Auto insurance is designed to protect you from financial hardship if you’ve been in an accident or have endured losses from covered events. Your auto insurance policy may also pay your medical bills after an accident or other related expenses. We at the MarketWatch Guides team researched selecting the best car insurance companies to help you decide on a provider and understand how car insurance works.

Key Takeaways

- Car insurance protects you from unnecessary expenses resulting from an accident or covered event.

- It’s important to choose the auto insurance coverage that fits your needs and financial situation.

- Several factors affect how much you pay for car insurance, like age, location, driving record and more.

What Is Car Insurance?

Auto insurance is a contract between you and your insurance company that covers your losses after a qualifying accident or event, up to a certain limit. These losses can include repairs to the vehicle, medical bills, rental cars and trip interruption coverage. Understanding how various types of vehicle insurance work, including how much motorcycle insurance costs can help you make informed decisions about your coverage needs. Some insurance coverage options also provide coverage for vandalism, theft, fires and environmental events.

You pay a premium to the insurance company and are protected against everything in the contract, which varies based on the policy type. The premium can vary based on a number of factors about yourself and your vehicle, but you can find the cheapest car insurance for your situation by selecting the right company. The insurance provider pays out on these qualified claims up to the agreed-upon policy limit, minus any deductible you owe.

What Does Car Insurance Cover?

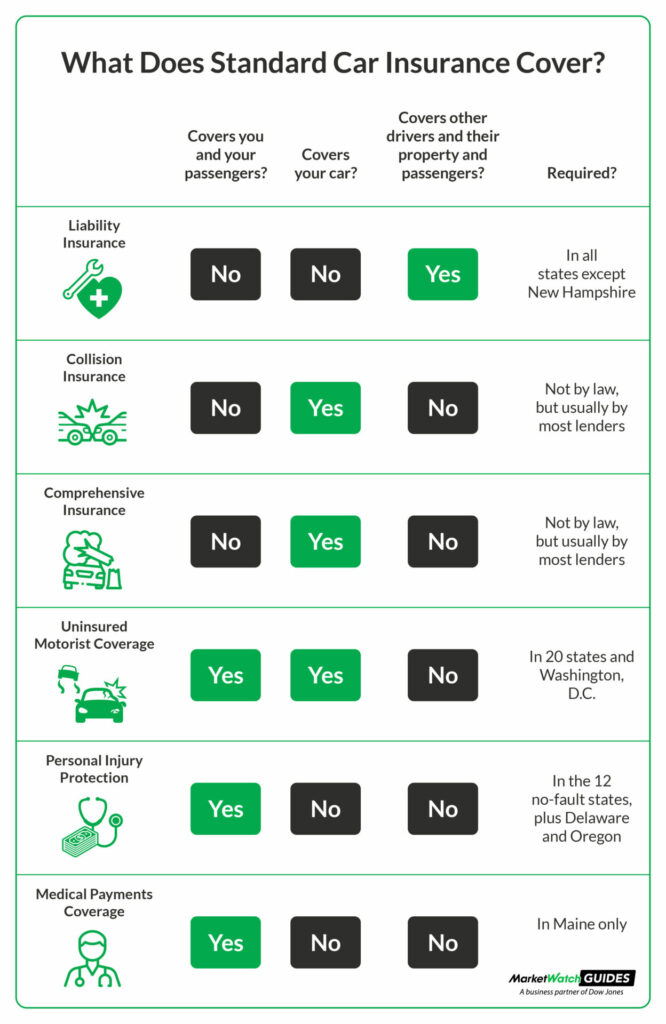

Most car insurance providers offer similar types of coverage. Here are the six standard policy types that all insurers offer:

Liability Insurance

Liability coverage consists of bodily injury (BI) and property damage (PD) liability car insurance. It pays for damages to someone else’s vehicle and their injuries if you cause an accident. It doesn’t cover your vehicle or medical expenses for you or your passengers.

This type of coverage is included in a minimum-liability policy, which is required in almost every state. Minimum liability, combined with collision and comprehensive policies, is called full-coverage car insurance.

Collision Insurance

Collision coverage pays to repair your vehicle damage after an accident, regardless of who caused it. While collision insurance isn’t required by any state, your lender will likely require it if you’re financing your car.

Comprehensive Insurance

Comprehensive coverage pays for repairs to your vehicle after a covered event that’s not related to a car accident. For example, if your car is vandalized or if a tree falls on it, this coverage pays the bills. While it’s not required by law, finance lenders typically make it mandatory while you owe money.

Underinsured/Uninsured Motorist Coverage

If you’ve been in an accident with someone who either doesn’t have insurance or doesn’t have enough insurance, you can still get your expenses paid for with underinsured/uninsured motorist coverage. This car insurance coverage pays for expenses for your vehicle and your passengers.

Personal Injury Protection (PIP)

PIP coverage applies to your and your passengers’ medical bills after a covered accident. It also takes care of funeral costs, lost wages and other miscellaneous expenses after an accident.

Medical Payments Coverage (MedPay)

MedPay is very similar to PIP. The only difference is that, with this coverage, the car insurance company is only going to pay out for medical expenses and funeral costs for you and your passengers — not lost wages.

What Car Insurance Doesn’t Cover

Keep in mind that insurance won’t cover everything. For example, most car insurance companies don’t cover the following:

- Wear and tear to the vehicle

- Mechanical failure

- Routine maintenance

- Drivers not listed on the policy

If you need additional coverage, talk to your insurance agent about the available add-on policies. You may also consider an extended car warranty to cover breakdowns.

How Does Car Insurance Work?

When you get a car insurance policy, you select the types of coverages that you’d like and agree to a certain amount of coverage with the insurer by determining limits for each. Your premium is the amount you pay for this coverage. Most companies give you the option to pay your entire premium up front (which often gets you a discount) or in monthly installments.

After a covered incident, you file an insurance claim with your provider. The adjuster takes a look at the claim to determine how much your policy will cover. The expenses are then paid for up to the coverage limits you’ve agreed on. However, there’s normally a deductible involved, which is an out-of-pocket amount you pay before coverage kicks in.

Determining Liability After an Accident

Liability, or fault, is often determined based on a few factors. Some of these factors include negligence, recklessness and intentional misconduct. You may be ruled at fault for an accident, based on the actions of you and the other driver leading up to the collision. If you’re at fault, your insurance pays for the damages you caused to the other driver.

Keep in mind that not every state requires someone to be assigned fault. In a no-fault state, your insurance company picks up the bill for your medical expenses.

Filing a Car Insurance Claim

After an auto accident in which your vehicle has been damaged or you’ve been injured, you’ll need to file an insurance claim. These are the key steps to filing a claim:

- Call the insurance company: It’s important to make contact as soon as possible after the accident, no matter who’s at fault. Some insurance providers allow you to use a mobile app, making the process easier.

- Gather your documents: Your provider requires certain documents from you to record the accident. If possible, getting a copy of the police report can help move the process along. Pictures or videos of the scene can also be included.

- Sort out the details: If your auto policy covers a rental car, you can work those details out right away on the call.

It often takes some time to get the claim approved and paid for, so be patient. The more detailed your records are, the faster you can expect the process to go.

If your vehicle isn’t worth the amount of the repairs, the insurance company has the right to consider it totaled and pay you for the car instead. In that case, you’ll receive a check for the actual cash value of the vehicle minus what you would’ve spent for the deductible.

What Is a Deductible?

The deductible is the amount you pay before the insurance company pays for covered repairs. For example, if you have a $1,000 deductible and the car repair costs $2,500, you’ll pay $1,000 and your insurance company will pay the remaining $1,500.

The higher your deductible is, the less you pay in premiums, but the more you’ll pay out of pocket in the event of an accident.

How Much Car Insurance Do I Need?

How much car insurance you need depends on a few factors, like what state you live in and whether your vehicle is financed.

Liability coverage is the most affordable coverage and should be added to every policy. In many states, the minimum required insurance includes property damage (PD) and bodily injury (BI) liability protection. Depending on the state you live in, you may need to abide by other insurance requirements, like PIP or uninsured/underinsured motorist coverage. See a list of state requirements below:

Many drivers also research State Farm insurance options and other major carriers to compare coverage requirements and costs.

| State | Proof of Auto Insurance |

| Alabama | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability per accident |

| Alaska | $50,000 BI liability per person $100,000 BI liability per accident $25,000 PD liability |

| Arizona | $25,000 BI liability per person $50,000 BI liability per accident $15,000 PD liability |

| Arkansas | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability |

| California | $15,000 BI liability per person $30,000 BI liability per accident $5,000 PD liability $15,000 Uninsured/underinsured motorist (UM/UIM) bodily injury (BI) liability per person $30,000 UM/UIM BI liability per accident |

| Colorado | $25,000 BI liability per person $50,000 BI liability per accident $15,000 PD liability |

| Connecticut | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per person $50,000 UM/UIM BI liability per accident |

| Delaware | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability $15,000 PIP |

| Florida | $10,000 PIP $10,000 PD liability $10,000 UM/UIM BI liability per person $20,000 UM/UIM BI liability per person |

| Georgia | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UMBI liability per person $50,000 UMBI liability per accident $25,000 UMPD liability |

| Hawaii | $20,000 BI liability per person $40,000 BI liability per accident $10,000 PD liability $10,000 PIP |

| Idaho | $25,000 BI liability per person $50,000 BI liability per accident $15,000 PD liability |

| Illinois | $25,000 BI liability per person $50,000 BI liability per accident $20,000 PD liability $25,000 UM/UIM BI liability per person $50,000 UM/UIM BI liability per accident |

| Indiana | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability |

| Iowa | $20,000 BI liability per person $40,000 BI liability per accident $15,000 PD liability |

| Kansas | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| Kentucky | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $10,000 PIP |

| Louisiana | $15,000 BI liability per person $30,000 BI liability per accident $25,000 PD liability |

| Maine | $50,000 BI liability per person $100,000 BI liability per accident $25,000 PD liability $50,000 UM/UIM BI liability per incident $100,000 UM/UIM BI liability per accident $2,000 medical payments coverage per person |

| Maryland | $30,000 BI liability per person $60,000 BI liability per accident $15,000 PD liability $30,000 UM/UIM BI liability per incident $60,000 UM/UIM BI liability per accident $15,000 UM/UIM PD liability $2,500 PIP |

| Massachusetts | $20,000 BI liability per person $40,000 BI liability per accident $5,000 PD liability $20,000 UM/UIM BI liability per incident $40,000 UM/UIM BI liability per accident $8,000 PIP |

| Michigan | $50,000 BI liability per person $100,000 BI liability per accident $10,000 PD liability $1,000,000 PIP $1,000,000 property protection insurance (PPI) |

| Minnesota | $30,000 BI liability per person $60,000 BI liability per accident $10,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident $40,000 PIP |

| Mississippi | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability liability |

| Missouri | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM BI liability per incident $50,000 UM BI liability per accident |

| Montana | $25,000 BI liability per person $50,000 BI liability per accident $20,000 PD liability |

| Nebraska | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| Nevada | $25,000 BI liability per person $50,000 BI liability per accident $20,000 PD liability |

| New Hampshire | Although New Hampshire does not technically require car insurance, the catch is that drivers must show proof of financial responsibility to qualify for this privilege. Drivers that can’t show they can afford the repair costs of an at-fault accident must buy car insurance. For those that must buy car insurance, they’re required to carry the following minimum limits: $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident $1,000 medical payments coverage per person |

| New Jersey | In New Jersey, there are two policies you can choose from: Standard and Basic. Standard policy requirements: $15,000 BI liability per person $30,000 BI liability per accident $5,000 PD liability $15,000 UM/UIM BI liability per incident $30,000 UM/UIM BI liability per accident $5,000 UM/UIM PD liability $15,000 PIP Basic policy requirements*: $5,000 PD liability $15,000 PIP *You have a limited right to sue under the Basic policy. |

| New Mexico | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability |

| New York | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability $25,000 UM coverage per person $50,000 UM coverage per accident $50,000 PIP |

| North Carolina | $30,000 BI liability per person $60,000 BI liability per accident $25,000 PD liability $30,000 UM/UIM BI liability per incident $60,000 UM/UIM BI liability per accident $25,000 UM/UIM PD liability |

| North Dakota | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| Ohio | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability |

| Oklahoma | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability |

| Oregon | $25,000 BI liability per person $50,000 BI liability per accident $20,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident $15,000 PIP |

| Pennsylvania | $15,000 BI liability per person $30,000 BI liability per accident $5,000 PD liability $5,000 first-party benefits (FPB) coverage |

| Rhode Island | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| South Carolina | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UMBI liability per incident $50,000 UMBI liability per accident $25,000 UMPD liability |

| South Dakota | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| Tennessee | $25,000 BI liability per person $50,000 BI liability per accident $15,000 PD liability |

| Texas | $30,000 BI liability per person $60,000 BI liability per accident $25,000 PD liability $30,000 UM/UIM BI liability per incident $60,000 UM/UIM BI liability per accident $25,000 UMPD liability $2,500 PIP |

| Utah | $25,000 BI liability per person $65,000 BI liability per accident $15,000 PD liability |

| Vermont | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability $50,000 UM/UIM BI liability per incident $100,000 UM/UIM BI liability per accident $10,000 UMPD liability |

| Virginia | Virginia will require its drivers to carry car insurance on and after July 1, 2024. More information on this new state policy change can be found in our Virginia state car insurance article. Effective July 1, 2024, resident drivers of Virginia must carry the minimum amounts of car insurance: $30,000 BI liability per person $60,000 BI liability per accident $20,000 PD liability $30,000 UM/UIM BI liability per incident $60,000 UM/UIM BI liability per accident |

| Washington | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability |

| Washington, D.C. | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident $10,000 UMPD liability |

| West Virginia | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability $25,000 UM BI liability per incident $50,000 UM BI liability per accident $25,000 UM PD liability |

| Wisconsin | $25,000 BI liability per person $50,000 BI liability per accident $10,000 PD liability $25,000 UM/UIM BI liability per incident $50,000 UM/UIM BI liability per accident |

| Wyoming | $25,000 BI liability per person $50,000 BI liability per accident $25,000 PD liability |

Additionally, if you lease or finance a vehicle, the lender can require you to carry more coverage. Many financial institutions mandate collision and comprehensive coverage, as well as gap insurance, which pays what’s left on the loan if your vehicle is totaled or stolen.

Aside from what you’re required to carry, it’s wise to look into the other options. If you can’t afford to pay a large amount of money for car repairs, finding a different insurance policy may be wise. Some providers also offer helpful add-ons, like rental car reimbursement, roadside assistance and towing.

How Much Does Car Insurance Cost?

The average cost of car insurance is $2,008 per year for full coverage and $627 per year for minimum coverage for a 35-year-old driver with a clean driving record and good credit. We chose this driver profile because it’s representative of a large number of drivers and excludes factors that may raise rates.

How much you pay could vary depending on many factors. But when you get car insurance quotes it’s good to compare costs to the averages from major providers to see if you’re getting a good deal. Typical car insurance costs vary significantly based on your individual circumstances and location.

Factors That Affect Car Insurance Costs

A person in New York may not pay the same amount for their Honda Civic as a person in California pays for their Tesla, even if they have the same amount of coverage. That’s because many factors go into determining how much someone pays for insurance.

Here are a few of the most significant factors that affect your insurance premium:

- Location: Car insurance rates vary by state. For example, Maine and Ohio have the lowest full-coverage premiums on average, while drivers in Michigan and Connecticut tend to pay the most. Drivers in urban areas also typically pay more than those in rural areas due to the increased likelihood of traffic accidents and theft.

- Age: Younger and elderly drivers are considered at higher risk for accidents than middle-aged drivers, so they usually pay more for insurance. Insurance for new drivers is typically among the most expensive due to their lack of driving history.

- Driving record: If you’ve had accidents, traffic violations or claims, you can expect to pay more.

- Credit history: In some states, your credit history is used to determine if you are a liability. If you live in Massachusetts, Hawaii, Michigan or California, your credit score can’t be used to calculate your rates.

- Gender: Men are more likely to be involved in an accident than women, so men’s car insurance premiums are generally higher in some states.

- Marital status: In many states, companies tend to charge married couples less because they are seen as lower risk.

- Vehicle: The insurance company must factor in the vehicle you drive. The actual cash value may need to be covered, so your premium reflects that price. So if you drive an expensive car, it may cost more to insure.

Many of these factors you can’t change. You can ensure that your driving history is clean and make sure you pay your bills so your credit history is favorable. Comparing providers like GEICO’s insurance offerings can help you find competitive rates despite these factors. It’s also possible to choose a vehicle that’s cheaper to insure if you aren’t picky about what you drive. It’s also possible to choose a vehicle that’s cheaper to insure if you aren’t picky about what you drive.

How Does Car Insurance Work?: FAQ

Below are frequently asked questions about how car insurance works:

The three main types of car insurance include liability, collision and comprehensive. Liability pays for the other person’s losses in an accident you’ve caused, while collision covers your vehicle and occupants. Comprehensive coverage is used for non-collision-related events, such as theft, fire and vandalism.

Collision coverage pays for the repairs and expenses done to your car during an accident. Comprehensive also pays to fix your vehicle, but for non-accident related events. For example, comprehensive insurance would cover you if your vehicle was stolen, damaged in a fire or vandalized.

Yes, car insurance is worth it. Some accidents aren’t preventable. If you cause damage to someone else’s car or create medical bills, you could end up spending a lot of money to make it right without car insurance. Plus, many states have insurance coverage requirements, leaving you vulnerable to fees and serious penalties if you’re caught driving without it.

If you have collision coverage, car insurance works by your provider paying for qualified repairs up to the amount you’ve agreed upon. If the car isn’t worth the amount of the repairs, the provider will pay you the actual cash value of the car instead. All of these expenses are paid after you cover the deductible.

Our Methodology:

Because consumers rely on us to provide objective and accurate information, we created a comprehensive rating system to formulate our rankings of the best car insurance companies. We collected data on dozens of auto insurance providers to grade the companies on a wide range of ranking factors. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Here are the factors our ratings take into account:

- Coverage (30% of total score): Companies that offer a variety of choices for insurance coverage are more likely to meet consumer needs.

- Cost and Discounts (25% of total score): Auto insurance rate estimates generated by Quadrant Information Services and discount opportunities are both taken into consideration.

- Industry Standing (20% of total score): Our research team considers market share, ratings from industry experts and years in business when giving this score.

- Customer Experience (15% of total score): This score is based on volume of complaints reported by the National Association of Insurance Commissioners (NAIC) and customer satisfaction ratings reported by J.D. Power. We also consider the responsiveness, friendliness and helpfulness of each insurance company’s customer service team based on our own shopper analysis.

- Availability (10% of total score): Auto insurance companies with greater state availability and few eligibility requirements score highest in this category.

Our credentials:

- 800+ hours researched

- 130+ companies reviewed

- 8,500+ consumers surveyed

Studies and Ratings We Cite

-

Our provider reviews cite several key industry studies and ratings, including:

- J.D. Power 2024 U.S. Insurance Shopping Study The annual J.D. Power U.S. Insurance Shopping Study measures customer satisfaction and purchase experience with auto insurance providers based on five categories: brand, price, distribution channel, quote process and policy offerings. The study average score is 676/1,000.

- J.D. Power 2024 U.S. Auto Claims Satisfaction Study The annual J.D. Power U.S. Auto Claims Study rates the claims experience customers have with different providers based on eight categories: trust, fairness of settlement, time to settle a claim, people, communication, ease of resolving a claim, ease of starting a claim and digital channels. Car insurance providers are assessed at the national level. The study average score is 697/1,000.

- NAIC Complaint Index The National Association of Insurance Commissioners Complaint Index is a representation of the number of complaints auto insurance providers receive relative to the average number of complaints for the industry based on their size. A score of 1 represents the average number of complaints for the industry.

*Data accurate at time of publication.