The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Founded in 2013, Robinhood shook up the financial industry by making stock trading as simple as swiping on your phone. More than a decade later, it’s still wooing individual investors with crypto, fractional shares and new managed portfolios. But not everyone’s buying in. In this review, the MarketWatch Guides team explains what you need to know before jumping on board.

Our Thoughts on Robinhood Investing

Robinhood turned the financial industry on its head when it debuted over 10 years ago, and its app now allows you to trade stocks, options and crypto commission-free. You can also invest in fractional shares, which are pieces of company stocks or ETFs. While commission-free trades are now the norm with most brokerages, Robinhood continues to improve its services. It recently upgraded its trading platform for improved usability and added a new robo-advising service, Robinhood Strategies.

Overall, Robinhood scored 4.5 out of 5 stars in our review. If you’re looking for an easy-to-use platform to trade stocks and crypto, we think Robinhood is an excellent choice.

Robinhood Pros and Cons

Robinhood offers an easy-to-use, intuitive app interface with the ability to seamlessly trade stocks, ETFs and cryptocurrency, as well as trade on margin with low fees. It’s hindered by its limited investment types and basic analytical tools.

Commission-free trades: Robinhood offers commission-free stock, options, ETFs and cryptocurrency trades.

Fractional shares: You can invest as little as $1 in portions of much more expensive securities.

Crypto access: Robinhood offers access to cryptocurrency trading with very low fees.

Individual retirement account match: Robinhood offers an IRA match of up to 1% of any contributions for regular customers and up to 3% for Gold customers.

Limited investment types: Robinhood doesn’t offer mutual funds, individual bonds or foreign exchange currency trading.

Basic research and tools: Robinhood recently improved its analysis and charting tools, but they’re still limited in scope to competitors’ tools, and the company is just beginning to expand its investor educational tools.

Robinhood’s Background and Reputation

Robinhood was founded in 2013 with the mission to “democratize finance.” The idea was to offer commission-free trading to individual investors, just like traders on Wall Street enjoyed. It was one of the first major financial technology companies to offer fractional shares and cryptocurrency trading. Plus, Robinhood’s app used a gamified approach and a simple interface that made investing feel more accessible to younger people and new investors.

While Robinhood has grown quickly, it has faced controversy. When a group of investors sparked retail trading that ran up the price of GameStop shares and AMC Entertainment shares in 2021, Robinhood restricted its users’ abilities to trade those stocks for a time. The move was heavily criticized.

Our review team reached out to Robinhood for a comment on this incident and received the following response from Robinhood:

“As we’ve said in the past, the events of the week of January 25, 2021 were unprecedented. We took swift action and temporarily limited buying for certain securities including GameStop and AMC to ensure that customers could continue trading in the thousands of other stocks available on our platform. Other broker-dealers took similar action.”

Despite this setback, Robinhood continues to improve its offerings. It’s one of a few brokerages with stock and ETF trading 24 hours a day, five days a week. For its so-called Gold members, Robinhood plans to introduce private-banking services and an artificial-intelligence investment tool this year.

How We Rated Robinhood

Robinhood scored the highest for its customer support and tools, including its user-friendly app and investing tools such as fractional shares and cryptocurrency trading. It scored the lowest for its trustworthiness, given its multiple fines and lack of transparency around its pricing.*

*Our review team reached out to Robinhood for a comment on our trustworthiness and pricing scores and received the following response from Robinhood:

“We disagree with the characterization that there is a lack of transparency around our pricing. More than 25 million people (as of May 31, 2025) trust us everyday. For every product Robinhood offers that includes fees, we clearly disclose the potential costs customers may incur from a transaction. Additionally, we maintain very detailed resources on our website (examples here, here and here) outlining our execution quality and fees where applicable, so customers can make informed decisions every step of the way.”

Robinhood Investment Options

You can invest in stocks, ETFs, options and cryptocurrency commission-free with Robinhood. The brokerage also offers fractional shares, futures and margin trading. In 2023, the company began offering basic retirement accounts, such as traditional and Roth IRAs, including rollover accounts. Its IRAs offer a 1% to 3% match of your IRA contribution for the year.

Robinhood doesn’t offer the same number of investing options as many competitors. It doesn’t have mutual funds, including low-cost index mutual funds, or fixed-income trading options such as bonds. It also doesn’t offer foreign exchange currency trading, preferred stocks or stocks that trade on foreign exchanges. However, you can still gain exposure to broader market indexes through ETFs like the S&P 500 ETF, which tracks the same index as many mutual funds.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Robinhood Features and Tools for Investors

Robinhood provides a wide range of tools for beginners and experienced users, and it frequently adds new features.

Fractional Shares

Fractional shares are stocks that are divided up and sold at a lower price than a full share to make it easier for individual investors to buy pricier stocks. This allows you to better diversify your portfolio with smaller amounts of money. You can buy fractional shares of most stocks and ETFs for as little as $1.

Robinhood Gold

Robinhood Gold is a subscription service, costing $5 per month or $50 annually, that offers subscribers premium features, such as:

- A higher annual percentage yield on any uninvested cash balances (through a cash sweep)

- Market data and research from Nasdaq and Morningstar

- No interest on your first $1,000 of margin trading

You’ll need the subscription to be eligible for the Robinhood Gold Credit Card, which offers 3% cash back on all purchases and up to 5% cash back on select purchases through the Robinhood travel portal. Also, if you have an IRA with Robinhood, you’ll receive up to a 3% match with your Gold subscription. You’ll be fully vested after you’ve kept the account open for five years.

Crypto Trading

Robinhood offers round-the-clock, in-app cryptocurrency trading for most coins with what is known as cold storage, which is offline storage for enhanced security. The app also offers so-called hot storage, or online storage which has more convenient access to user assets for day-to-day transactions. It also offers crime-protection insurance as an added security measure. You can trade 28 popular cryptocurrencies, including bitcoin, ethereum, dogecoin and Trump, with trades as small as $1.

Robinhood offers custodial service, meaning you don’t directly own the keys to your investments.

Cash Card and High-Yield Cash Management

Robinhood provides several ways to manage your everyday money. The company currently offers a debit card, the Robinhood Cash Card, when you open a Robinhood spending account. If you opt in to Robinhood’s cash-sweep program, any uninvested cash in your brokerage account will be swept into partner banks and will earn interest. Gold members receive a 4% APY, which is paid out monthly. Regular members earn a lower interest rate.

Robinhood Fees and Pricing

Most Robinhood trades are commission free, but there are other fees. These may include regulatory fees, spread fees on crypto, margin interest fees and subscription fees to access Robinhood’s premium features.

Payment for Order Flow

The company makes the majority of its money from payment for order flow. With this practice, wholesale trading firms pay retail broker-dealers such as Robinhood for a chance to fulfill orders from its clients. While the practice is legal, it has come under scrutiny from lawmakers due to potential conflicts of interest. For instance, a brokerage may be incentivized to use only certain firms to fulfill orders. PFOF has been banned in the United Kingdom, Australia and Canada.

Our review team reached out to Robinhood for a comment on its PFOF practices and received the following response from Robinhood:

“Robinhood pioneered commission-free, no account minimum investing, and the brokerage industry has followed our lead. Our model was made possible by an established and regulated market practice known as payment for order flow (PFOF), which has helped bring tens of millions of new investors into the stock market, many for the first time, driving the cost of investing and trading down to historically low levels.”

While you won’t pay a fee with PFOF, you may not receive the fastest trade execution or the best price for your trade compared to brokers that don’t engage in PFOF. But if you don’t make a high number of trades, you shouldn’t notice much of a difference since the time delay might only be seconds and the pricing difference is a fraction of a cent.

Robo-Advising

There’s a $50 minimum investment for a Robinhood Strategies account, which is a robo-advised account. Robo-advised accounts are managed accounts that use algorithms to set up and rebalance your portfolio based on your investing goals and risk tolerance. Its management fee is 0.25% of the assets under management per year, per account.

Margin Trading

Robinhood’s margin trading rates are very competitive. Like most brokerages, Robinhood charges margin interest on a tiered system based on how much you borrow. You’ll pay 5.75% for balances of $50,000 or less, and rates decrease for higher balance tiers.

Other Costs and Fine Print

In the MarketWatch Guides team’s investing survey, hidden costs were customers’ No. 1 frustration with their brokerage. Many of Robinhood’s fees are in line with other brokerages’ fees, though many of them are hidden:

- Securities and Exchange Commission fees: Robinhood pays SEC fees to cover its regulation costs, which it passes on to its customers.

- Trading-activity fee: Robinhood also passes its FINRA trading-activity fees on to customers. These fees are fractions of a cent per share and are capped at $8.30 per trade, which would be equivalent to a trade of roughly 50,000 stock shares.

- Per-option contract fee: When you trade options, Robinhood charges a flat 4 cents per option contract.

- Spread: There’s a difference between the price you buy crypto for and the price it’s sold for, which is known as a spread. Robinhood states that for every $100 traded in the default setting, it receives 70 cents.

Robinhood Trading Platform and Apps

Robinhood’s web platform and app make it easy to make trades and manage different types of investments, but we found the web platform much easier to navigate.

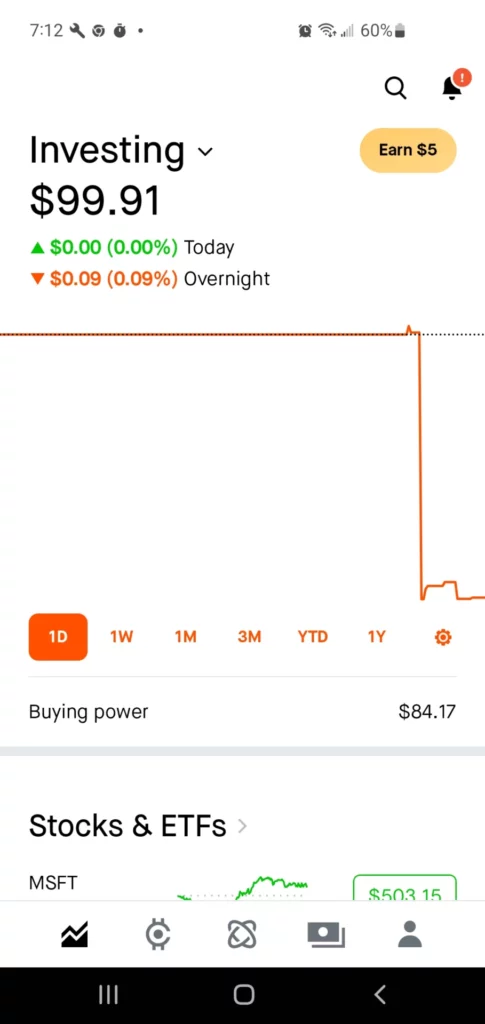

Mobile App Interface

Robinhood’s mobile app is simple and easy to use once you figure out what the icons mean. It allows users to make instant deposits, and it supports multiple types of trades, which are quick and easy to place on the app. However, it doesn’t have analytical tools such as charting or robust market data. We also found that it occasionally lags when you switch between apps on your phone.

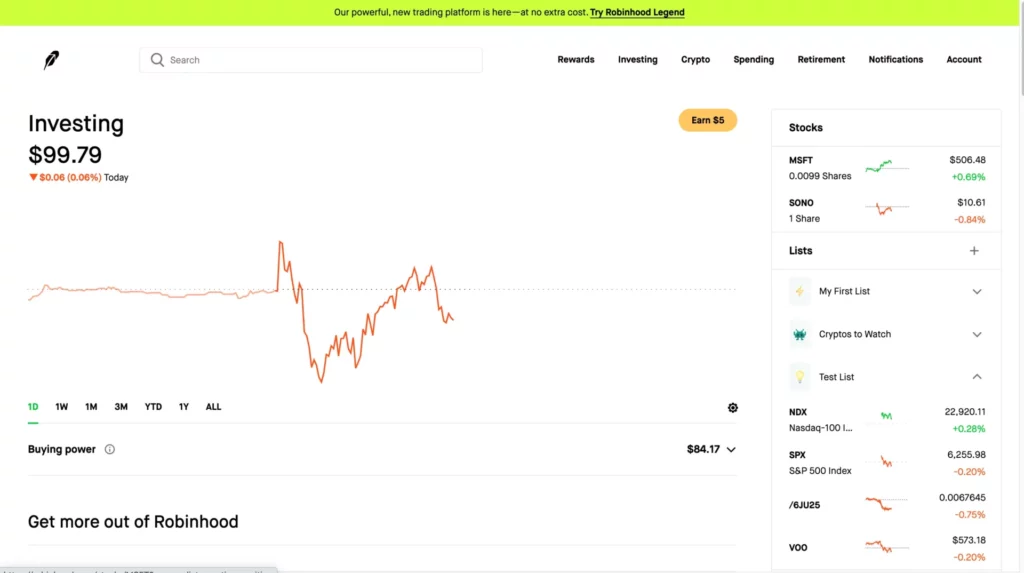

Web Platform Overview

Robinhood upgraded its desktop interface, Robinhood Legend, in October 2024. The new interface offers features such as customizable layouts, advanced trading tools, technical indicators and real-time data, as well as index options trading features. It offers easy-to-access news and research, but we found the process for accessing screeners a little odd — you’ll need to click on the search bar but not type anything, which will activate a dropdown menu with pre-built screeners such as Top Movers. Unfortunately, this is not an intuitive process, and we only figured it out through trial and error.

While the platform is a marked upgrade from its previous desktop web, it still lacks some of the robust analytical tools that some other brokerages, such as Interactive Brokers, offer, such as backtesting, drawing tools and advanced stock screeners with filters.

Our Experience Opening an Account With Robinhood

Robinhood is known for its user-friendly app, and we found the brokerage had straightforward instructions for account setup. However, clicking through more than 20 individual screens to create an account in the app was cumbersome, and we wished some steps were combined. We weren’t required to verify our ID until we entered our debit card information, and then we had to input a government ID and three selfies.

Once the account was open, we tried to trade options, but after answering more than a dozen questions, we were told we weren’t eligible. We weren’t able to get a specific reason even after chatting with a customer support agent. But we found it fairly easy to make market trades, and we liked the app’s simple, mostly black-and-white visual interface.

Our review team reached out to Robinhood for a comment on our researcher’s experience and received the following response from Robinhood:

“At Robinhood, all customers must first be approved before they can trade options, and access levels are determined by their experience, risk tolerance level, and financial background. Each brokerage firm has the discretion to set the specific parameters for their customers to determine eligibility on trading specific products. With a Level 2 options designation, you can execute options trades like: Long calls, Covered calls, and Long puts. With a Level 3 designation, you can execute all of the above trades, along with limited risk spreads like: Credit spreads, Debit spreads, Iron condors, and Iron butterflies.”

“We offer a variety of ways for our customers to increase their options knowledge including the Options Trading Essentials hub on Robinhood Learn [—] a dedicated platform providing comprehensive education on the ins and outs of options trading, risk management, and more. To further support our customers, we’ve also expanded our Help Center with in-depth resources on options and margin trading, and we offer a series of YouTube videos covering a variety of options trading topics, which are accessible to everyone.”

Is Robinhood Safe and Legit?

Robinhood is a legitimate, registered broker-dealer that’s regulated by the SEC and FINRA. It also provides insurance through the Securities Investor Protection Corp., which protects your funds if Robinhood fails or becomes insolvent. Your investment funds are protected for up to $500,000 for investments and $250,000 for non-invested cash.

Security Measures

Robinhood uses two-factor authentication and encrypts all sensitive data, such as Social Security numbers, before storing them. However, there have been safety concerns, as the company has been fined by the SEC for failure to adequately protect its customers’ information and sensitive data.

Regulatory Oversight

Like many other popular brokerages, Robinhood has been fined multiple times by both the SEC and FINRA:

- In 2020, the company agreed to pay $65 million to the SEC for misleading customers about how it made money and for executing orders at prices that were unfavorable to its customers.

- In 2021, FINRA levied a $70 million fine against Robinhood for misleading communication around margin trading and trading practices.

- In January 2025, Robinhood agreed to pay $45 million to the SEC to settle charges related to inadequate identity-theft protection, failure to provide accurate trading information to the SEC and failure to address known cybersecurity risks.

- In March 2025, FINRA fined the company $26 million for misleading communication around the way it executed certain market orders and for failure to implement anti-money-laundering programs.

Our review team reached out to Robinhood for a comment on its FINRA and SEC fines and received the following responses from Robinhood:

2020 SEC Fine

“The settlement relates to historical practices that do not reflect Robinhood’s practices today. We are fully transparent in our communications with customers about our current revenue streams, have significantly improved our best execution processes, and have established relationships with additional market makers to improve execution quality. We recognize the responsibility that comes with having helped millions of investors make their first investments, and we’re committed to continuing to evolve Robinhood as we grow to meet our customers’ needs. The settlement fully resolves the SEC’s inquiry, and we do not expect it to affect our operations or our ability to continue investing in our product or in serving others.” — Robinhood spokesperson

2021 FINRA Fine

“Robinhood has invested heavily in improving platform stability, enhancing our educational resources, and building out our customer support and legal and compliance teams. We are glad to put this matter behind us and look forward to continuing to focus on our customers and democratizing finance for all.” — Robinhood spokesperson

2025 SEC Fine

“We are pleased to resolve these matters. As the SEC’s order acknowledges, most of these are historical matters that our broker-dealers have previously addressed. We are well-positioned to continue leading the industry in developing the innovative products and services our customers want and need to participate in U.S. and global financial markets. We look forward to working with the SEC under a new administration.” — Lucas Moskowitz, general counsel, Robinhood Markets

2025 FINRA Fine

“We are pleased to resolve these historical matters, many of which date as far back as 2014, and which Robinhood Securities and Robinhood Financial have since remediated. Robinhood will continue to democratize finance for the next generation of investors.” — Erica Crosland, associate general counsel and head of regulatory enforcement and investigations, Robinhood Markets

Who Is Robinhood Best For?

Take a look at who we recommend Robinhood for — and who we don’t.

Great Fit For:

- First-time investors: Robinhood’s simple interface makes it a solid fit for beginning investors, and it’s easy to make stock and ETF trades without paying commissions.

- People interested in stocks and crypto: Robinhood allows you to buy and trade both stocks and cryptocurrencies.

- Mobile-only traders: Robinhood’s app can be a better choice than some competitors’ apps, which may limit which assets you can trade.

Not Ideal For:

- People who want passive mutual funds: Robinhood doesn’t offer mutual funds or bonds.

- Retirement-focused investors: While you can roll a company 401(k) into a Robinhood IRA, the company’s lack of bond and mutual fund options makes it less than ideal if you’re mainly investing for retirement.

- High-frequency traders needing fast execution: Robinhood lacks advanced analytical tools, so high-frequency traders won’t have the robust tools and charting they need.

Comparison: Robinhood vs. Other Platforms

Robinhood offers more commission-free trades than competitors such as Fidelity and Vanguard. For example, it doesn’t have contract fees for options, but it has more hidden fees. Unlike Fidelity, Robinhood takes PFOF, meaning your trades may not be executed as quickly or cheaply. If you’re looking for more passive investment options such as mutual and index funds, Robinhood doesn’t offer those.

| Features | Robinhood | Fidelity | Vanguard |

|---|---|---|---|

| Our star rating | 4.5/5 | 4.9/5 | 4.6/5 |

| Minimum investment (self-directed accounts) | $0 | $0 | $0 |

| Online ETF commissions | $0 | $0 | $0 |

| Standard options per contract fees | $0 | $0 to 65 cents | $1 |

| 24/7 customer service | ✓ | ✓ | X |

| Number of no-transaction-fee mutual funds | 0 | More than 2,100 | More than 3,160 |

| Fractional shares | ✓ | ✓ | ✓ |

| Cryptocurrency trading | ✓ | ✓ | X |

| Options trading | ✓ | ✓ | ✓ |

| Futures trading | ✓ | X | X |

Frequently Asked Questions About Robinhood Review

One of the downsides of using Robinhood is its limited investment options. It doesn’t offer mutual funds, foreign-exchange trading or fixed-income products such as bonds.

Yes, you can buy and sell 28 cryptocurrencies on Robinhood. It’s a custodial service, meaning you don’t directly hold the keys to your trades — Robinhood holds them on your behalf. If you want complete ownership of your coins, you may consider opening a Robinhood Wallet or using another brokerage.

Yes, you can use Robinhood for retirement investing since it offers IRAs. If you’re a Gold subscription member, the company offers up to a 3% match for IRA contributions. However, it doesn’t have workplace retirement plans such as 401(k)s, so its retirement offerings are more limited than many other brokers’ options.

Methodology

Our team researched 35 of the top brokerages in the United States, analyzing disclosures, websites and regulatory documents to collect over 3,000 data points. To determine the best brokerages, we ranked institutions in five categories: trustworthiness, investment offerings, customer support and tools, pricing and platform experience.

We looked at brokerages’ risk factors, investment and fee disclosures, state registration information and websites to understand their investment terms and options. We considered each company’s trading platform and educational tools to help investors understand usability and features. We also looked at each company’s U.S. Securities and Exchange Commission registration status, Better Business Bureau rating, Financial Industry Regulatory Authority membership and data security measures, among many other data points.

To learn more, read our full investing methodology.

This category measures regulatory status, BBB ratings and data security.

We scored firms based on their account types and asset options, including support for self-directed, managed and fractional-share portfolios.

We rated the quality and availability of customer service, educational support and tools, customization options, and personal advisers and robo-advisers.

We evaluated each brokerage’s affordability by analyzing trading fees, fund expenses and minimum investment requirements.

We evaluated a brokerage’s web and mobile platforms for ease of use, considering customer reviews and app store ratings.

Acorns, Ally Invest, Betterment, Charles Schwab, Citi, E-Trade, eToro, Fidelity, Firstrade, Forex.com, Fundrise, Goldman Sachs Wealth Management, Interactive Brokers, JPMorgan Chase, Merrill Edge Guided Investing, Moomoo, Morgan Stanley, Ninjatrader, Principal, Public, Raymond James, Robinhood, SoFi, T. Rowe Price, tastytrade, Titan, TradeStation, TradeZero, Uphold, Vanguard, Wealthfront, Webull, Wells Fargo, Yieldstreet, Zack’s Trade

Our Brokerage Testing Methodology

The MarketWatch Guides team believes that to provide the most accurate, honest and useful insights on brokerages, we need to experience their platforms the same way you would. We test brokerages firsthand to report what it’s like to open and fund an account, place trades and interact on these platforms.

With each brokerage we test, we fund an account to see how intuitive the funding process is and to track how long it takes for transfers to clear. Where available, we place market, options and fractional-share trades to test order execution. We also rate each brokerage’s platform based on factors including how easy it is to navigate and how many advanced tools and research resources it offers.

*Data accurate at time of publication

*This review is for informational purposes only and is not a recommendation to buy or sell any financial product or service. While we strive to keep our content accurate and up to date, we cannot guarantee the accuracy of all information, including interest rates, fees and offers, which may change without notice. Please consult each provider’s website for the most current details.