The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Ally Invest is the investment-specific branch of the Ally Financial portfolio. It may not have cryptocurrency or fractional shares, but what it does have could be even more valuable: a user-friendly banking-and-brokerage platform. Learn more below in the MarketWatch Guides team’s review of Ally Invest.

Our Thoughts on Ally Invest

Ally, which contains Ally Bank, Ally Invest and Ally + Ladder, stands out for having one of the best integrated banking and investing experiences in our review of brokerages. Within the Ally app, you can instantly transfer money from savings to investing accounts, which offers a clear edge for existing Ally customers. Ally Invest also shines with its $0 commissions, its lack of account minimums for self-directed accounts and its low costs for options at 50 cents per contract.

However, Ally Invest falls short in its limited research and educational offerings, and it doesn’t have fractional shares or investment options such as futures and foreign exchange. Because it still offers a good selection of investments and tools such as charts and screeners, Ally Invest may be best for intermediate investors rather than beginners or more advanced traders.

Ally Invest Pros and Cons

Consider the benefits and downsides of using Ally Invest:

Instant transfers between Ally accounts: You can instantly transfer money from your Ally savings or spending account to your Ally Invest account instead of waiting three to five days for an automated clearing house transfer like some competitors offer.

Automated and human advice: Ally Invest has self-directed, robo and managed portfolios, and you can integrate all three options in your portfolio.

Fee-free robo portfolio: The brokerage’s robo-adviser service has a minimum investment of only $100, and its cash-enhanced portfolio option has no advisory fee.

Limited investment options: Ally Invest doesn’t have crypto trading, fractional shares, futures or foreign exchange — you’re limited to basic stocks, exchange-traded funds, options and fixed-income trades.

More basic research and educational resources: Ally Invest has articles, screeners and real-time stock quotes, but they may feel basic compared to courses and community forums from brokerages such as Fidelity and Interactive Brokers.

Ally Invest’s Background and Reputation

Ally Invest is part of Ally Financial, which also owns Ally Bank. Ally Financial was founded in 1919 as the General Motors Acceptance Corp., providing financing for GM vehicles. In 2010, GMAC rebranded as Ally Bank. Ally Invest launched in 2017, shortly after the company acquired online brokerage firm TradeKing.

How We Rated Ally Invest

Ally Invest received 4.8 out of 5 stars in our brokerage review for its low prices for self-directed accounts, solid customer support and transparent pricing.

Ally Invest Options

You can trade stocks, ETFs, bonds, Treasurys, mutual funds and options with Ally Invest. You can also trade penny stocks, which are low-priced stocks, with a $100 minimum order. Most of these trades are commission free for self-directed accounts, and Ally allows you to trade with a cash account or on margin. Ally Invest also has individual retirement accounts, including traditional and Roth IRAs.

However, you can’t trade futures, cryptocurrency, futures or forex with the brokerage. Ally also doesn’t have fractional shares, which feels like a missed opportunity given that so many of its competitors, such as Charles Schwab and Robinhood, have fractional shares.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Ally Invest Features and Tools

Ally Invest makes banking and investing within one platform feel seamless, and it has robo-advised portfolios and personal investment advice.

Banking and Investing in One App

Ally Invest is part of the Ally banking app, making it easy to access and keep track of your banking and investing accounts in one spot.

Instant Cash Transfers

While Ally Invest doesn’t have a cash-sweep option in its investing accounts, you can instantly transfer money from your Ally high-yield savings account to your investing account, which allows you to receive Ally’s high-yield savings account rate on any uninvested cash.

Robo Portfolios

You can open a robo-advised portfolio with just $100, and there are two fee tiers:

- Cash-enhanced portfolio: This option doesn’t have an advisory fee, and 30% of your portfolio is set aside in cash, which earns interest.

- Market-focused portfolio: About 98% of this portfolio is invested in the stock market, with roughly 2% held as a cash buffer. This option has a 0.30% annual advisory fee, equating to $3 per $1,000 invested.

If you’re invested in ETFs within a portfolio, you may also be charged an underlying ETF expense ratio, which covers total operating expenses over a year.

Personal Advice

If you have $100,000 or more to invest in an Ally Invest account and would like a professional manager, you can enroll in Ally’s Personal Advice service. It provides a dedicated portfolio manager who creates a personalized plan for your investments. Annual advisory fees for this service range from a blended 0.75% to 0.85% based on the amount you’ve invested.

| Portfolio Balance | Annual Advisory Fee (Blended) |

|---|---|

| Up to $250,000 | 0.85% |

| $250,000 to $1 million | 0.80% |

| More than $1 million | 0.75% |

Ally Invest Fees and Pricing

Ally Invest’s prices are low across the board, with lots of fee-free U.S. stocks and ETFs to choose from, plus thousands of mutual funds without transaction fees or loads. However, its margin-trading rates and its fees for certificates of deposit are on the higher side.

Commissions and Fees

Here are Ally Invest’s commissions and fees:

- Stocks and ETFs: You’ll pay $0 commissions to trade most U.S.-based stocks and ETFs that cost $2 or more, and there are many no-load mutual funds.

- Penny stocks: If you buy low-priced penny stocks, you’ll pay a $4.95 commission plus 1 cent per share on each order. You must place a minimum of $100 per order.

- Options: Options have $0 commissions and a flat fee of 50 cents per contract to both buy and sell.

- Bonds and Treasurys: These cost $1 per bond to trade. There’s a $10 minimum and a $250 maximum per transaction.

- CDs: CDs cost $24.95 per transaction.

- Margin trading: Ally Invest charges as high as 12% for balances below $25,000 and as low as 7.50% for balances of $1 million or more.

Other Costs and Terms

Ally Invest tends to be transparent about its costs and practices. For instance, like many competitors, Ally makes money on its $0 commission trades through payment for order flow, a practice where brokerages accept payments for placing investors’ trades with certain market makers. While light traders probably won’t notice any impact, active traders may notice differences in price and the speed of trade execution compared to brokerages that don’t accept PFOF, such as Fidelity.

The table below lists common charges and regulatory fees at Ally Invest, which most brokerages pass on to customers. All fees are for self-directed accounts. Robo and managed accounts have the same or lower fees.

| Type | Fee |

|---|---|

| Foreign stock incoming transfer fee | $50 |

| Paper statement fee | $4 per statement |

| Index products | 35 cents per contract |

| Option expiration sellouts | $40 plus commission |

| Automated Customer Account Transfer (Transfer Out) | $50 |

| IRA annual fee | $0 |

| IRA transfer fee | $50 |

| IRA closure fee | $25 |

| Options regulatory fee | $0.02645 per contract (buys and sells) |

| Trading activity fee | $0.000166 per equity share (sells only) $0.00279 per options contract (sells only) $0.00105 per bond (sells only) |

Ally Invest Trading Platform and Apps

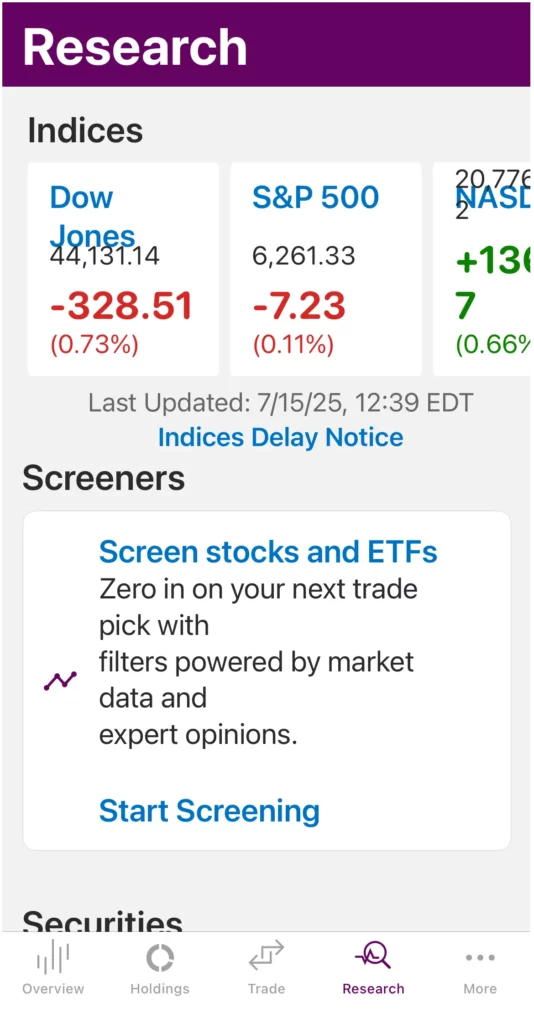

Ally Invest has a streamlined, all-in-one mobile app that’s convenient for everyday trades but lacks advanced research tools and fractional-share trading. Its web platform provides a more robust experience with improved charting, screeners and real-time data, though it still trails more advanced competitors such as Charles Schwab in technical analysis features.

Mobile App Interface

The Ally app integrates all of your Ally accounts — including spending, loans, savings and investments — into one app. You can access the investment platform with a single tap, but navigating within it can be somewhat unintuitive at first, according to the MarketWatch Guides researcher who opened an Ally Invest account. The app’s “Quick Trade” button lets you place market and options orders, though our researcher thought placing options orders was a bit confusing due to an unintuitive user interface and unclear instructions. Unlike platforms such as Fidelity, Ally doesn’t support fractional-share trading.

While there are tabs for dividend and technical data, our researcher thought the stock charting tools were basic and the overall research functionality was limited. However, they thought the app held up well for making standard trades and didn’t bombard users with too many preferences.

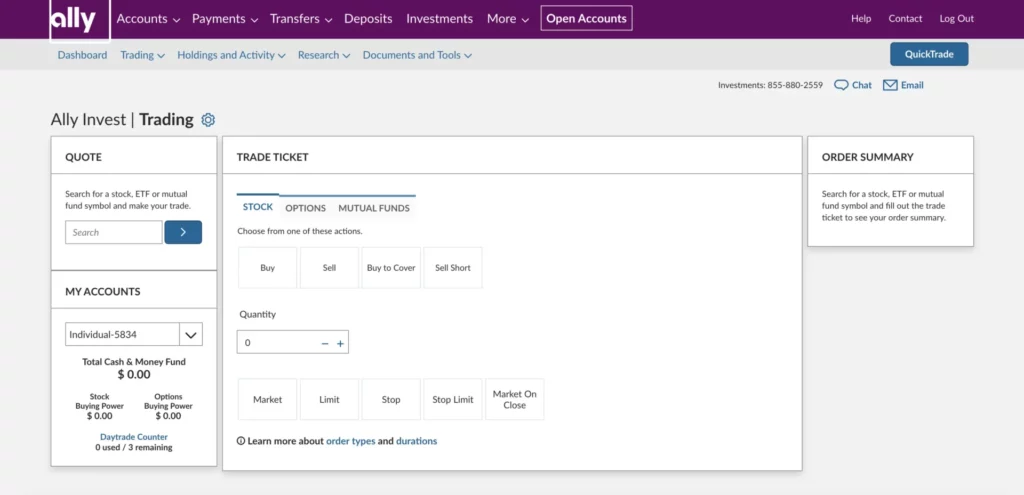

Web Platform Overview

Ally’s web platform, while simple and intuitive, offers a more complete experience than the mobile app, especially for users who want deeper functionality and analysis tools. Trading is streamlined with different tabs for stocks, options and mutual funds, although new investors might be confused by the different order types. The web platform also enhances the research experience, offering more real-time stock quotes, screeners and market data.

Ally Invest’s desktop interface includes a broader range of charting features compared to the mobile app, with multiple chart styles, technical indicators and drawing tools. These features make it more viable for technical analysis, but the platform may still fall short of what’s available from more advanced brokerages, such as Schwab’s Thinkorswim or Fidelity’s Active Trader Pro.

Our Experience Opening an Account With Ally Invest

A member of our MarketWatch Guides research team opened an account with Ally Invest and shared their thoughts on the experience.

Application

Our researcher felt that opening an Ally Invest account was more involved than opening an account with a brokerage such as Fidelity, probably because Ally Invest allows you to trade options and on margin, while Fidelity doesn’t automatically allow this. It took our researcher about 15 minutes and 12 steps to open an account. They liked that Ally Invest provided a helpful FAQ section and explained complex information in easy-to-understand language.

Funding

Because our researcher already had an Ally savings account, they were able to fund their investing account instantly.

Trading

Our researcher found the “Quick Trade” button to be handy, and it took them directly to the trading window. They thought trades were executed quickly and that the costs, commissions and fees were clearly spelled out.

We reached out to Ally Invest regarding our experience but did not receive a response.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

Who Is Ally Invest Best For?

Ally Invest is designed for slightly more sophisticated investors who already understand the basics of trading and are ready to level up, but it’s not ideal for crypto traders or people who want the lowest margin rates.

Great Fit For:

- Current Ally customers: It’s easy to open an Ally Invest account if you’re already an Ally banking customer. The company also offers instant transfers between accounts.

- Intermediate-level investors: If you’ve traded in the past and are looking for a solid brokerage for trading options or trading on margin, Ally Invest can be a great choice.

- People who want to self-invest and use a robo-adviser: You can easily open a robo portfolio in addition to a self-directed account at Ally. There are also no annual fees for cash-enhanced robo accounts.

Not Ideal For:

- New or advanced investors: Ally doesn’t have fractional shares or the in-depth educational resources some competitors have. Its more advanced trading options might also be confusing for those who don’t want to wade through options and margin trading, but not robust enough for advanced traders.

- Margin traders: Ally’s margin rates are higher than many competitors’ rates — such as Interactive Brokers and Webull — so it’s not ideal for heavy margin traders.

- Crypto traders: Ally Invest doesn’t have crypto trading.

Comparison: Ally Invest vs. Other Platforms

Ally Invest beats competitors such as Schwab and Fidelity on its options contract fees, but it doesn’t have fractional shares or cryptocurrency. Schwab and Fidelity beat Ally on educational and research offerings.

| Features | Ally Invest | Charles Schwab | Fidelity |

|---|---|---|---|

| Our star rating | 4.8/5 | 4.8/5 | 4.9/5 |

| Minimum investment (self-directed accounts) | $0 | $0 | $0 |

| Online ETF commissions | $0 | $0 | $0 |

| Standard options per-contract fees | 50 cents | 65 cents | $0 to 65 cents |

| 24/7 customer service | ✓ | ✓ | ✓ |

| Number of no-transaction-fee mutual funds | More than 1,000 | More than 4,000* | More than 2,100 |

| Fractional shares | X | ✓ | ✓ |

| Cryptocurrency trading | X | ✓ | ✓ |

| Options trading | ✓ | ✓ | ✓ |

| Futures trading | X | ✓ | X |

Frequently Asked Questions About Ally Invest

Ally Invest is Ally Financial’s investing division. You can open an Ally Invest account within the Ally mobile app and trade stocks, ETFs and options for $0 commissions.

Ally Invest can be a good place to invest since it has a wide range of choices, especially for intermediate investors. It also charges $0 commissions on most U.S.-based stock and ETF trades and has excellent customer service.

Whether Ally or Vanguard is better for you depends on what you’re looking for in a brokerage. In our review of over 30 brokerages, Ally received 4.8 out of 5 stars, while Vanguard received 4.6 out of 5 stars. Ally scored higher than Vanguard because it doesn’t have account minimums for its stocks, ETFs and mutual funds, unlike Vanguard, which requires a minimum of $1,000 for mutual funds and $1 for ETFs.

Ally also earned higher scores in our customer support and tools and pricing categories. It has 24/7 phone support, live chat and email support, none of which Vanguard has. For pricing, Ally charges 50 cents per options contract, while Vanguard charges $1.

Ally may or may not be a better choice for you than Robinhood — it depends on the types of investments you want to make, among other factors. In our brokerage review, Ally received 4.8 out of 5 stars, and Robinhood earned 4.5 out of 5 stars. Ally scored higher than Robinhood in our trustworthiness, investment offerings and customer support categories. However, if you’re interested in trading crypto or fractional shares, Robinhood is a better choice since Ally doesn’t have them.

Our Methodology

Our team researched 35 of the top brokerages in the United States, analyzing disclosures, websites and regulatory documents to collect over 3,000 data points. To determine the best brokerages, we ranked institutions in five categories: trustworthiness, investment offerings, customer support and tools, pricing and platform experience.

We looked at brokerages’ risk factors, investment and fee disclosures, state registration information and websites to understand their investment terms and options. We considered each company’s trading platform and educational tools to help investors understand usability and features. We also looked at each company’s U.S. Securities and Exchange Commission registration status, Better Business Bureau rating, Financial Industry Regulatory Authority membership and data security measures, among many other data points.

To learn more, read our full investing methodology.

This category measures regulatory status, BBB ratings and data security.

We scored firms based on their account types and asset options, including support for self-directed, managed and fractional-share portfolios.

We rated the quality and availability of customer service, educational support and tools, customization options, and personal advisers and robo-advisers.

We evaluated each brokerage’s affordability by analyzing trading fees, fund expenses and minimum investment requirements.

We evaluated a brokerage’s web and mobile platforms for ease of use, considering customer reviews and app store ratings.

Acorns, Ally Invest, Betterment, Charles Schwab, Citi, E-Trade, eToro, Fidelity, Firstrade, Forex.com, Fundrise, Goldman Sachs Wealth Management, Interactive Brokers, JPMorgan Chase, Merrill Edge Guided Investing, Moomoo, Morgan Stanley, Ninjatrader, Principal, Public, Raymond James, Robinhood, SoFi, T. Rowe Price, tastytrade, Titan, TradeStation, TradeZero, Uphold, Vanguard, Wealthfront, Webull, Wells Fargo, Yieldstreet, Zack’s Trade

Our Brokerage Testing Methodology

The MarketWatch Guides team believes that to provide the most accurate, honest and useful insights on brokerages, we need to experience their platforms the same way you would. We test brokerages firsthand to report what it’s like to open and fund an account, place trades and interact on these platforms.

With each brokerage we test, we fund an account to see how intuitive the funding process is and to track how long it takes for transfers to clear. Where available, we place market, options and fractional-share trades to test order execution. We also rate each brokerage’s platform based on factors including how easy it is to navigate and how many advanced tools and research resources it offers.

*Data accurate at time of publication

*This review is for informational purposes only and is not a recommendation to buy or sell any financial product or service. While we strive to keep our content accurate and up to date, we cannot guarantee the accuracy of all information, including interest rates, fees and offers, which may change without notice. Please consult each provider’s website for the most current details.