The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

In this review, the MarketWatch Guides team will analyze SoFi Invest’s investment offerings, highlighting the brokerage’s fees, pros and cons, along with who it might be best suited for.

*Our review team reached out to SoFi for a comment on its FINRA penalties but did not receive a response.

Our Thoughts on SoFi Investing

SoFi Invest is an online investing platform that offers various levels of services and features for both newer and more experienced investors. Exclusive members get additional benefits, including unlimited access to financial planners. However, if you’re looking for a brokerage with advanced trading tools and resources, you may want to look elsewhere.

SoFi Invest Pros and Cons

Some of the main benefits of SoFi Invest, the investing arm of financial technology company SoFi, are its user-friendly support, trading tools and customer service options. The investing platform also offers relatively affordable trades and a wide range of options for more experienced, hands-on investors. However, there are some cons to consider, such as recent FINRA fines.*

Minimal fees: SoFi Invest offers $0 commissions for self-directed cash or margin accounts that trade U.S.-listed securities and options, which also have low or no fees.

Wide range of portfolio options: SoFi Invest offers a diverse range of both active and passive investment options with varying risk levels.

SIPC protection: Money invested with SoFi Invest is protected by the Securities Investor Protection Corp. for up to $500,000, including a $250,000 limit for cash, in the rare case that a brokerage fails.

Quick account setup: You can open a SoFi Invest account online within minutes, with funds deposited in one or two business days.

Restricted features: SoFi automated investing accounts don’t offer tax-loss harvesting.

FINRA fines and penalties: SoFi and Apex Clearing Corp., its clearing firm, have faced serious allegations and fines within the past two years.*

No crypto or futures: SoFi doesn’t offer direct trading for crypto or futures, but you can trade crypto through one of its partners, BitGo or Blockchain.

*Our review team reached out to SoFi for a comment on its FINRA penalties but did not receive a response.

SoFi Invest’s Background and Reputation

SoFi Invest’s parent company SoFi was founded in 2011, offering student-loan refinancing, mortgages and personal loans before launching its investment arm in 2019. In February 2025, the company revamped its premium membership, known as SoFi Plus, to offer benefits for investors, including a 1% rewards match on recurring investment deposits and preferred access to initial public offerings. This membership level is $10 per month or free with qualifying direct deposits to a SoFi checking and savings account. All trades are executed through SoFi’s clearing firm, Apex Clearing Corp.

In our May 2025 survey of 2,000 investors, about 90% of SoFi Invest customers reported being “satisfied” or “very satisfied” with the platform.

How We Rated SoFi Invest

SoFi Invest earned an overall score of 4.5 out of 5 stars in our review. The brokerage received a perfect score for its customer support and tools and a nearly flawless rating for its platform experience. This further highlights SoFi’s user-friendly services and guidance.

SoFi Investment Options

Below are SoFi Invest’s main investment offerings.

SoFi Active Invest

SoFi Active Invest is a hands-on approach to managing your investments. It’s best suited for people who want more control over their funds and have at least a basic understanding of investing. SoFi Active Invest has a $5 minimum investment and doesn’t charge commissions for stocks and ETFs. It lets you make after-hours trades, which can help you stay ahead of trends.

Here are SoFi’s Active Invest options:

- Alternative investments including commodities, foreign currency and private credit

- ETFs

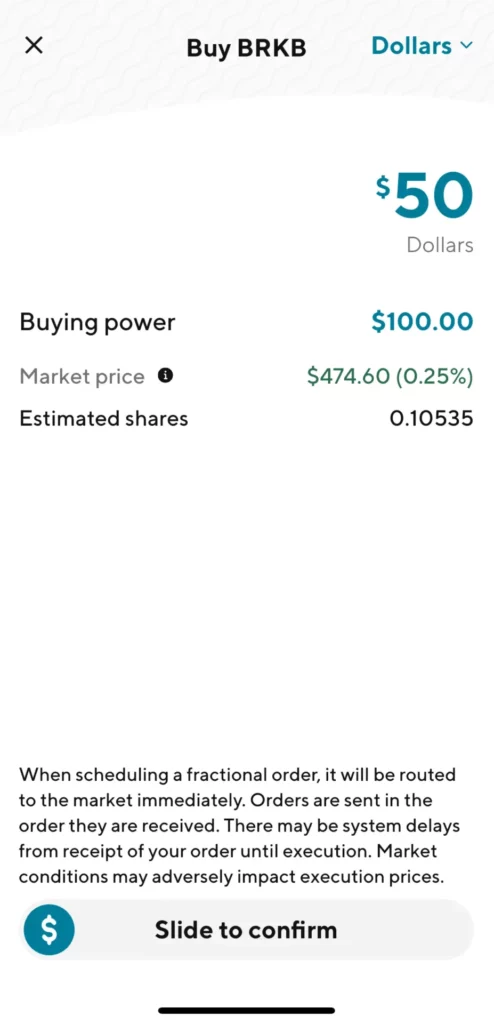

- Fractional shares

- Initial public offerings

- Margin investing

- Mutual funds

- Options

- Stocks

SoFi Robo-Adviser

SoFi has three automated investing robo-adviser portfolios: Classic, Classic with Alternatives and Sustainable. They all have different risk levels and goals. You need a minimum of $50 to enroll, and an annual advisory fee of 0.25% applies. These portfolios are monitored daily and automatically rebalanced.

These types of SoFi Invest portfolios are likely good options for novice investors or those who don’t have time to rebalance their investments regularly. A robo-adviser can also be a good choice for an investor who wants to share earnings with their partner since SoFi offers joint accounts.

SoFi Retirement Accounts

You can choose a self-directed or automated individual retirement account, depending on how hands-on you want to be. SoFi offers a 1% match on rollovers and most types of IRAs. Its IRAs don’t have a minimum deposit requirement or commissions on stocks or ETFs. SoFi offers Roth and traditional IRAs, as well as simplified employee pension IRAs.

The listings that appear are from companies from which this website may receive compensation, which may impact how, where and in what order products appear. Not all companies, products or offers were reviewed in connection with this listing.

SoFi Features and Tools for Investors

All investable assets offered through SoFi Invest come with a free introductory 30-minute session with a SoFi financial planner. These meetings can only be done online. SoFi Invest also regularly offers introductory specials when you fund a new account, such as up to $1,000 in stock. Check the SoFi website to see if there are any active offers.

Below are other useful features and tools for SoFi investors.

Commission-Free Trading

SoFi Invest has $0 commissions for self-directed cash or margin accounts that trade U.S.-listed over-the-counter securities, including EFTs and options. This makes simple trading affordable for most investors. Other charges may apply, such as a $5 fee for each options exercise or assignment.

Fractional Shares

SoFi Invest has access to fractional shares, with $0 commissions and investment opportunities as low as $5. It’s an affordable and easy way to own a slice of stock of popular companies, such as Amazon, Apple or Netflix.

Initial Public Offerings

SoFi Active Invest members can invest in IPOs without having to adhere to account minimums.

Crypto Trading

SoFi stopped offering crypto services directly in 2023, and you can’t trade directly through the company. Instead, SoFi Invest is now partnered with BitGo — which has support for over 700 coins and tokens — and Blockchain for crypto trading.

SoFi Invest Fees and Pricing

If you have an automated investing account, SoFi charges an annual advisory fee of 0.25%, which is based on your account value. Self-managed accounts don’t charge this fee, but there are others to be aware of. One of these fees is a $25 inactivity fee for account holders who don’t log in within a six-month period. Another is the 11% rate on margin trading.

There are several other fees, which vary based on your investment type and purpose. For example, there’s a $100 IRA closing fee. Below are some costs associated with SoFi Invest products.

| Item/Investment Type | Fees |

|---|---|

| ETFs and stocks | $0 commission Management fees with some ETFs (paid through the fund, not directly by investors) |

| Options | $5 per exercise or assignment |

| IPOs | $50 for first sale, then $5 for each subsequent sale (both within 120 days of IPO) |

| Mutual fund | 0.2% transaction fee ($20 max per transaction) for some mutual fund purchases |

| Trading activity fee | $0.000166 per share for equity sells and $0.00279 per contract for options sells (fee is rounded up to the nearest penny and no greater than $8.30) |

| Options regulatory fee | 3 cents per options contract (for buys and sells) |

| Options Clearing Corp. clearing fee | 2 cents per options contract (for buys and sells) up to 2,750 contracts $55 flat rate per trade for trades with over 2,750 contracts |

SoFi Invest Trading Platform and Apps

While many brokers have multiple trading platforms available on popular app stores, SoFi just has one: SoFi – Banking & Investing. The app lets you take care of your banking and investing needs all in one place. It’s also highly rated, earning 4.8 out of 5 stars from more than 379,000 reviews in the Apple App Store and 4.4 out of 5 stars from more than 46,000 reviews in the Google Play Store.

Mobile App Interface

SoFi’s mobile app interface is fairly straightforward, with an investing and learning tab at the bottom of the screen to get started, according to our researcher’s first-hand experience with the app. About 79% of SoFi customers in our survey said their favorite feature of SoFi Invest is that it’s easy to use.

Web Platform Overview

SoFi’s web platform has the same features as its mobile app. This is unlike some other brokers, such as Charles Schwab, whose web platform doesn’t have the ability to trade futures. SoFi having all features available on its web platform makes for an easier trading experience for investors who don’t prefer trading in an app.

Our Experience Opening an Account With SoFi Invest

A member of our MarketWatch Guides research team opened a SoFi Invest account and recorded their experience. Because they were already a SoFi banking customer, the application took only two minutes — the quickest among the brokerages we’ve tested. Funding the brokerage account was immediate.

Our researcher found the website navigation very confusing, and they felt there were minimal educational resources compared to other brokers, such as Fidelity. However, once they found the trading feature, completing a trade was simple.

Our researcher had a much easier time navigating the SoFi Invest mobile app but again found minimal educational resources. The app also lacked live chat and customization options. However, the trading experience was seamless. Overall, our tester had a good experience with SoFi Invest and preferred the app over the website for trades.

Our review team reached out to SoFi for a comment on our researcher’s experience but did not receive a response.

Is SoFi Invest Safe and Legit?

Yes, SoFi Invest products are generally considered safe and legit since the company is a member of the SIPC. This means that up to $500,000 — including a $250,000 limit for cash — is protected in the rare case that the brokerage fails. This protection doesn’t apply to investment losses.

SoFi Invest products have few complaints in the Consumer Financial Protection Bureau’s complaint database, with only about 30 investment-related complaints within the last three years. In comparison, SoFi overall has had more than 3,000 complaints across its financial products during that time.

Security Measures

SoFi has security measures in place to protect your investments.

- Two-factor authentication: SoFi has two-factor authentication, such as a security code, fingerprint or face recognition as an extra layer of protection.

- Third-party testing: SoFi has its systems and security controls reviewed by third parties annually.

As for user privacy, SoFi has the right to share your personal information for everyday business and marketing purposes. The broker doesn’t allow you to limit this sharing, but it does let you limit the personal information that’s shared for certain reasons, per federal law, such as:

- Sharing information about your creditworthiness with affiliates for everyday business purposes

- Sharing information with affiliates so they can market to you

- Sharing information with nonaffiliates to market to you

Regulatory Oversight

Both SoFi and its clearing company, Apex Clearing Corp., have been fined by FINRA in recent years.

2024 FINRA Fine

On May 2, 2024, FINRA fined SoFi $1.1 million for rolling out a cash-management brokerage account that allowed customers to steal from customers of other financial institutions. The report stated that about 800 accounts were opened, which third parties then used to transfer roughly $8.6 million from external customers’ accounts without authorization.

2025 FINRA Fine

On Feb. 4, 2025, Apex Clearing Corp. was fined $3.2 million by FINRA for issues with its program of lending customers’ fully paid securities to third parties. According to FINRA, violations included misrepresenting how customers would be compensated for the loans and failing to provide required written disclosures to all customers.

Our review team reached out to SoFi for a comment on its FINRA penalties but did not receive a response.

Who Is SoFi Invest Best For?

Consider these factors to help you decide whether SoFi Invest is right for your financial goals.

Great Fit For:

- Beginner investors who want intuitive trading tools and guidance

- Investors who want to take care of banking and investing needs in the same app

- Investors who want hands-on or hands-off investments, with a free 30-minute session with a financial planner

Not Ideal For:

- Experienced investors who want complex trading tools often used by day traders

- Investors who want their banking and investment products in separate apps

- Investors who want to trade futures or crypto, since SoFi doesn’t offer these services

“SoFi Invest can be a solid entry point for newer investors,” Stephan Shipe, Ph.D., a chartered financial analyst and certified financial planner and the founder of Scholar Financial Advising told MarketWatch Guides. “The platform is user-friendly and lowers the barrier to getting started, which is a good thing. But as a client’s financial life becomes more complex, SoFi’s offerings may not keep up.”

Comparison: SoFi Invest vs. Other Platforms

SoFi has a 3-cent fee for options contracts, which is more affordable compared to other brokers. Below, we compare SoFi to Vanguard and Charles Schwab.

| Features | SoFi Invest | Vanguard | Charles Schwab |

|---|---|---|---|

| Our star rating | 4.5/5 | 4.6/5 | 4.8/5 |

| Minimum investment (self-directed accounts) | $5 | $1 (ETFs) $3,000 (most mutual funds) | $1 |

| Online ETF commissions | $0 | $0 | $0 |

| Standard options per contract fees | 3 cents | $1 | 65 cents |

| 24/7 customer service | ✓ | X | ✓ |

| Number of no-transaction-fee mutual funds | 6,000 | More than 3,160 | More than 4,000 |

| Fractional shares | ✓ | ✓ | ✓ |

| Cryptocurrency trading | ✓* | X | ✓ |

| Options trading | ✓ | ✓ | ✓ |

| Futures trading | X | X | ✓ |

Frequently Asked Questions About SoFi Invest

Investing through SoFi Invest can be a good idea for beginners, especially since the company has low fees, a wide variety of investment options and an easy-to-navigate mobile app. The brokerage also offers a free 30-minute consultation with a financial planner. If you’re considering buying SoFi stock, research its past performance and assess how individual stocks fit your investment goals and risk tolerance.

You can’t withdraw money from SoFi Invest if you haven’t met the following two criteria:

- Your deposit hold must settle within five full business days after your deposit was posted.

- Your sell trade must settle one business day after your trade was executed.

Yes, you have the opportunity to make money on SoFi through investments such as stocks. SoFi Invest also regularly offers bonuses for new accounts to help you get started. For example, it offers a claw-game promotion for new active investing brokerage account holders. With this game, you can win a random stock worth $5 to $1,000.

Our Methodology

Our team researched 35 of the top brokerages in the United States, analyzing disclosures, websites and regulatory documents to collect over 3,000 data points. To determine the best brokerages, we ranked institutions in five categories: trustworthiness, investment offerings, customer support and tools, pricing and platform experience.

We looked at brokerages’ risk factors, investment and fee disclosures, state registration information and websites to understand their investment terms and options. We considered each company’s trading platform and educational tools to help investors understand usability and features. We also looked at each company’s U.S. Securities and Exchange Commission registration status, Better Business Bureau rating, Financial Industry Regulatory Authority membership and data security measures, among many other data points.

To learn more, read our full investing methodology.

This category measures regulatory status, BBB ratings and data security.

We scored firms based on their account types and asset options, including support for self-directed, managed and fractional-share portfolios.

We rated the quality and availability of customer service, educational support and tools, customization options, and personal advisers and robo-advisers.

We evaluated each brokerage’s affordability by analyzing trading fees, fund expenses and minimum investment requirements.

We evaluated a brokerage’s web and mobile platforms for ease of use, considering customer reviews and app store ratings.

Acorns, Ally Invest, Betterment, Charles Schwab, Citi, E-Trade, eToro, Fidelity, Firstrade, Forex.com, Fundrise, Goldman Sachs Wealth Management, Interactive Brokers, JPMorgan Chase, Merrill Edge Guided Investing, Moomoo, Morgan Stanley, Ninjatrader, Principal, Public, Raymond James, Robinhood, SoFi, T. Rowe Price, tastytrade, Titan, TradeStation, TradeZero, Uphold, Vanguard, Wealthfront, Webull, Wells Fargo, Yieldstreet, Zack’s Trade

Our Brokerage Testing Methodology

The MarketWatch Guides team believes that to provide the most accurate, honest and useful insights on brokerages, we need to experience their platforms the same way you would. We test brokerages firsthand to report what it’s like to open and fund an account, place trades and interact on these platforms.

With each brokerage we test, we fund an account to see how intuitive the funding process is and to track how long it takes for transfers to clear. Where available, we place market, options and fractional-share trades to test order execution. We also rate each brokerage’s platform based on factors including how easy it is to navigate and how many advanced tools and research resources it offers.

*Data accurate at time of publication

**This review is for informational purposes only and is not a recommendation to buy or sell any financial product or service. While we strive to keep our content accurate and up to date, we cannot guarantee the accuracy of all information, including interest rates, fees and offers, which may change without notice. Please consult each provider’s website for the most current details.