lease’s remaining balance | If you total your vehicle in an accident but still owe more on your car loan than the vehicle was worth, you’ll have to pay off the rest of that loan yourself. You can also invest in gap insurance to pay the remaining balance on your loan or lease. |

| Emergency roadside services | Standard policies don’t cover roadside services like fuel deliveries, tows or jump-starts. |

| Other drivers | If people who share your address regularly drive your vehicle, you must name them on your policy. Otherwise, your insurance carrier might not cover any damages they cause. |

Do I Need Car Insurance?

All states except New Hampshire require drivers to carry liability car insurance for any vehicle they drive. PIP is required in at least 12 states, and UIM/UM is required in 22. Even in New Hampshire, you have to prove to the state you can afford to cover expenses related to a car accident before you can opt out of insurance. When shopping for coverage, comparing quotes from major auto insurance providers can help you find the right policy for your needs.

Driving without required coverage is illegal and could result in fines, registration or license suspension — or even jail time. If you don’t have car insurance, you’ll be on the hook for all damages you caused. If you don’t have money to pay these expenses, the other driver can take you to court to recover them.

Having car insurance protects you from the financial fallout of accidents. If you’re involved in one, the other driver’s insurance can work with yours to settle claims.

What Does Car Insurance Cover?: FAQ

Below are frequently asked questions about what car insurance covers.

Most car insurance covers damages done to another driver’s vehicle or personal property involved in a collision and any medical expenses incurred by the other party. Full coverage offers financial protection to cover repair and replacement costs for your vehicle and medical bills you and your passengers incur. Optional policies exist to cover other costs, like gap insurance paying the difference between your remaining car loan balance and your damaged vehicle’s fair market value.

Liability car insurance covers damage done to another vehicle or personal property from an accident you caused. Full car insurance covers the cost of repairs due to car accidents, fire damage, flood, tornado, falling objects, potholes, large animal collisions and vandalism.

Liability car insurance is the minimum coverage required in 49 states. It usually includes both bodily injury liability and personal property damage liability. If you finance or lease a vehicle, your lender is likely to require you to have full coverage insurance to protect their investment.

Our Methodology:

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Coverage (30% of total score): Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Cost and Discounts (25% of total score): Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities are both taken into consideration.

- Industry Standing (20% of total score): Our research team considers market share, ratings from industry experts and years in business when giving this score.

- Customer Experience (15% of total score): This score is based on volume of complaints reported by the National Association of Insurance Commissioners (NAIC) and customer satisfaction ratings reported by J.D. Power. We also consider the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

- Availability (10% of total score): Auto insurance companies with greater state availability and few eligibility requirements score highest in this category.

Our credentials:

- 800+ hours researched

- 130+ companies reviewed

- 8,500+ consumers surveyed

Studies and Ratings We Cite

-

Our provider reviews cite several key industry studies and ratings, including:

- J.D. Power 2024 U.S. Insurance Shopping Study The annual J.D. Power U.S. Insurance Shopping Study measures customer satisfaction and purchase experience with auto insurance providers based on five categories: brand, price, distribution channel, quote process and policy offerings. The study average score is 676/1,000.

- J.D. Power 2024 U.S. Auto Claims Satisfaction Study The annual J.D. Power U.S. Auto Claims Study rates the claims experience customers have with different providers based on eight categories: trust, fairness of settlement, time to settle a claim, people, communication, ease of resolving a claim, ease of starting a claim and digital channels. Car insurance providers are assessed at the national level. The study average score is 697/1,000.

- NAIC Complaint Index The National Association of Insurance Commissioners Complaint Index is a representation of the number of complaints auto insurance providers receive relative to the average number of complaints for the industry based on their size. A score of 1 represents the average number of complaints for the industry.

*Data accurate at time of publication.