The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

You can’t have a conversation about top U.S. brokerages without Fidelity coming up — and for good reason. With zero-commission trades, low mutual-fund costs and educational resources on just about every investing subject there is, Fidelity continues to set the gold standard for investors of all levels. Below, the MarketWatch Guides team shares our thoughts on Fidelity, including its pros and cons.

Our Thoughts on Fidelity Investing

Fidelity is our top pick for brokerage accounts, earning 4.9 out of 5 stars in our review. It received high scores in all of our review categories, including perfect scores for its investment offerings, customer support and tools.

Fidelity was also the most popular brokerage in our May 2025 investing survey of 2,000 investors, where we asked respondents about their experiences with brokerages. Twenty-five percent of respondents said they were Fidelity customers. Of those, over 92% said they were “satisfied” or “very satisfied” with the brokerage.

Fidelity Pros and Cons

Fidelity caters to a broad spectrum of investors, from beginners to seasoned professionals, with tons of investment options and excellent planning and research tools. However, it has some drawbacks.

Wide investment selection: Fidelity has thousands of mutual funds, bonds, certificates of deposit and Treasury bills, plus options and commodities, such as gold and international stocks from 25 countries, with 16 currency exchanges.

Excellent research resources: Fidelity has robust research and educational tools, including virtual courses about investing in options, futures and cryptocurrency.

Retirement and long-term planning: The brokerage has individual retirement accounts, workplace retirement accounts and resources to help with long-term retirement planning and projections.

Fractional-share investing: Fidelity allows fractional-share investing in brokerage and cryptocurrency trading, making it easier to start investing and balance your portfolio.

Limited crypto access: You’ll need to set up a separate account to trade cryptocurrency. There are also only three crypto coins offered, which is much less than competitors such as Robinhood, which offers 28 coins.

Platform can be overwhelming: Beginners may have difficulty figuring out how to navigate and trade on Fidelity’s platform since it has so many technical terms, third-party reports and screeners with multiple filters.

No futures or foreign-exchange trading: While Fidelity has a wide variety of investments, it doesn’t offer futures or forex trading, which may be a deal breaker for more advanced investors.

Fidelity’s Background and Reputation

Founded in 1946, Fidelity is a privately held, family-owned company with over 77,000 employees across 11 countries. In the 1990s, it was one of the first brokerages to offer a website, and in 2016, it launched its robo-adviser, Fidelity Go. In 2019, the company introduced zero-commission trading for U.S. stocks, exchange-traded funds and options on the heels of competitors such as Charles Schwab. Today, it’s one of the two largest mutual-fund companies in the U.S.

Fidelity has been fined by the Financial Industry Regulatory Authority twice. In October 2023, it received a $900,000 fine for failing to provide an adequate options approval system, and in January 2025, it was fined $600,000 for lacking oversight of an employee who misappropriated $750,000 from international plan participants. While these fines are notable, they’re relatively minor compared to those imposed on firms such as Robinhood, which FINRA recently fined $26 million for violating several FINRA rules.

Our review team reached out to Fidelity for comment on its FINRA fines but did not receive a response. We also reached out to Robinhood for a comment on its FINRA fines and received the following response:

“We are pleased to resolve these historical matters, many of which date as far back as 2014, and which Robinhood Securities and Robinhood Financial have since remediated. Robinhood will continue to democratize finance for the next generation of investors.”

— Erica Crosland, associate general counsel and head of regulatory enforcement and investigations, Robinhood Markets

How We Rated Fidelity

Fidelity, our top brokerage pick, excels for its investment offerings, customer support and educational tools.

Fidelity Investment Options

Fidelity has a wide range of assets you can invest in, including stocks, ETFs, options, mutual funds, fixed income products including bonds and CDs, precious metals, international investments and retirement accounts, such as IRAs and 401(k)s. It also has self-employed 401(k)s for owners of sole proprietorships. However, the brokerage doesn’t offer forex or futures trading.

Notably, Fidelity has over 3,000 mutual funds without commissions, including its industry-leading Fidelity’s zero-expense-ratio funds. It also has a limited number of crypto options, currently trading bitcoin, ethereum and litecoin.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

The Fidelity customers we surveyed invested in the assets below. Survey respondents could choose more than one option.

| Type of Investment | Percentage of Survey Respondents |

|---|---|

| Stocks | 78% |

| Mutual funds | 62% |

| ETFs | 43% |

| Bonds | 39% |

| Crypto | 22% |

Fidelity Features and Tools for Investors

Fidelity provides many valuable tools and resources needed to build and manage a diversified portfolio:

Fractional Shares

Fidelity offers fractional shares, which are portions of a stock sold at a lower price than a full share. You can purchase a partial share of a stock for as little as $1. You can only start trading fractional shares on the Fidelity app, but you can sell shares you already own on Fidelity’s website.

Fidelity Go (Robo-Adviser)

Fidelity Go, the company’s robo-adviser, doesn’t have advisory fees for accounts under $25,000, but it charges an annual fee of 0.35% of managed assets for accounts with $25,000 or more. With an account over $25,000, you’ll have access to unlimited 30-minute coaching calls with trained advisers.

Fidelity doesn’t have a minimum-balance requirement to open a robo-adviser account. Still, you’ll need at least $10 in your account to invest in your chosen strategy. Fidelity Go is available for taxable accounts, IRAs and health savings accounts.

Research and Education Tools

Fidelity has multiple research and educational tools. It has podcasts, webinars, educational videos and virtual classroom courses in technical analysis and options trading, along with guides and tools to help you understand the brokerage’s offerings. For example, it has a Technical Indicator Guide, an Options Strategy Guide and a Thematic Stock Screener, which can help you find investments by topic, from AI to social responsibility. Active traders can track premarket activity to identify potential opportunities before regular trading hours begin.

Retirement- and Goal-Planning Tools

Fidelity has a retirement-planning tool that accounts for your Fidelity balances, expected Social Security benefits and other income to make projections about how much money you’ll have at retirement. It also has a retirement calculator that estimates how much you should have saved by each age, as well as dozens of articles on how to save for retirement and a goal-tracking system to provide visual progress on your savings goals.

Fidelity Crypto

Fidelity Crypto allows you to trade popular cryptocurrency coins on the Fidelity app after setting up a crypto account. You can buy fractional shares of crypto for as little as $1. You’re limited to three cryptocurrencies: bitcoin, ethereum and litecoin. You can buy coins directly through Fidelity Crypto, through ETF funds or through an IRA. You can trade crypto within your IRA in all eligible states except California and Oregon.

Fidelity Fees and Pricing

In our investing survey, 67% of the 508 Fidelity clients we surveyed felt like Fidelity’s fees were “very” or “extremely” transparent.

Free Features

Fidelity charges $0 in commissions for U.S. stocks, ETFs and options (with a 65-cent fee on options contracts). For fixed-income investments, you’ll pay $1 to trade bonds or CDs on the secondary market and $0 to trade U.S. Treasurys online (but if you use a representative, you’ll pay $19.95 or more per trade). It also has commission-free trading online for Fidelity and hundreds of non-Fidelity mutual funds. Some mutual funds, however, have trading fees ranging from $49.95 to $100.

Fidelity also has many services with $0 fees that other brokerages charge for, including low-balance transactions, bank wires, late settlements and insufficient-funds fees. It doesn’t charge inactivity or account-maintenance fees on most brokerage and retirement accounts, and it offers free transfers between Fidelity accounts. The company also doesn’t accept payment for order flow, a practice where wholesalers pay retail brokerages for fulfilling orders from its customers.

Margin Rates

Like most brokerages, Fidelity uses a tiered system for margin trading. Interest rates start at 12.575% for margin loans of less than $25,000 and are as low as 8.25% for balances of $1 million or higher.

Robo-Adviser and Managed Accounts

Fidelity’s managed accounts have higher fees than its self-directed accounts.

| Portfolio | Costs and Fees | Balance |

|---|---|---|

| Fidelity Go (robo-adviser)* | 0.00% 0.35% of assets under management | Under $25,000 $25,000 or more |

| Fidelity Wealth Management | 0.20% to 1.50% of AUM** | $500,000 or more |

| Fidelity Private Wealth Management | 0.20% to 1.04% of AUM** | $2 million or more (with $10 million or more in investable assets) |

**Doesn’t include underlying fund costs and other fees, such as exchange and regulatory fees

Other Costs and Fine Print

Some costs may not be clearly outlined. The costs below assume you’re buying and trading online. If you make a trade over the phone or with a Fidelity representative, you’ll pay higher fees.

- Options regulatory fee: This is a nominal fee for options trading that’s passed on to the customer.

- Activity assessment fee: All sell orders are charged an activity assessment fee, which has historically ranged from 1 to 3 cents per $1,000 traded.

- Mutual fund load fees: Some mutual funds charge heavy commissions when they’re bought and sold, with fees ranging from 4% to 8%.

- Crypto spread: This is the difference between what Fidelity pays and what the customer pays. It varies by volume and is disclosed in the app.

Fidelity Trading Platform and Apps

Fidelity has a mobile app and web-based platform that are designed to be intuitive and easy to use, but they could be overwhelming for new investors given the number of trading options and tools to choose from.

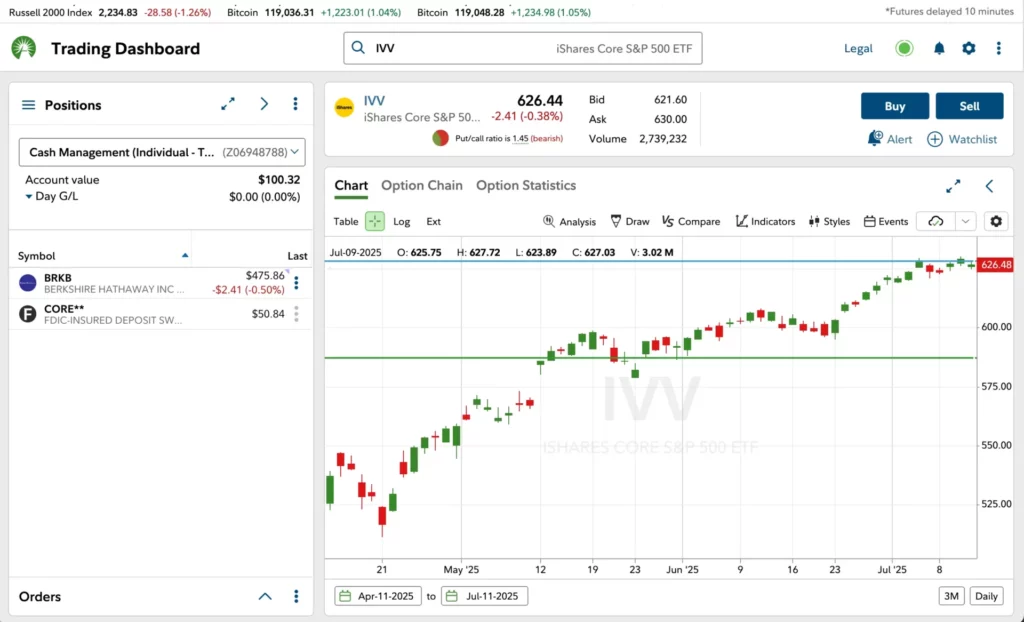

Web Platform

Fidelity has two web-based trading platforms. One is its regular trading dashboard, which features a portfolio tracker and charting tools. The other is Active Trader Pro, a downloadable trading platform. It has real-time trading insights and market data, plus charting tools. It also lets you customize where some trades are executed, create and save orders ahead of time and trade with extended hours. In our testing, we were able to place a market order with just two clicks. Placing fractional-share orders was just as easy.

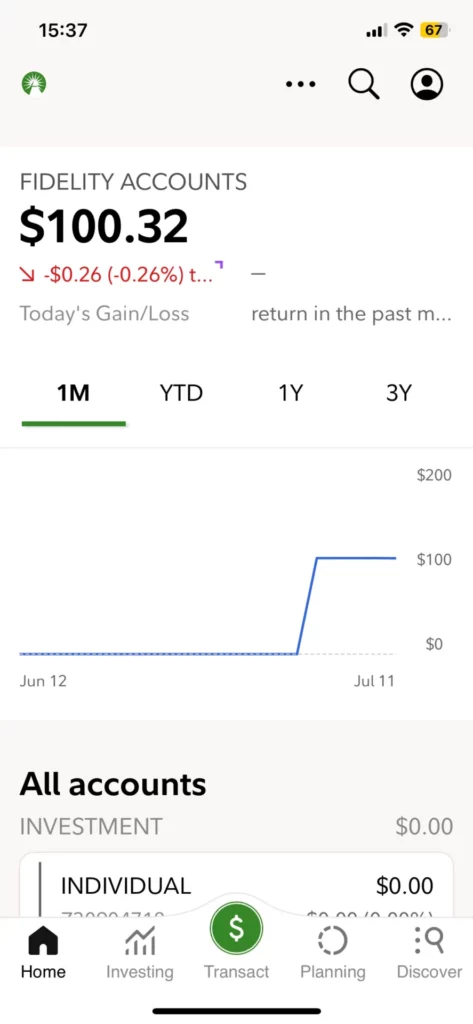

Mobile App

Fidelity’s mobile app has 4.8 out of 5 stars in the Apple App Store, with more than 2.8 million ratings. It has 4.6 out of 5 stars in the Google Play store, with more than 190,000 reviews. It’s user friendly and has a clean and functional design. It allows you to set up automatic deposits, alerts and spending and savings goals. During testing, we found the app to be fairly intuitive to use. Features such as advanced quote screens and the ability to place fractional-share orders worked smoothly. However, options trading wasn’t available to us due to eligibility restrictions. This could be a limitation for active traders.

Our Experience Opening an Account With Fidelity

Opening an account with Fidelity was easy, taking only a few minutes to complete on the brokerage’s website. There were helpful website links for confusing questions. Initially, we didn’t need to verify our ID, but it was requested later. Funding the account was also a snap, with instant connection available through Finicity or the option to mail a check.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Who Is Fidelity Best For?

Fidelity is known for its comprehensive research tools, fee-free index funds and extensive retirement tools. But is it the right fit for you?

Great Fit For:

- Beginners who want long-term planning tools: Fidelity offers free retirement advice and doesn’t have account minimums or charge fees for robo-adviser balances below $25,000.

- Retirement investors: Fidelity has many types of retirement accounts and extensive forecasting and planning tools. It also has retirement calculators, target-date retirement funds and renowned customer service guidance.

- Research-driven or do-it-yourself investors: DIY investors will appreciate Fidelity’s analytical tools, charts and third-party research, as well as real-time news and market updates.

Not Ideal For:

- Day traders: Fidelity doesn’t have direct-market routing, built-in backtesting or advanced analytical tools for rapid trade execution.

- Crypto-first investors: Fidelity’s crypto selection and features are minimal, and it doesn’t provide crypto wallets or direct access to your crypto keys. For those focused on cryptocurrency trading, Robinhood’s platform offers access to 28 different coins compared to Fidelity’s three.

- Traders focused on options or futures: Fidelity only has basic options trading, and it doesn’t have futures trading.

Comparison: Fidelity vs. Other Platforms

Fidelity has similar pricing and investment offerings compared to brokerages such as Charles Schwab and Vanguard, but it beats them with its proprietary zero-expense-ratio mutual funds and crypto trading. While Fidelity excels with its zero-expense-ratio funds, investors looking for low-cost index fund options might also consider the Vanguard S&P 500 ETF or other popular index funds such as the SPDR S&P 500 ETF.

| Features | Fidelity | Charles Schwab | Vanguard |

|---|---|---|---|

| Our star rating | 4.9/5 | 4.8/5 | 4.6/5 |

| Minimum investment (self-directed accounts) | $0 | $0 | $0 |

| Online ETF commissions | $0 | $0 | $0 |

| Standard options per contract fees | $0 to 65 cents | 65 cents | $1 |

| 24/7 customer service | ✓ | ✓ | X |

| Number of no-transaction-fee mutual funds | More than 2,100 | More than 4,000* | More than 3,160 |

| Fractional shares | ✓ | ✓ | ✓ |

| Cryptocurrency trading | ✓ | ✓ | X |

| Options trading | ✓ | ✓ | ✓ |

| Futures trading | X | ✓ | X |

Frequently Asked Questions About Fidelity

Yes, Fidelity is a good brokerage for beginners since it has an easy-to-use website and app for trading and doesn’t have a minimum investment amount to open an account. Also, most of its trades are commission-free. Fidelity also has a lot of podcasts, courses and video tutorials to help you learn basic and more advanced investing concepts.

Yes, Fidelity is a safe brokerage to use. It’s a licensed broker-dealer and a member of FINRA. It’s also backed by insurance from the Securities Investor Protection Corp., so if the brokerage failed, your investments would be protected for up to $500,000.

Like most brokerages, Fidelity charges some fees it doesn’t immediately disclose. While many of its stock, ETF, options and mutual-fund trades are commission-free, it charges 65 cents per options contract, nominal regulatory and activity fees and larger transaction and trading fees for certain mutual funds and fixed-income investments. You’ll also pay a spread when you buy crypto (which is disclosed in Fidelity’s app).

Yes, you can use Fidelity for retirement investing. It has traditional, Roth and rollover IRAs, as well as many retirement calculators, educational articles and tools to help you track where you stand and how much more you need to save and invest before retirement. It also has unique retirement investments, such as crypto within your IRA.

Methodology

Our team researched 35 of the top brokerages in the United States, analyzing disclosures, websites and regulatory documents to collect over 3,000 data points. To determine the best brokerages, we ranked institutions in five categories: trustworthiness, investment offerings, customer support and tools, pricing and platform experience.

We looked at brokerages’ risk factors, investment and fee disclosures, state registration information and websites to understand their investment terms and options. We considered each company’s trading platform and educational tools to help investors understand usability and features. We also looked at each company’s U.S. Securities and Exchange Commission registration status, Better Business Bureau rating, Financial Industry Regulatory Authority membership and data security measures, among many other data points.

To learn more, read our full investing methodology.

This category measures regulatory status, BBB ratings and data security.

We scored firms based on their account types and asset options, including support for self-directed, managed and fractional-share portfolios.

We rated the quality and availability of customer service, educational support and tools, customization options, and personal advisers and robo-advisers.

We evaluated each brokerage’s affordability by analyzing trading fees, fund expenses and minimum investment requirements.

We evaluated a brokerage’s web and mobile platforms for ease of use, considering customer reviews and app store ratings.

Acorns, Ally Invest, Betterment, Charles Schwab, Citi, E-Trade, eToro, Fidelity, Firstrade, Forex.com, Fundrise, Goldman Sachs Wealth Management, Interactive Brokers, JPMorgan Chase, Merrill Edge Guided Investing, Moomoo, Morgan Stanley, Ninjatrader, Principal, Public, Raymond James, Robinhood, SoFi, T. Rowe Price, tastytrade, Titan, TradeStation, TradeZero, Uphold, Vanguard, Wealthfront, Webull, Wells Fargo, Yieldstreet, Zack’s Trade

Our Brokerage Testing Methodology

The MarketWatch Guides team believes that to provide the most accurate, honest and useful insights on brokerages, we need to experience their platforms the same way you would. We test brokerages firsthand to report what it’s like to open and fund an account, place trades and interact on these platforms.

With each brokerage we test, we fund an account to see how intuitive the funding process is and to track how long it takes for transfers to clear. Where available, we place market, options and fractional-share trades to test order execution. We also rate each brokerage’s platform based on factors including how easy it is to navigate and how many advanced tools and research resources it offers.

*Data accurate at time of publication

*This review is for informational purposes only and is not a recommendation to buy or sell any financial product or service. While we strive to keep our content accurate and up to date, we cannot guarantee the accuracy of all information, including interest rates, fees and offers, which may change without notice. Please consult each provider’s website for the most current details.